Q2’2022: Malaysians Can Finally Travel Abroad!

Welcome to Malaysians on Malaysia: Our quarterly report on Malaysian consumer Confidence Index (MYCI). Businesses are allowed to fully operate without restrictions & we are allowed to travel abroad; our MYCI improved further. Read on for essential insights into consumer confidence, behaviour, e-wallet, tech, crypto and e-sports trends in Malaysia.

Businesses are fully operating, travelling aboard is opened, COVID-19 is still a fight throughout the nation. We see a different norm that we have adapt into during this period of economy that is fully opened. Our Malaysian on Malaysia study gives us a glimpse of the trends and sentiments during this period – this time focusing on how consumers confidence improved after the relaxation of movement restrictions and the reopening of international borders. Our previous coverage on Malaysian consumer confidence for 1Q’2022 can be found here.

OPPOTUS MYCI Further Improves But Financial Well-Being See Contraction

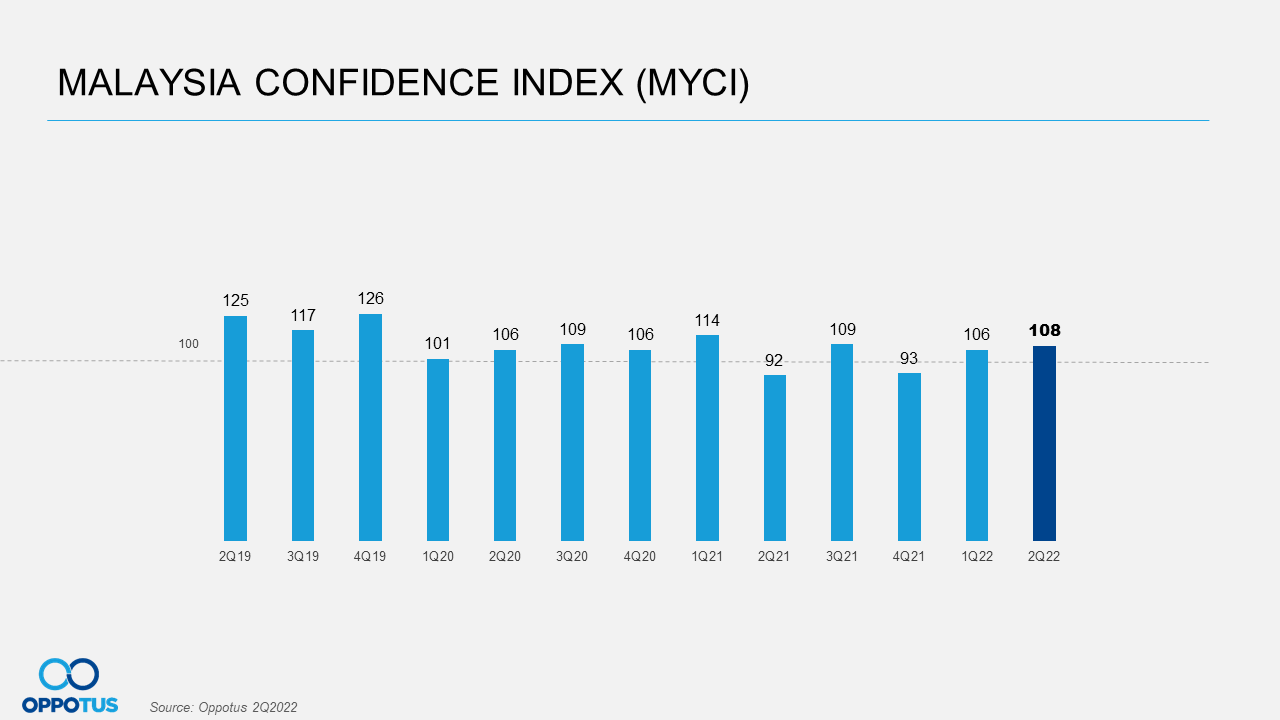

Our Malaysia Confidence Index (MYCI) continues to increase of optimism across the Malaysia market at 108-points. With COVID-19 restrictions going away and international borders reopening, these positive sentiments have helped to boost Malaysians’ confidence and vibes. Key indices of Malaysian perceptions towards the Nation’s economy surged this quarter to pre-Covid levels suggesting that many have expectations of better things to come. However, the rising cost of living has somewhat impacted Malaysians. It caused the financial well-being numbers taking a dip this quarter.

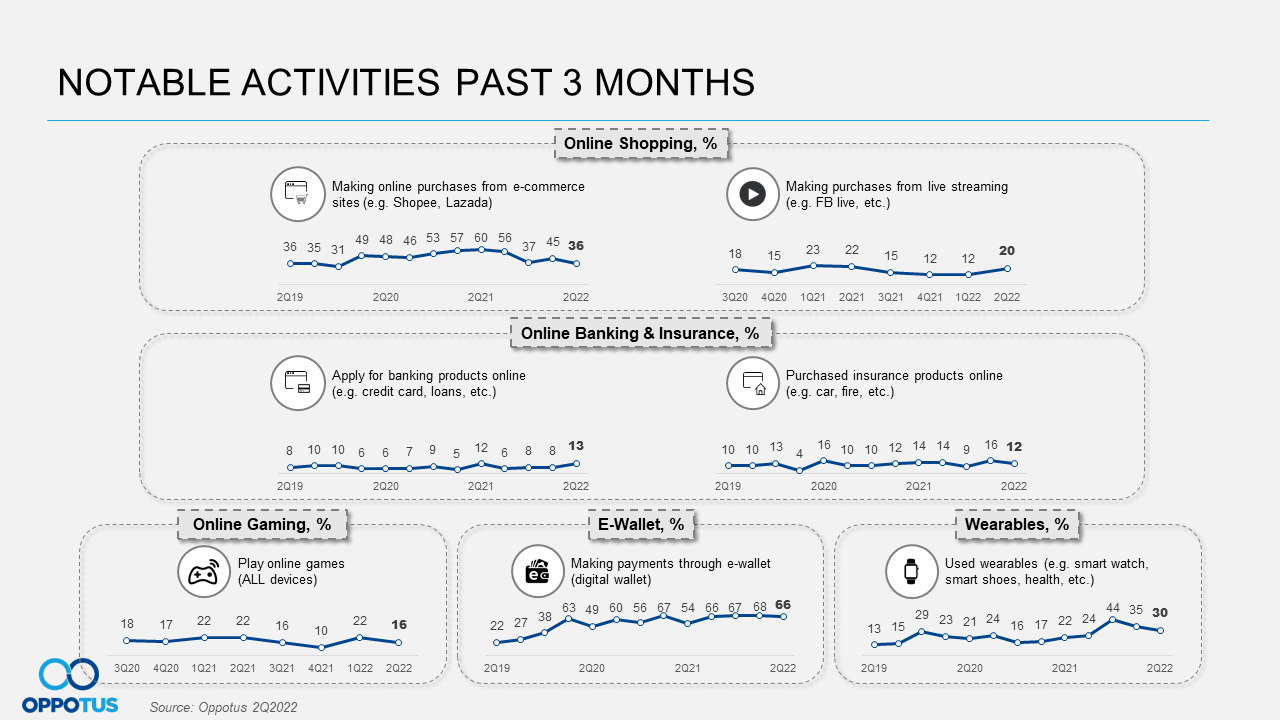

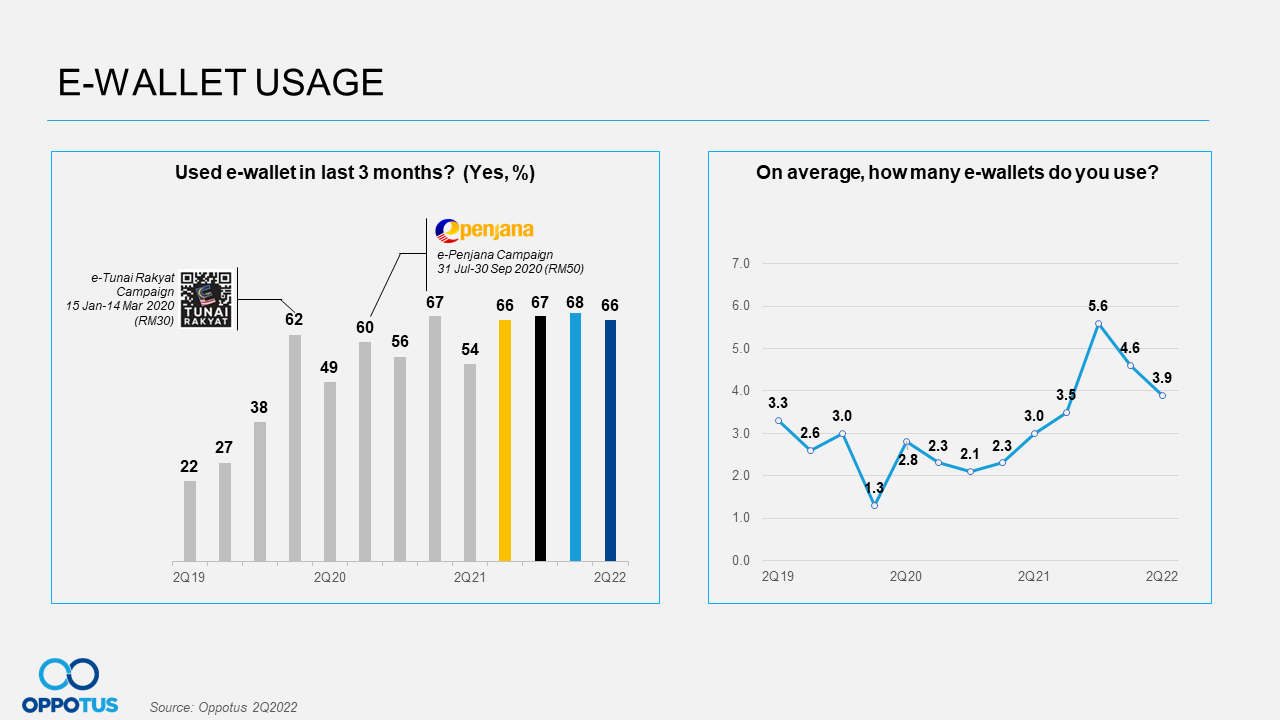

E-Wallet Usage Are At Mass Adoption Levels

E-wallet usage has plateaued at current levels at two-thirds of the adult Malaysian population for the last 4 quarters, suggesting that it has reached mass adoption mainstream status. However, due to the decrease in promotional activities from e-wallet provider, Malaysians now use an average of 3-4 brands of e-wallets. Consumer are spending at an average RM259.78 monthly through e-wallet in-store.

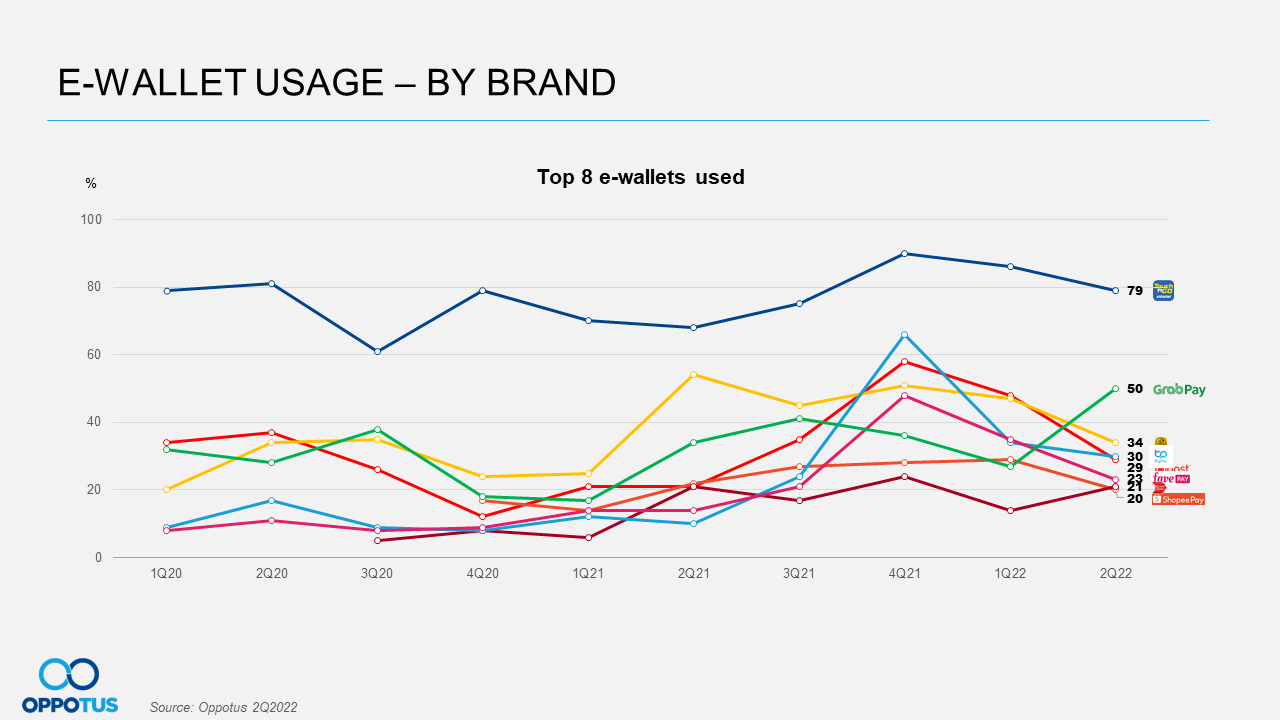

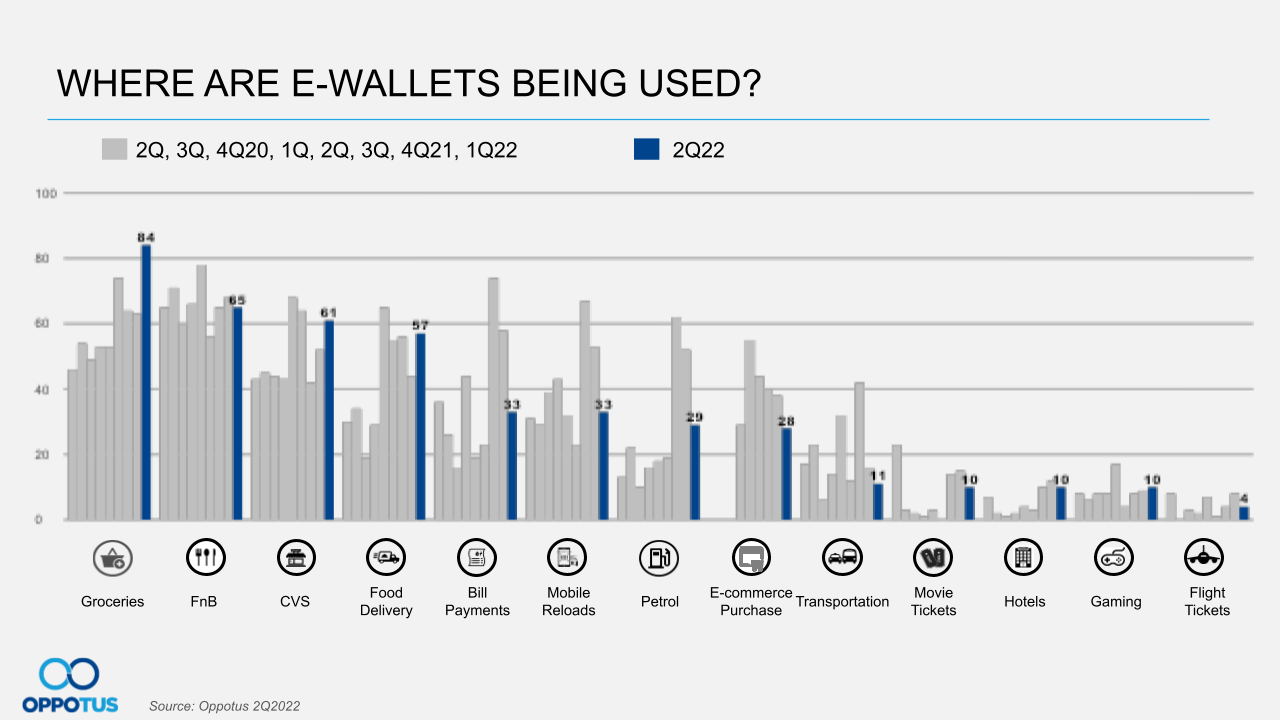

Consistently, Touch ‘n Go e-wallet continues to be the leader among other providers. Unexpectedly, GrabPay sees a spike to #2 in 2Q’2022, and CIMB Pay recorded an improvement as well. As Malaysians are slowly entering into cashless society, e-wallet continues to be commonly used, especially at Groceries, F&B, Convenience Stores (CVS), and so on.

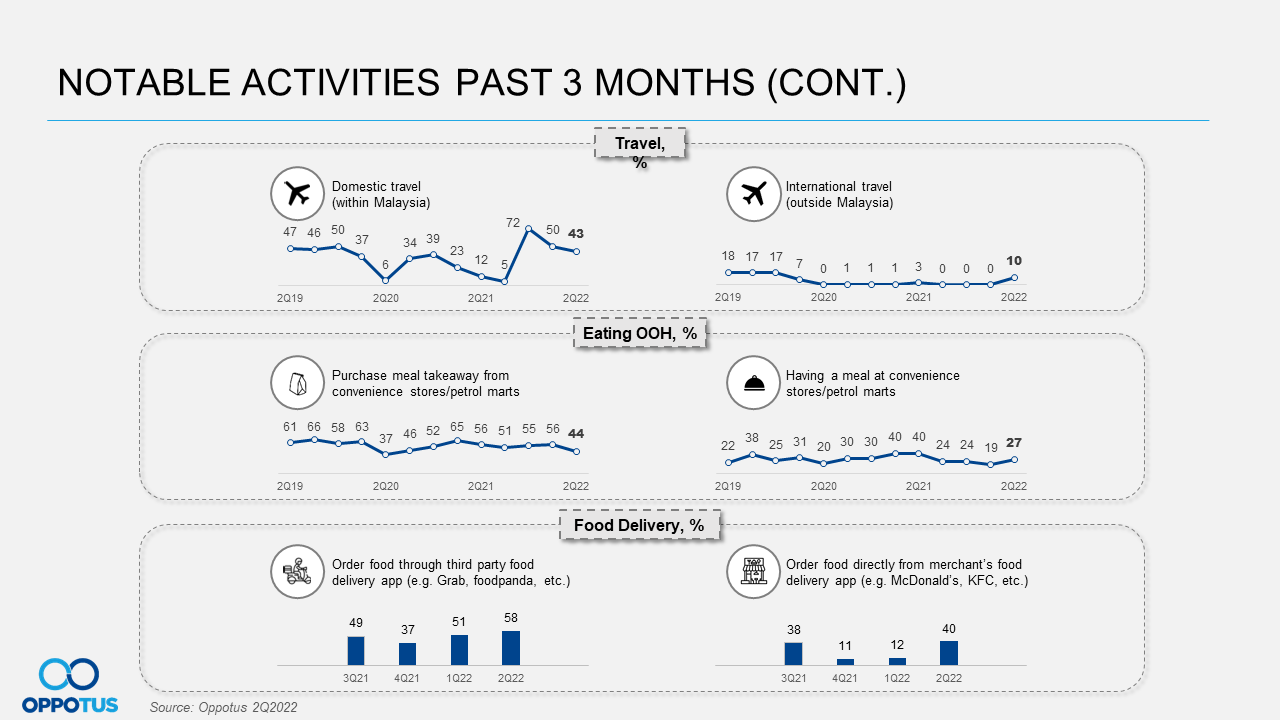

International Travel Revives

After 2 years of travel restrictions, Malaysians can finally travel locally and internationally. With restrictions lifting across the global and Malaysia opening its borders, we see 10% of Malaysians travel to their favourite destinations abroad, on the way to recovering to pre-Covid levels. We noticed that the international travel industry in Malaysia is moving towards an optimistic direction.

https://www.slideshare.net/Oppotus/oppotus-malaysians-on-malaysia-2q2022-253186118

If you like to dig deeper into the numbers, please do reach out to us on theteam@oppotus.com

We perform slightly better in 2Q’2022 (108-points) compared to the first quarter of 2022 (106-points). With all economic sectors back in full operations in this quarter and international border opening, our MYCI continues to record an uptick; similarly, across our economic indices too. This suggests an overall increase of optimism across the Malaysian market and expecting better things to come.

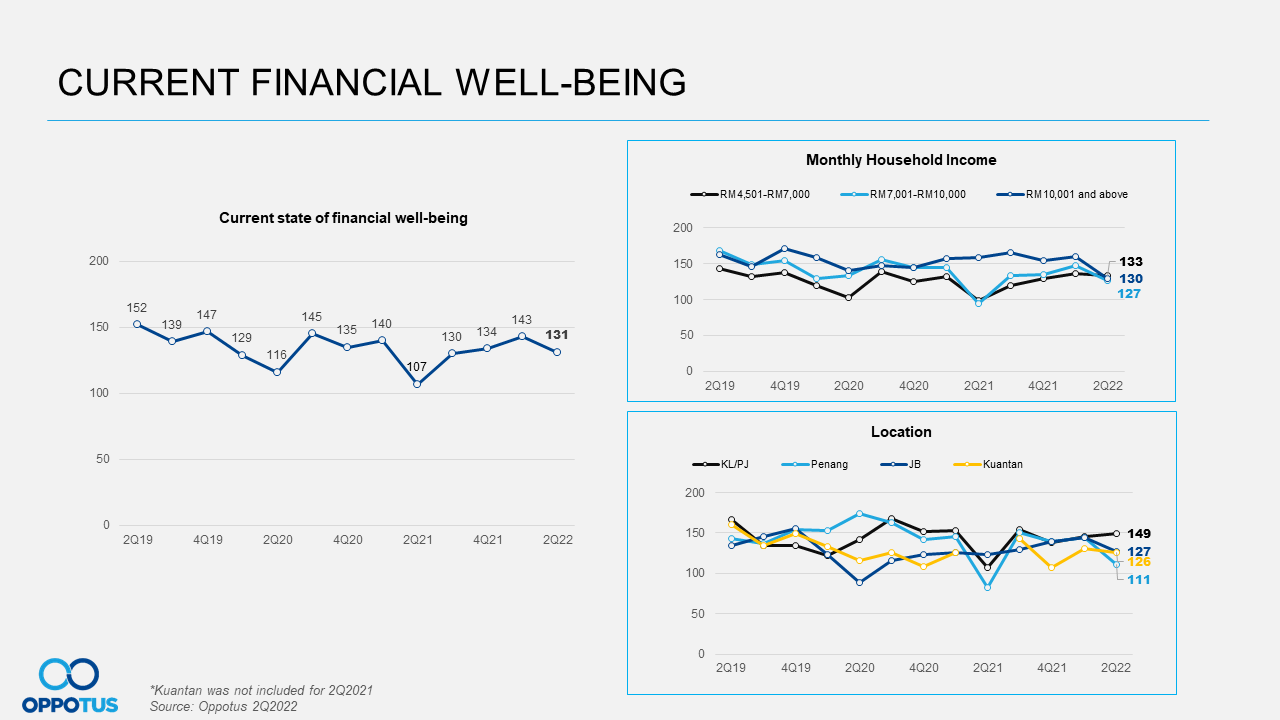

Malaysians’ government finally allow businesses across all sectors to operate in full force. Hence, Malaysians are still remaining hopeful with their current financial well-being. However, a slight dip is recorded this quarter since its uptrend from FMCO. This can be due to the rise in cost of living the country is currently experiencing which have damped Malaysians’ confidence somewhat.

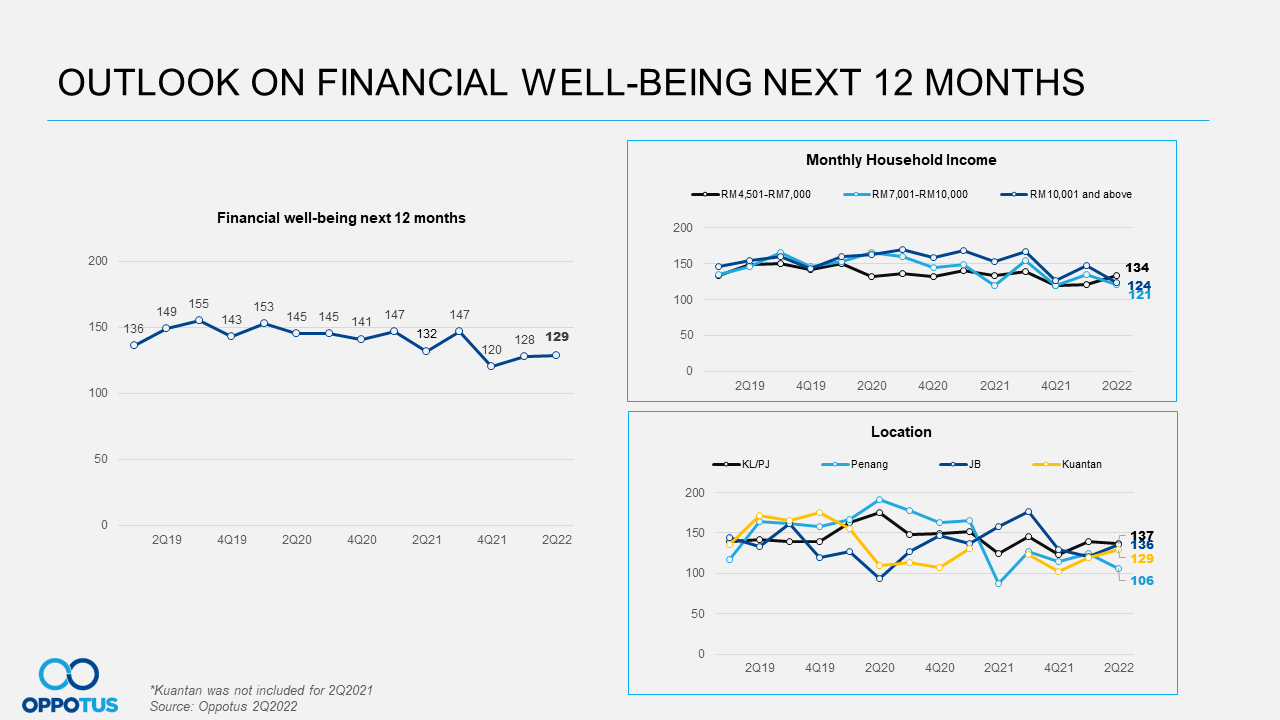

However, Malaysians are ever hopeful, and remain positive that their financial well-being will be better in the next 12 months. We also see that there is slight drop on the Monthly Household income for mid and high income group.

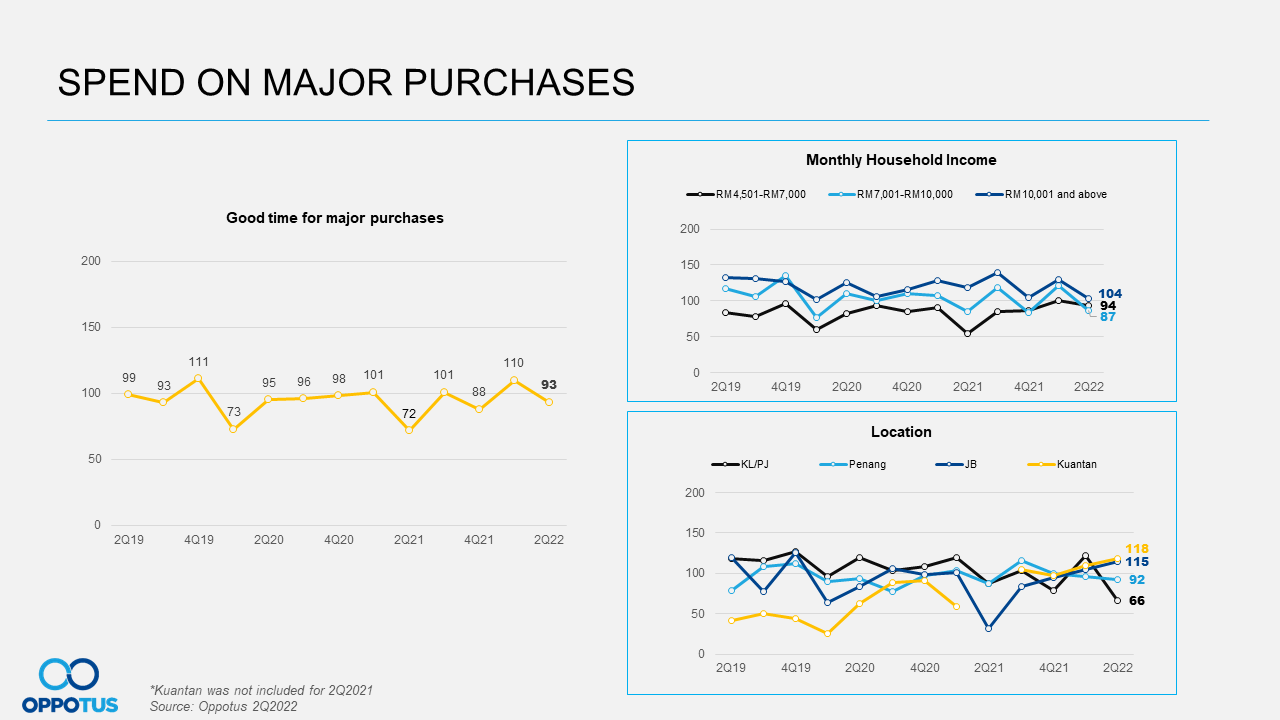

We assumed that Malaysians will be ready to increase their expenses on major purchases after movement restriction lifted. However, sentiments here going backward and we could see a slight dip from 110-points to 93-points in 2Q’2022, erasing what we have achieved last quarter. The index has now gone back to below 100-points mark again, meaning Malaysians are being more mindful with using of money in this time.

The COVID-19 pandemic and lockdown caused many people around the world have lost their jobs and source of income, same goes to Malaysians. In order to win back what they have lost for the past two years, inflation occurred. Consequently, a rise in cost of living happened and causes people to spend less on major purchases. Various income groups have similar contraction as well.

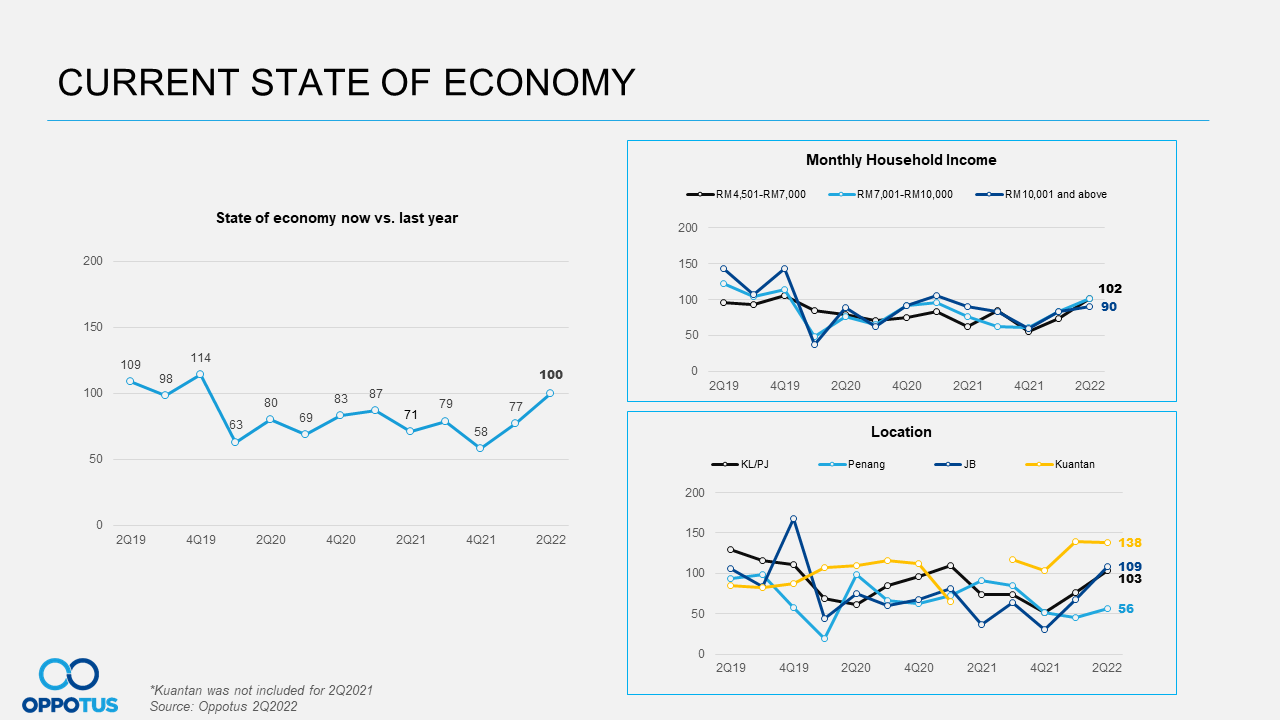

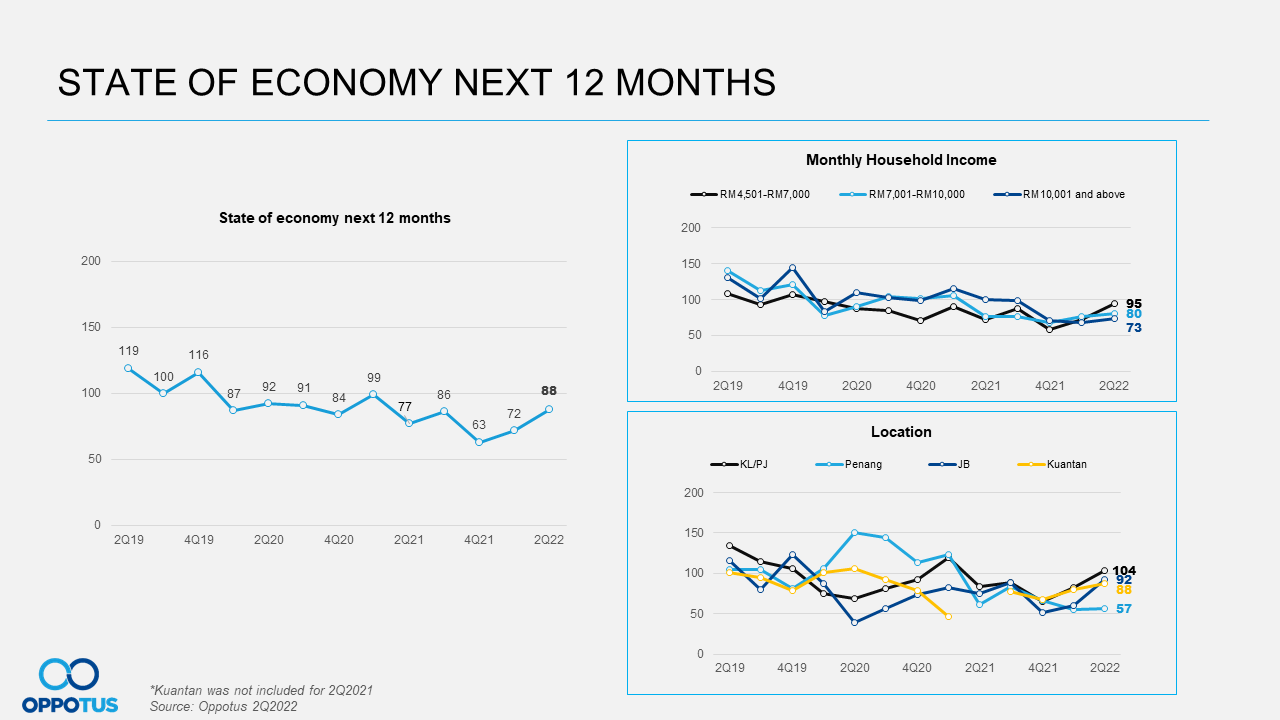

After over 2 years of being below 100-points mark, Malaysians’ confidence towards the economy is back as the index surge to reach the important 100-points mark in 2Q’2022. Positive sentiments are seen across all income groups & locations. While it is just at the borderline, it is still a positive note that we are moving forwards from the COVID-19 pandemic. It uplifted Malaysians confidence & our economy is getting better as all restrictions have been removed.

Likewise, not only Malaysians are a lot more positive with the country’s economy for now. They appear to have positive vibes towards the country’s state of economy continue in the near future. This quarter inching towards the 100-points mark (recorded as good growth). We can expect the lifted restrictions in the country will be able to speed up our economy recovery process.

Ever since the Malaysian government lifted movement control restrictions, people are able to travel around the country now. After a long travel drought, 10% of Malaysians can’t wait any longer and finally travel to their favourite destination abroad. During the 1st two month of Q2, there is a spike on local travel is because there is fair bit of public holiday. Based on our MYCI, we can see that soon domestic and international travel will be back to normal rate that we saw in 2019.

People are making lesser online purchases from e-commerce sites & live streaming after MCO has been lifted. This is because people are able to shop physically in stores now. Even though Malaysians are shopping lesser online, majority of the stores accept digital payment. Therefore, the e-wallet usage rate has remained stable for the past year.

As Malaysians are going back to the ‘normal’ lifestyle, ordering food through third parties and merchant food delivery apps have become the easiest way to satisfy one’s belly. Not only that, the hectic work and study schedules cause online gamers to have lesser time for online games too.

With COVID-19 restrictions going away, e-wallet penetration has remained relatively stable (average of 66%) for a year. However, the average number of e-wallets used recorded another dip in 2Q’2022. It seems like the average number of e-wallets used is stabilizing back to 3-4 e-wallets per user. It could be due to a decrease in promotional activities among the providers. Averagely, Malaysians spend RM259.78 monthly on purchases through their e-wallets.

Once and again, Touch ‘n Go e-wallet remains as the leader among other players. However, its usage recorded a slight dip again this quarter. Surprisingly, GrabPay sees a spike to #2 in 2Q’2022 (50%), it has surpassed its previous peak (40% in 3Q’2021). Meanwhile, CIMB Pay recorded an improvement as well; from 14% (1Q’2022) to 21% (2Q’2022). While the usage of MAE, Boost, Fave Pay, Shopee Pay recorded a decline this round.

E-wallet adoption is gaining momentum in rural areas. Malaysia has experienced a huge growth in the usage of digital payments across different channels. Malaysians are spending lesser on majority of the other channels in 2Q’2022 except Groceries, F&B, Convenient Store (CVS), and Food Delivery. Groceries is now top the list and recorded a sharp rise in e-wallet usage in 2Q’2022 (recording an all-time high).

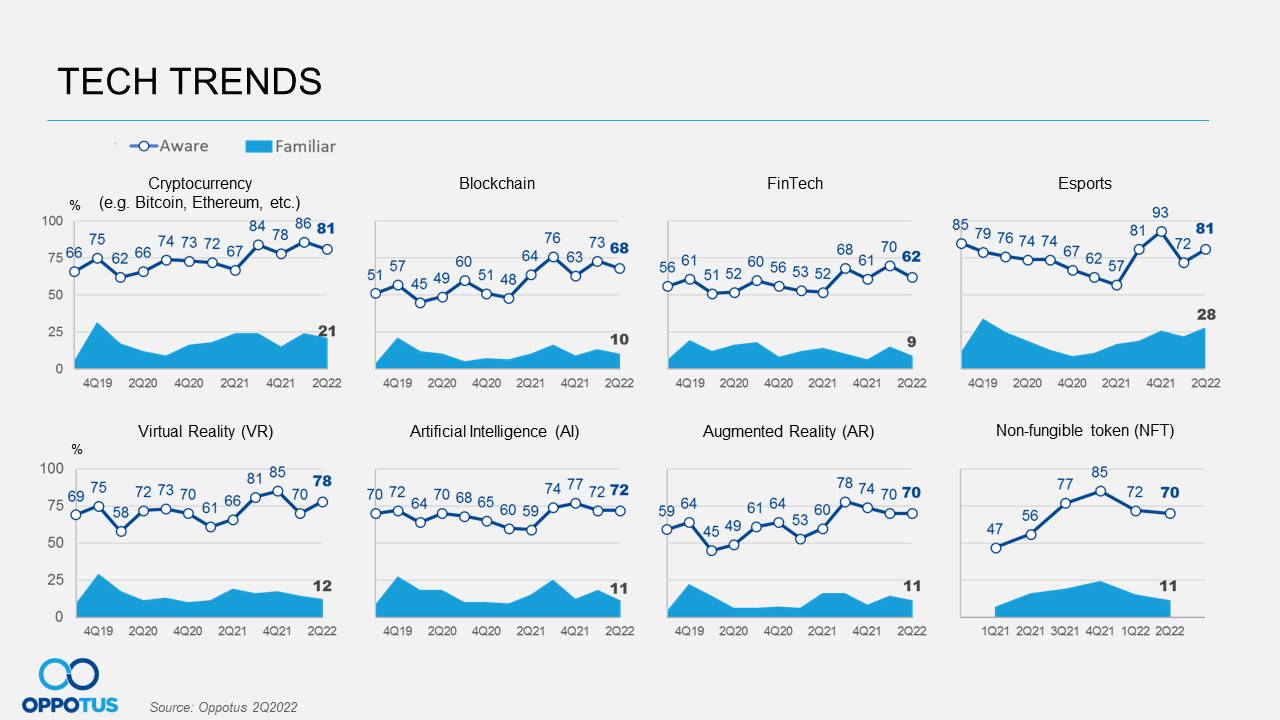

Today’s technology is constantly progressing through innovations and changes. In 2Q’2022, Malaysians’ awareness towards majority of the tech trends recorded a drop; which are Cryptocurrency (-5%), Blockchain (-5%), FinTech (-8%), and Non-fungible token (NFT) (-2%). E-Sports (+9%) & Virtual Reality (VR) (+8%) are the trending technologies Malaysians are interested in this round. While Artificial Intelligence (AI) and Augmented Reality (AR) remain unchanged this quarter.

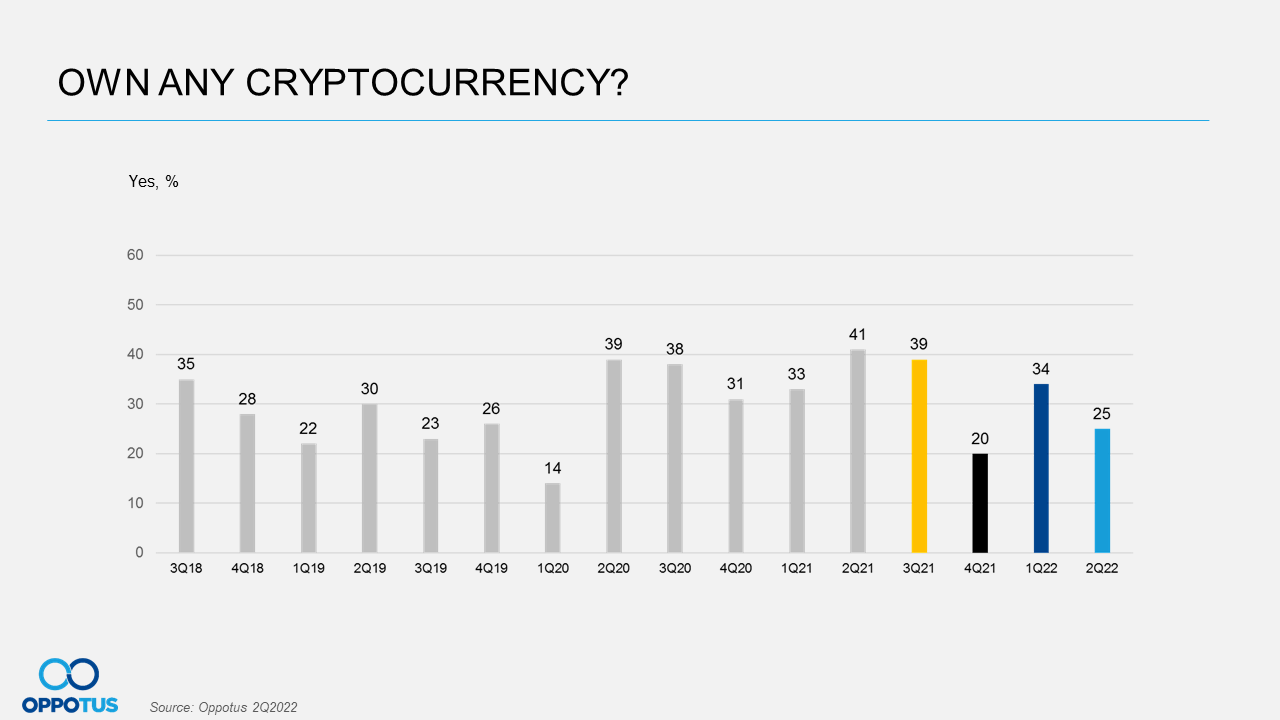

Ever since 3Q’2021, the Cryptocurrency adoption rate in Malaysia has been extremely unstable. Just as we thought the ownership of cryptocurrency will continue to grow after its comeback with 34% in the first quarter of 2022, the ownership rate is back to square one this quarter. The recession in the US could be one of the major reasons why cryptocurrency has seen a drop in users.

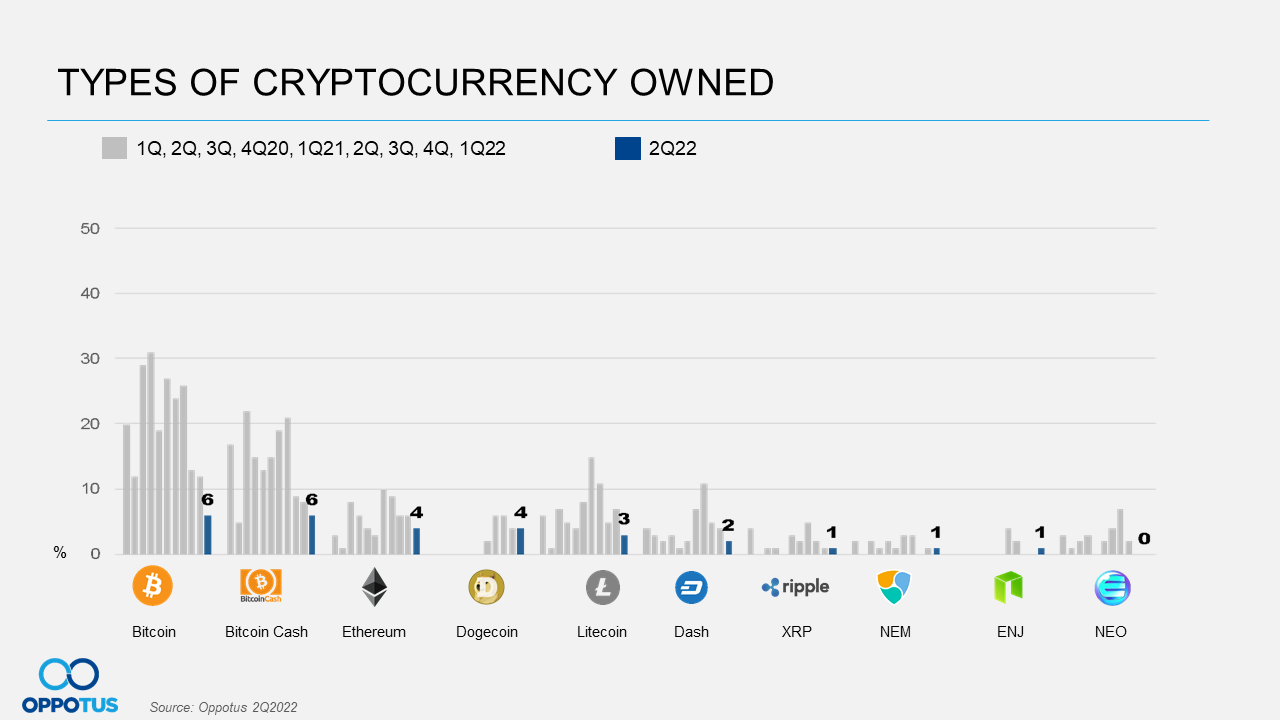

As consequence of the US Recession, it causes an overall decline in Malaysian Cryptocurrencies ownership as well. Ownership of top players such as Bitcoin and Bitcoin Cash are also recording an all-time low. However, the latter are still the most popular coin among Malaysian crypto owners (6%), followed by Ethereum and Dogecoin (4%).

Note: Malaysians on Malaysia cover opinions of Malaysians aged 18 and above, M40 and T20 segments, in key cities of Peninsula Malaysia representatively.

For a closer look at the data, feel free to contact us at theteam@oppotus.com.