Bitcoin, Litecoin, Ethereum, XRP, NFT’s, Dogecoin and more. This year it has become more and more difficult to look at the news or browse the internet without seeing headlines and discussions about cryptocurrency on a daily basis. Some are adamant that cryptocurrency is the future while others remain convinced that it is merely a bubble – but how has the crypto craze affected Malaysians? Is there a Malaysian Cryptocurrency market playing host to a burgeoning population of newly minted crypto-millionaires? Or have Malaysians been slow on the uptake when it comes to this global phenomenon?

What’s the Deal With “Crypto”?

The potential usages of cryptocurrency go far beyond just being an alternative form of currency. One possibility is for facilitating low cost money transfers, allowing participants to send and receive money quickly for a lower transaction fee compared to a financial intermediary. This makes it a popular option for international money transfers and non-cash remittance. Additionally, individuals are able to make anonymous transactions without the delay they would face if dealing with traditional banks when transferring large sums of money.

While cryptocurrency investors usually either treat cryptocurrency as a long term value asset or trade it on cryptocurrency markets for profit, it is also possible to earn interest with ‘yield farming’. Decentralised finance (DeFi) lending allows investors to earn from interest from deposits. Besides that, digital token-based fundraising allows individuals to invest in innovative start-ups that offer Initial Coin Offerings (ICOs) in exchange for established cryptocurrencies such as Bitcoin and Ether. More applications of cryptocurrency include getting paid to post content, renting out hard drive space to cloud servers, and even as a universal currency to be used while travelling.

The first cryptocurrency was Bitcoin, launched in 2009 by Satoshi Nakamoto. Cryptocurrencies are generalised into two categories, Bitcoin and altcoins. Altcoins are alternatives to Bitcoin such as Litecoin, Namecoin, and Peercoin. Most altcoins use a similar framework as Bitcoin with additional applications or improved functions. However, some coins use a separate system instead of Bitcoin’s open-source protocol. Examples include Ethereum, Ripple, and Omni.

Recent Events in the Crypto Market

In 2021, Bitcoin and other forms of cryptocurrency have experienced multiple surges, with the prices of various coins reaching new all time highs on multiple occasions. In January the value of bitcoin reached $30,000 per coin, and as of March Bitcoin is trading at approximately $60,000 according to data on CoinMetrics. Bitcoin’s upwards trend has yet to show signs of waning as it’s currently in the bull market with some analysts speculating that its price could even hit the $100,000 mark. However, despite how promising it appears, the market for Bitcoin remains highly volatile and experts are warning investors of the possibility that Bitcoin could go into a ‘winter’ state where prices decline continuously for a few years.

The surge in cryptocurrency prices has also contributed to the increased popularity and value of crypto-related companies, such as trading platforms that have gone mainstream. A notable example of this is Coinbase – an exchange platform for cryptocurrencies like Bitcoin and Ethereum based in US which recently went public. The company’s initial public offering (IPO) was listed on Nasdaq closed at $328.28 per share, with analysts speculating that Coinbase’s stock will continue to see an upward trend, reaching $500 per share within the year. This is a boon for the cryptocurrency-based economy as Coinbase’s IPO marks a significant step forward for the legitimisation of cryptocurrencies.

There have also been some unprecedented trends in the world of digital tokens, such as the now infamous Dogecoin. Sporting the image of the beloved Shiba Inu “Doge” meme, the cryptocurrency was originally created as a joke but surged to a market value of $50 billion in April. Fans attempted to push the price up in celebration of Dogeday on April 20th, popularising the hashtag #DogeDay all across social media. However, like a roller coaster after reaching its peak, the price fell as Dogeday came to pass and the hype died down.

Finally we have Elon Musk. A pivotal figure who has triggered explosive surges in the cryptocurrency market with his cryptic tweets. Prices of crypto rose 20% when he added the hashtag #bitcoin to his Twitter bio. His tweets about Dogecoin also contributed greatly to pushing the phenomenon globally and creating hype surrounding the coin which caused its value to rise significantly. Another one of his crypto related jokes on Twitter was made into reality when a new cryptocurrency ‘Elongate’ entered the market. Though it should be noted that Elongate has no association with Musk, beyond it’s name being a joke that references his history of influencing the cryptocurrency market.

NFTs

Another new offering that is currently rising very rapidly in popularity in the crypto market. NFT stands for non-fungible token and is part of the Ethereum blockchain. Each NFT represents a unique and verifiable code which can be seen as a “serial number” and is used to represent ownership of digital assets such as art, music, or other forms of digital media. NFTs are usually used to sell virtual collectibles and have recently entered the more prestigious luxury goods market when a digital art by artist Beeple made into an NFT was sold for a whopping $69 million.

Cryptocurrency trends in Malaysia

Now that we have an idea of what has been going on in the world of cryptocurrency. let’s take a look at how Malaysians perceive this volatile but lucrative currency.

What % Own Cryptocurrency?

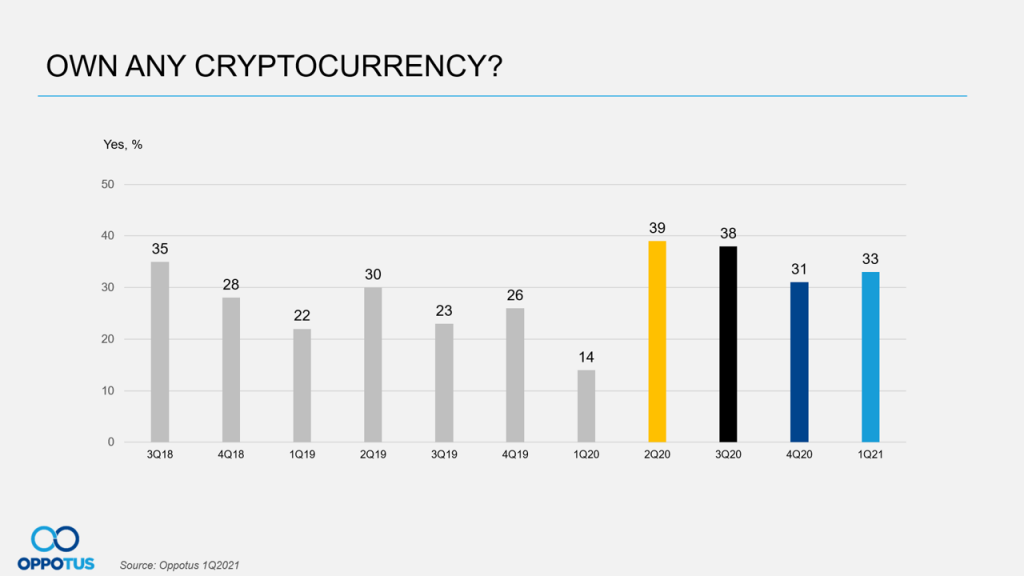

Overall, about 30% of urban Malaysians above the age of 18 own cryptocurrency. There was a slight downward trend from 2018 to early 2020, but in the past year Malaysian cryptocurrency ownership has remained above 30%. The cryptocurrency ownership among urban Malaysians started with a low 14% in the first quarter of 2020 as the market reported a 10% loss due to the Black Thursday crash in March.

However, Malaysian cryptocurrency ownership reached its peak in the second quarter of 2020, surging close to 40% when Bitcoin prices rose in April and maintained its strong performance till June. Ownership has since maintained at a rate of 30% for the remainder of the year until the start of 2021. This occurred amidst the COVID-19 pandemic as global governments and central banks announced their money-printing efforts, triggering the population to find ways to hedge inflation.

Types of Cryptocurrency Owned?

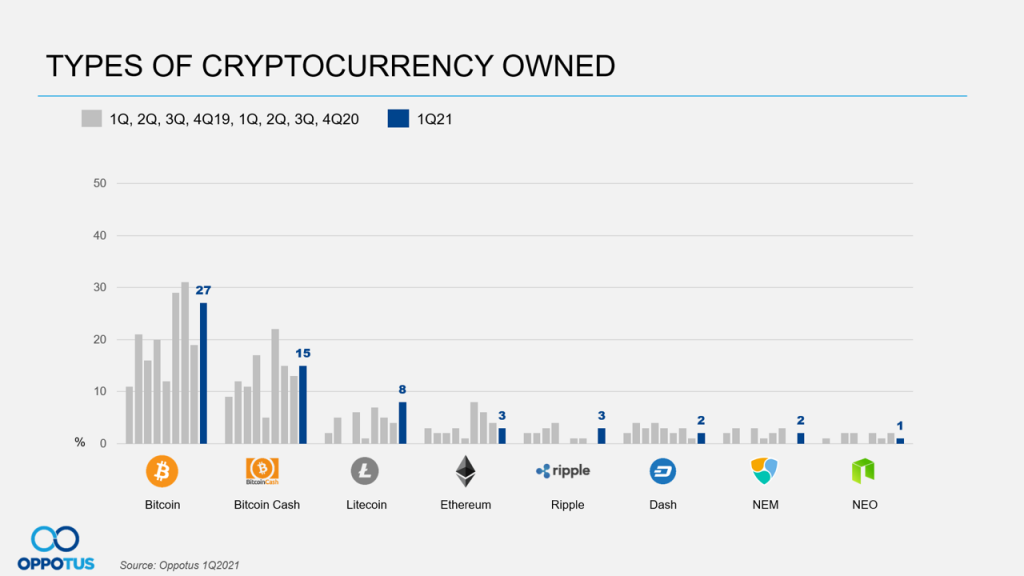

Generally the most popular cryptocurrency is the all time favourite Bitcoin (27%) with recent record high prices of US$60,000, followed by Bitcoin Cash (15%) in 2021. Even though Bitcoin maintains its strong position in the market, its network has a limit to transaction processing which has made Bitcoin cash more attractive as the network is able to handle more transactions per second at a lower cost.

In early 2021, other cryptocurrencies also gained popularity, especially Litecoin (and more recently Ripple XRP) which went up to 8% while Ethereum has slowly lost its appeal since the second quarter of 2020. This may be due to the fact that Ethereum has a higher average transaction fee compared to Litecoin. Litecoin is also more similar to Bitcoin, using the same blockchain system and offering speedier transaction time compared to Bitcoin.

What’s the Profile of Malaysian Cryptocurrency Owners?

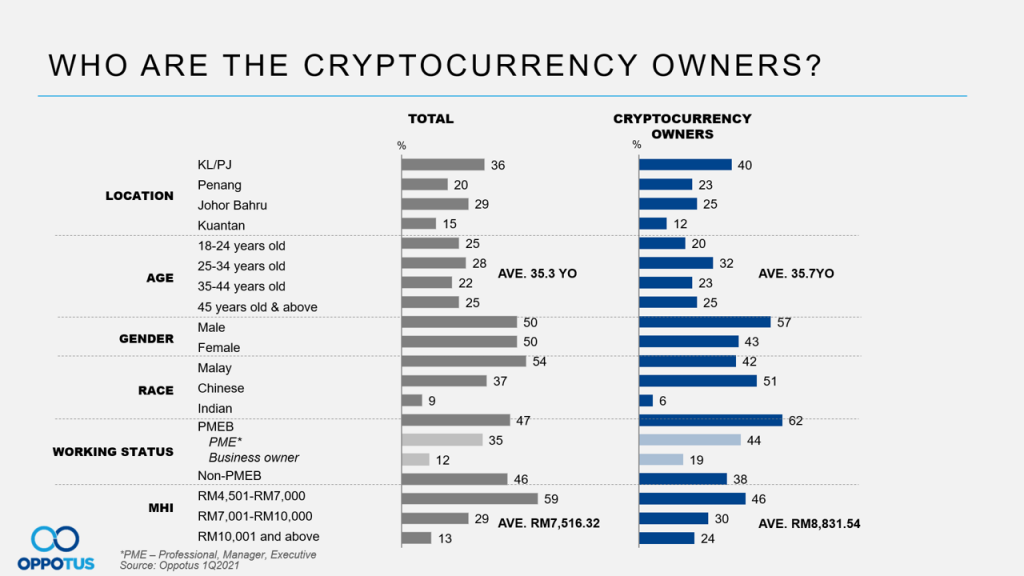

Looking at the demographics of Malaysian cryptocurrency owners, we find that the average age of all cryptocurrency owners comes to 35.7 years old. The highest segment of ownership belongs to 25-34 year olds at 32% and the lowest is reported among 18-24 year olds. This implies that the generation of millennials who are currently in their mid 20’s/early 30’s with more stable income are more able to invest that their younger counterparts, while also being more willing to invest in the volatile cryptocurrency compared to the older generation who are more risk averse and skeptical towards new technology.

Furthermore, males (57%) are also more likely to own cryptocurrency compared to females (43%) which is in line with various studies that state males have a higher tendency to invest than females. Based on race, the Chinese seem to resonate more with cryptocurrency compared to other races, making up 51% of cryptocurrency ownership. Malays come in second at 42% and Indians show the least interest in cryptocurrency at only 6%.

Malaysian Cryptocurrency ownership is predominantly taken by PMEBs (Professionals, Managers, Executives, Business-owners) (62%), especially among business owners. This corresponds with the data where highest ownership according to location is in KL and PJ area(40%) where many business hubs are located, followed by Johor Bahru, Penang, and lastly Kuantan. In terms of income, those with higher average monthly household income of RM8,800 tend to invest in cryptocurrency more, with strong skews towards the T20 segment

How Do Malaysians Invest Cryptocurrency?

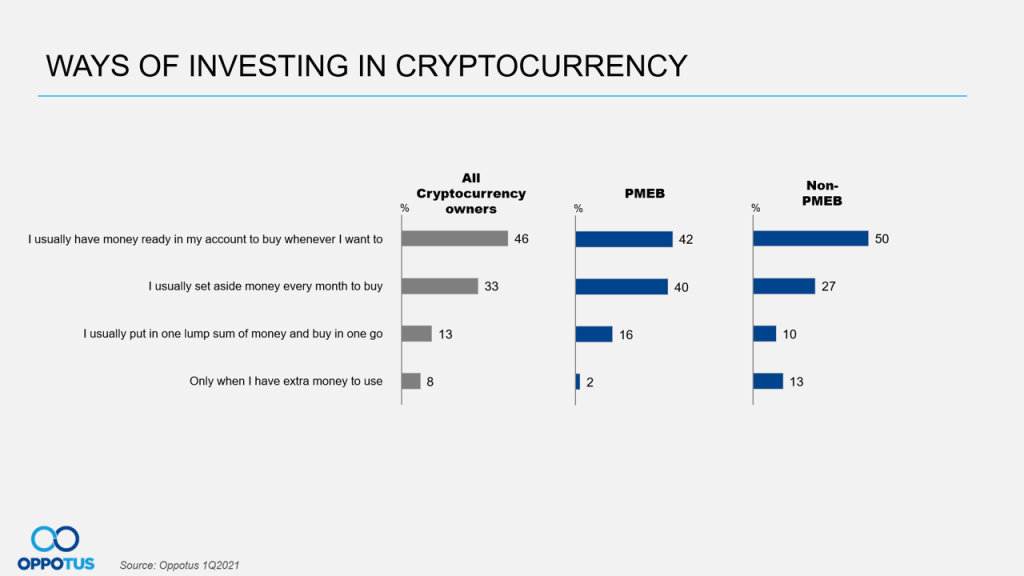

Investment in cryptocurrency depends on the person’s financial capability. PMEBs usually budget their expenses to invest in cryptocurrency while non-PMEBs tend to only invest when they have extra money to spend. Nowadays due to the surge in Bitcoin prices, making an investment plan has become crucial if one wants to profit in this high risk asset.

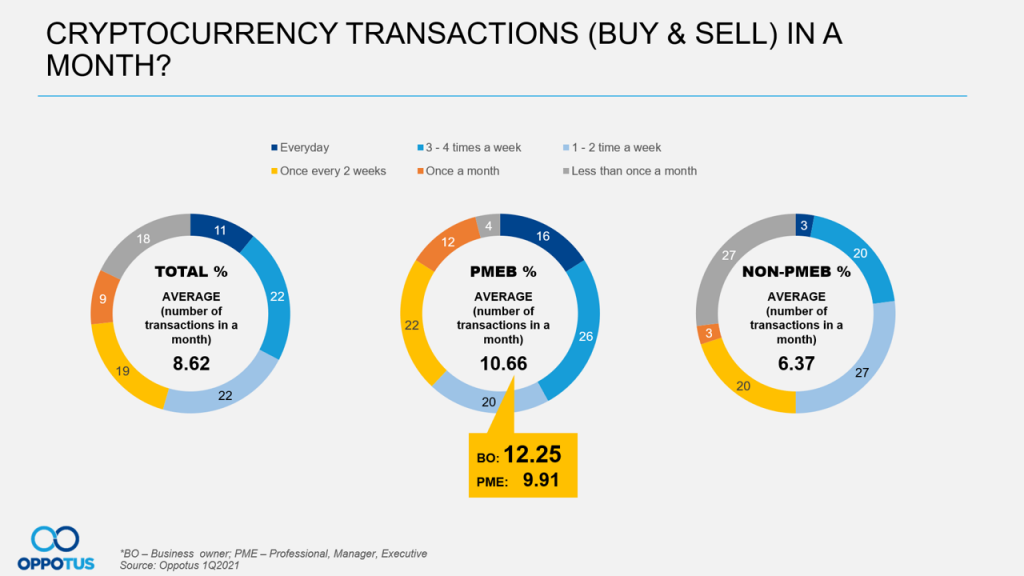

Cryptocurrency Monthly Trading Frequency?

On average, PMEBs engage more frequently in a number of cryptocurrency transactions at 10.66 per month compared to non-PMEBs (6.37 per month). Business owners in particular trademore frequently (12.25 per month) than PMEs (9.91 per month). At least 60% of PMEBs invest in cryptocurrency on a weekly basis, of which 15% invest daily. Non-PMEBs on the other hand also commonly trade on a weekly basis, however only 3% invest daily. This reflects the data where PMEBs budget their expenses, hence they have a higher tendency to invest daily.

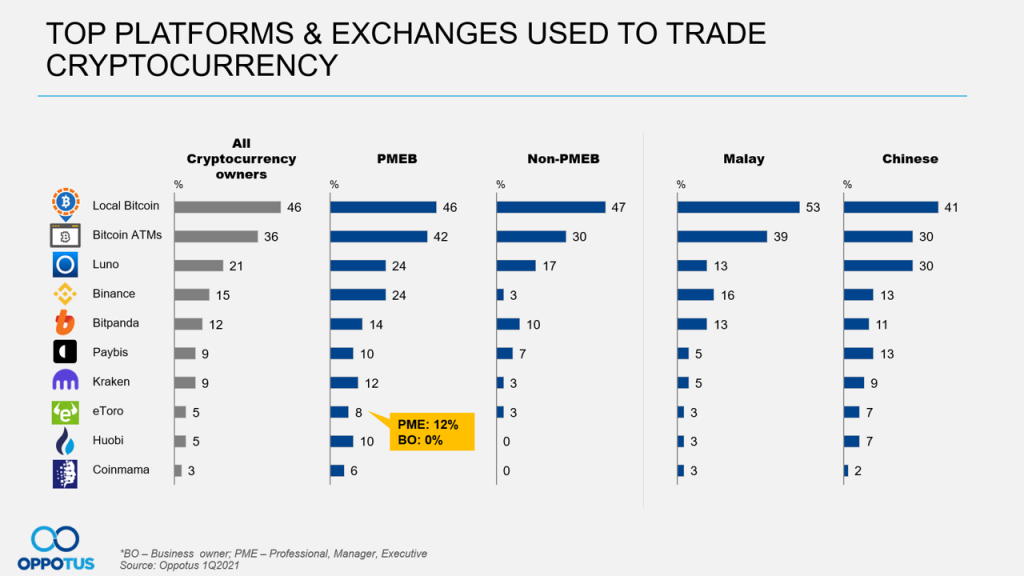

Top Platforms and Exchanges Used?

Overall, the top 3 platforms for trading used in the Malaysian Cryptocurrency scene for both PMEB and non-PMEB is Local Bitcoin followed by Bitcoin ATMs and Luno. The data also shows that PMEBs’ choice of cryptocurrency is more fragmented compared to non-PMEBs. PMEBs have a higher tendency to use platforms such as Binance, Kraken, Houbi, and Coinmama. Binance shows a high usage of 24% among PMEBs because the site is aimed at cryptocurrency exchange experts and offers more advanced features for the pros, which is why it attracts people who actively invest in cryptocurrency.

A vast majority of Malays trade on Local Bitcoin (53%) and the least on Luno (13%) whereas for Chinese there is a more even distribution among the top 3 platforms although Local Bitcoin still stands out at 41%.

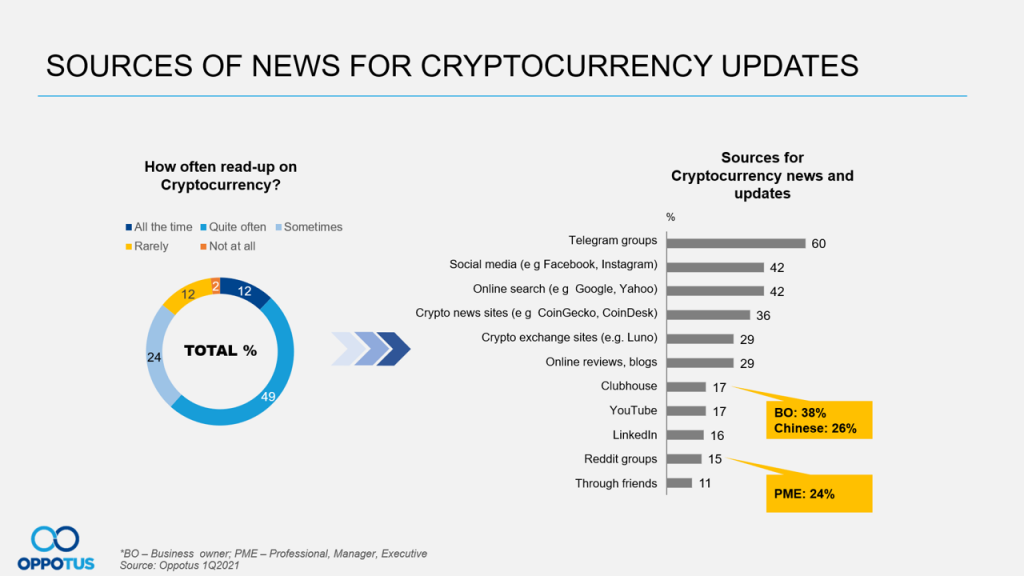

Source of News for Cryptocurrency Updates?

When it comes to keeping up to date with news on cryptocurrency, Telegram groups (60%) is the key source for information followed by social media (42%), online search (42%), and crypto news sites (36%). Over 60% of investors in the Malaysian Cryptocurrency scene follow news and updates very closely. Among business owners, Clubhouse is a more prominent choice for sourcing news while Reddit is more common among PMEs. Clubhouse is a social media platform for many tech savvy and crypto investors to gather and chat where some famous figures such as Elon Musk would also appear. It’s the perfect place not only just for gathering information but also having fruitful discussions for those with an appetite for investing in cryptocurrency.

To conclude, PMEBs are more enthusiastic when it comes to cryptocurrency, especially among business owners. Bitcoin with its illustrious history remains the top cryptocurrency Malaysians prefer to invest in, but other cryptocurrencies with better transaction speed and fees such as Litecoin are also gaining traction. And finally, as with any investment, one should make all due considerations for risks and trade-offs before investing.

If you would like to find out more about Malaysian cryptocurrency trends and get additional insights on this up and coming market, feel free to contact us at: theteam@oppotus.com. Or, check out our latest Malaysians on Malaysia article for more insights on Malaysian trends and digital advancements such as e-wallet usage.