Welcome to Malaysians on E-Wallet, our quarterly study offering detailed insights into usage of e-wallets amongst Malaysians.

One of the emerging trends in the digital and payments spheres is the e-wallet. The e-wallet is gaining more and more traction in Malaysia as more brands are cashing in to gain a competitive edge in this unique subsegment of financial technology as consumers grow more tech-savvy.

With more non-banks being licensed by Bank Negara Malaysia, the country is looking set to embrace a cashless society in which consumers can perform strings of payments using a variety of methods.

Whilst e-wallet usage in Malaysia is still in its infancy as many brands are focusing more on acquiring customers and merchants, the increasing rate of mobile penetration across Malaysian demographics provides a wealth of possibilities.

Developments in the e-commerce and tech industry have paved a way for the emergence of e-wallets, which are quickly gaining popularity in Malaysia. While convenience remains as the biggest attraction for e-wallet usage, the ability to ensure secure transactions and the increasing prevalence of cashback or reward systems have also made a big contribution to the expansion and adoption of the market. Consumers nowadays are also showing an increasing willingness to adopt new technology, and are certainly more open to trying out non-traditional payment methods.

So what exactly is an E-Wallet?

E-wallet is a means of authentication and payment for device independent e-payment instructions, where it allows users to make transactions quickly and securely. It serves a function much like a physical wallet, but removes the physical inconvenience of storing the clutter of several cards, cash notes and more. The Real-time Retail Payments Platform (RPP) as introduced by Bank Negara Malaysia, has served as a catalyst and enabler for innovative payments in Malaysia by providing a platform which provides real-time payment services to customers of financial institutions.

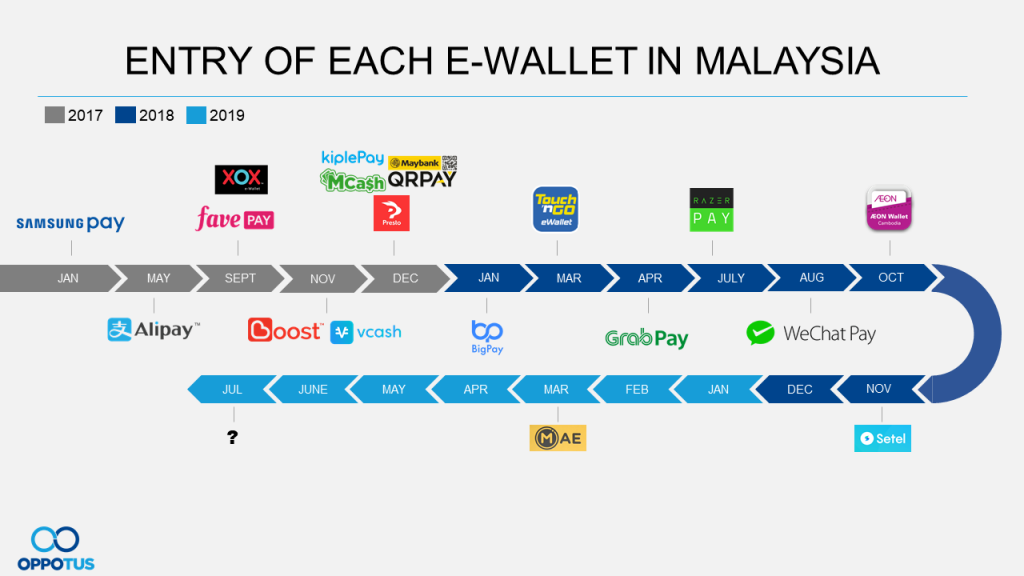

Here we have a list of all of the e-money issuers that have been introduced to the Malaysian market, going back as early as 2017. Ever since the RPP was introduced, the mobile e-wallets scene in Malaysia has grown exponentially as more and more prominent brands have opted to adopt the technology.

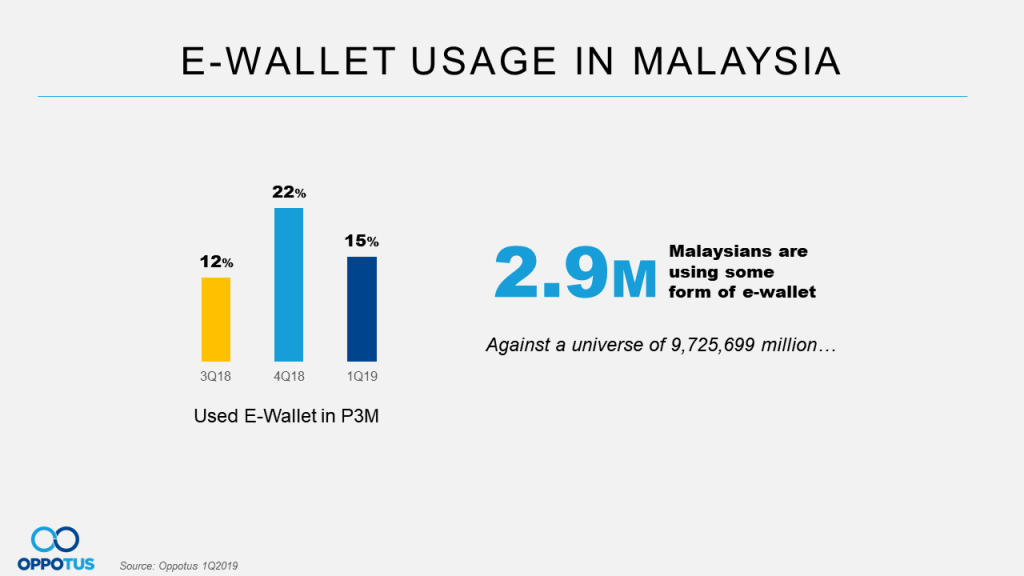

There has been a positive adoption of e-wallets amongst Malaysians (aged 18 and above in key cities), as seen in the numbers which show a clear overall growth in e-wallet usage. As the competition between e-wallet services gets more intense, usage almost doubled in 4Q18 thanks to the buzz and hype around the different e-wallets coupled with the major 11.11 and 12.12 sales from e-commerce sites and year-end holidays which further boosted the growth of e-wallets. However, we see a decline in the usage of e-wallets 1Q19, as this is when all the aforementioned major activities begin to slow down.

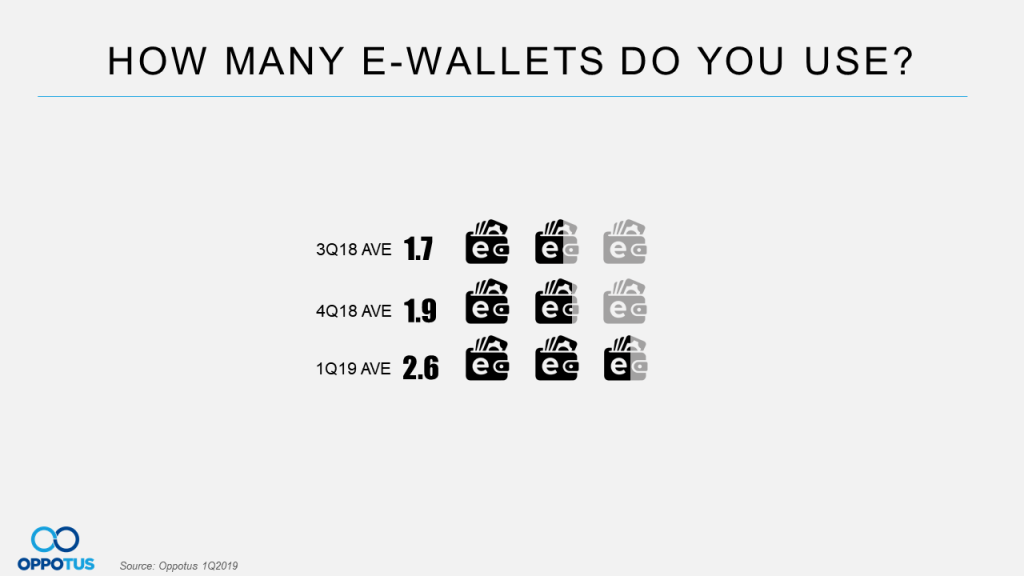

The range of e-wallet usage amongst individual consumers has been gradually increasing since 3Q18, with consumers reaching the point where they are regularly using 2 to 3 e-wallets at a time on average. This shows that people are getting more receptive towards the payment medium and are also more willing to try out different platforms, thanks in part to the various rewards and incentives that are offered by each provider – we should see this number continue to grow before it eventually begins to shrink as the e-wallet scene consolidates itself.

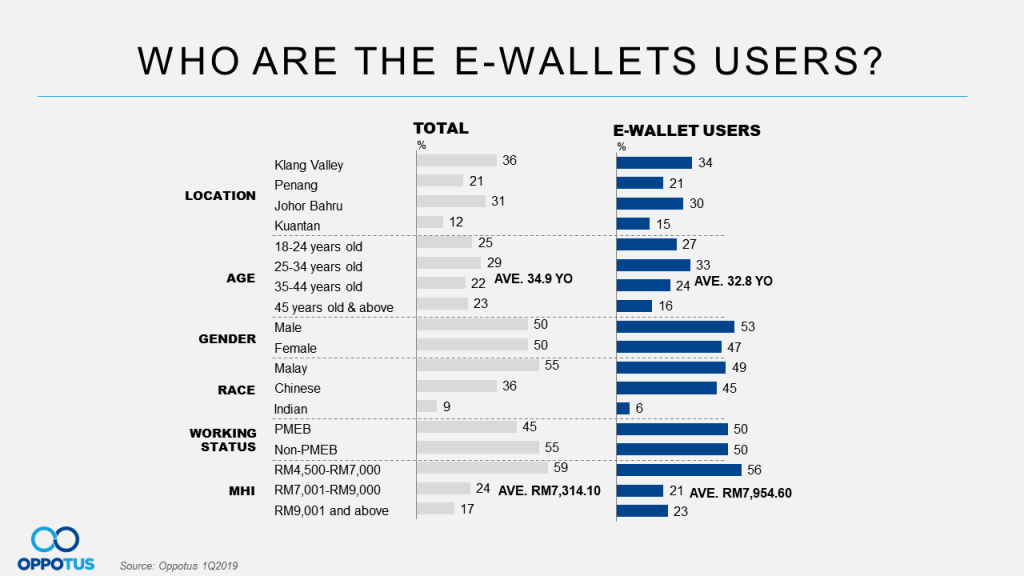

So who exactly are these e-wallet users? They seem to be slightly skewed towards the millennials – young professionals (25-34 year-olds) in above average income groups.

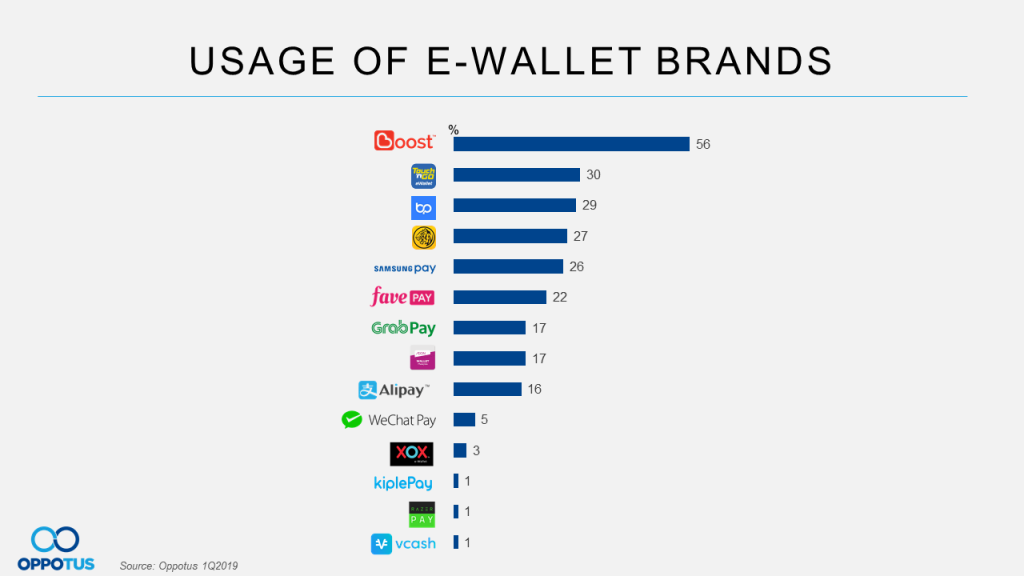

Boost is currently the highest used e-wallet out of all the e-wallet providers in Malaysia. This is no surprise given their generous promotions, cashback and deals which encourages more adoption from new users while also giving existing users more incentives to keep using it.

Coming in next is the Touch’n’Go e-wallet which has achieved a strong presence in the market of late. This is thanks to it’s unique new features such as PayDirect and RFID which make it a competitive player in the market. Following closely behind is AirAsia’s BigPay, Maybank QR and SamsungPay.

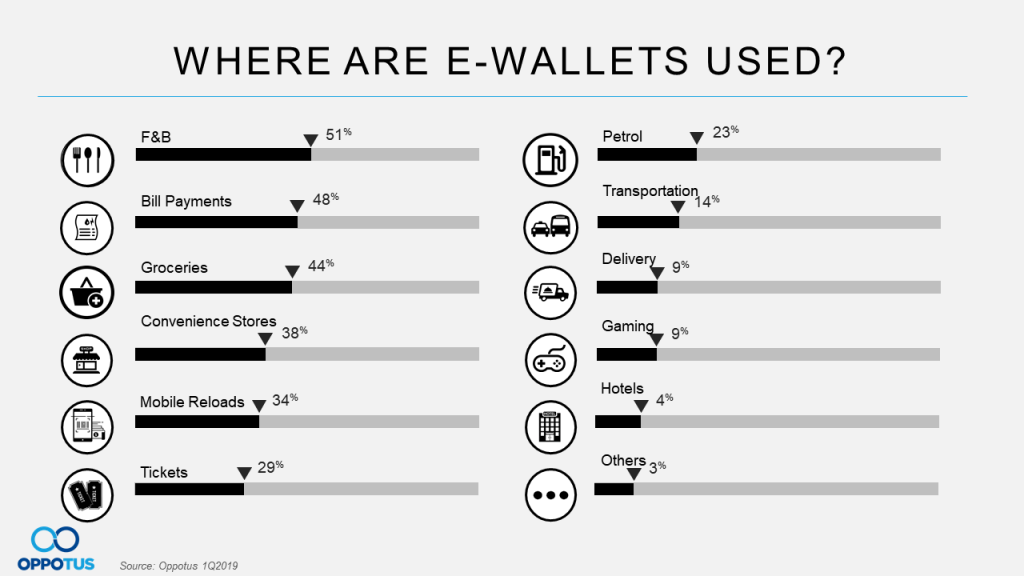

When it comes to the ways that e-wallets are used, we find that usage is predominantly for payments of F&B services. This makes sense given the many cash-back rebates and 2X points rewards available at various kinds of outlets, ranging from street vendors, to casual restaurants, to popular nation-wide chains such as Tealive. Usage of e-wallets for bill payments, groceries, convenience stores and mobile reloads are not far behind.

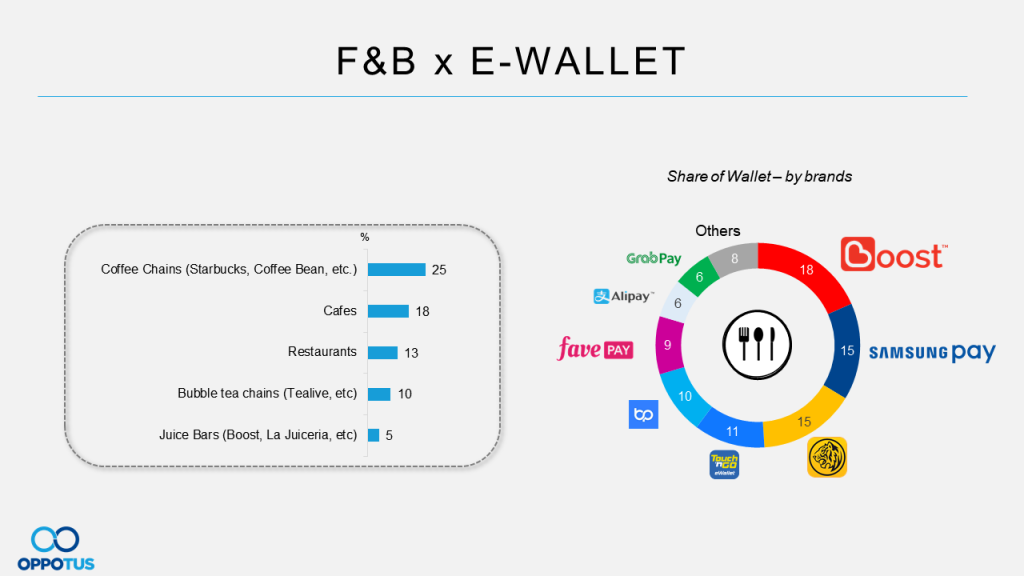

Amongst all the types of F&B outlets where e-wallets are used, coffee chains such as Starbucks and Coffee bean top the list for the most usage.

Boost, Samsung Pay and Maybank QRPay are the key players in this category with TnG, BigPay and Fave Pay following behind.

Looking into bill payment, Boost alone takes up close to 30% of the space while again, Samsung Pay, Maybank QR, Big Pay and Fave Pay are competing closely.

Finally, when it comes to groceries, the AEON Wallet (13%) is seen to make its mark here, although Boost (18%), TnG and Maybank QRPay still lead the pack.

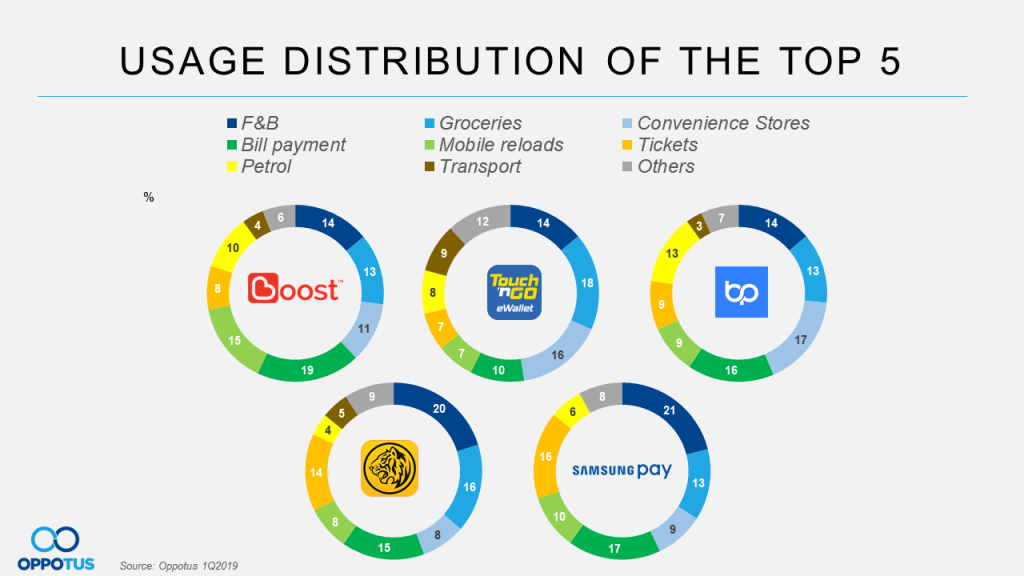

Here we see the usage distribution of each of the top 5 most used e-wallets in Malaysia.

Boost is leading in the Bill payment and Mobile Reload segments, while

TnG has a higher share for Transportation; Big Pay for Petrol; and Ticketing for Maybank QR and Samsung Pay.

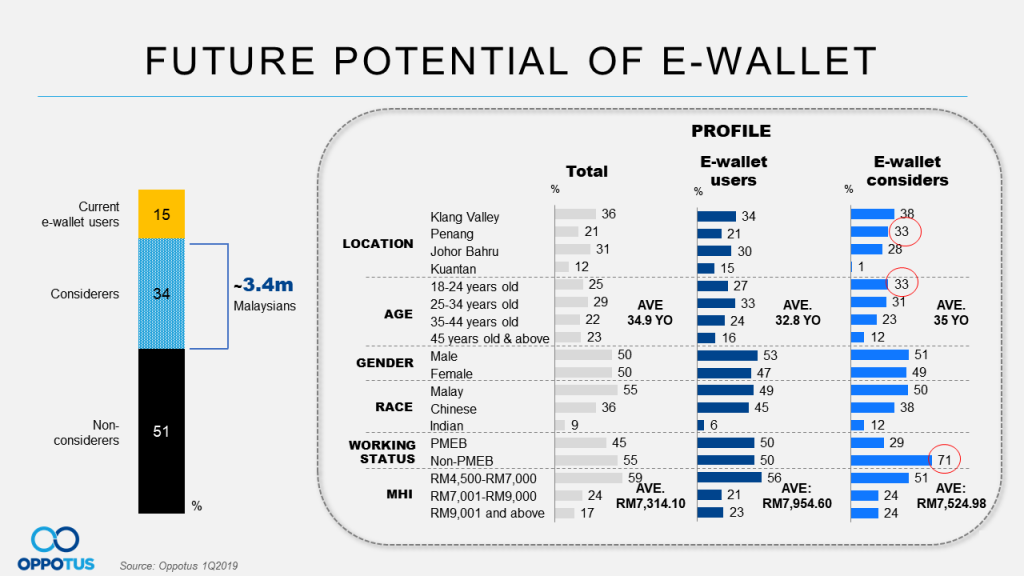

With our study showing that there is an estimated 3.4 million more Malaysians who are considering the adoption of e-wallet usage in the coming 6 months, with Gen Z and non-professionals leading the way, the battle of e-wallets will continue to be intense.

Who will reign supreme at the end of the day? Whoever it may be, one thing is for sure – E-wallets are here to stay and will become ubiquitous as people continue to become more tech savvy while also becoming more aware of the convenience and additional benefits of e-wallets.

We spoke to over 500 Malaysians on the ground face-to-face across key cities in Malaysia – Klang Valley, Johor Bahru, Penang and Kuantan. They were aged 18+, distributed proportionally by ethnic groups, gender and income groups.

If you would like to dive deeper into the data and get further insights in to e-wallets, feel free to contact us at: theteam@oppotus.com