2020 continues to be an unprecedented year of challenges and lifestyle changes for people around the world. As people continue to adapt their everyday lifestyles to fit with the “new normal”, one distinctly observable and inevitable trend has been the spike in the usage of e-commerce, and with it, e-wallet usage in Malaysia.

With the end of 2020 coming up, and this year’s 11.11 sale in the rear view mirror, we thought this would be a good time to take a look back at how e-wallet usage in Malaysia has evolved throughout the year 2020.

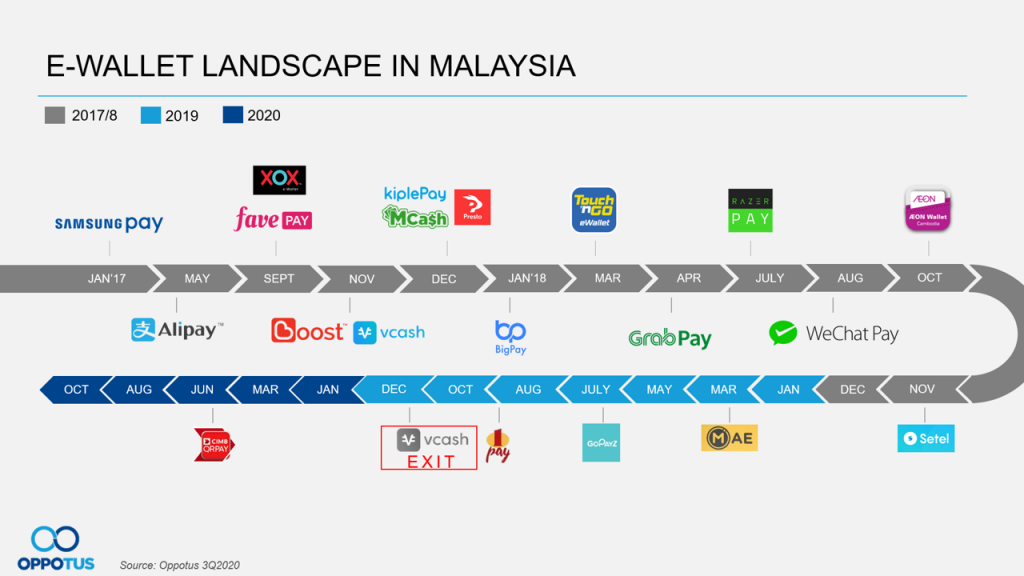

After the past 3 years of several new e-wallets being introduced each year, we have now reached a point where the introduction of new e-wallets has slowed considerably. The only new e-wallet to be introduced in Malaysia this year was CIMB QR Pay, which made its debut in June 2020.

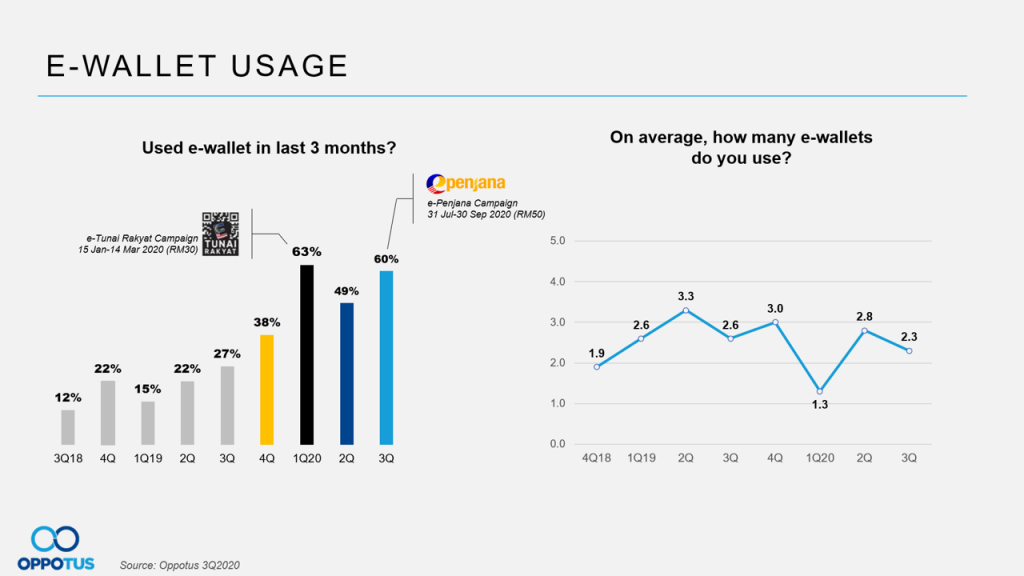

This year, Malaysian consumers were able to benefit from two campaigns by the government which bestowed credit for all e-wallet users to take advantage of. These were the e-Tunai Rakyat Campaign during 15th Jan – 14th March, and the e-Penjana Campaign during 31st July – 30th September.

As one would expect, these campaigns resulted in surges of e-wallet usage in Malaysia in Q1 and Q3 of this year, with the latter coinciding with the Recovery Movement Control Order (RMCO) implemented by the Government to curb effects of the COVID-19 pandemic.

During the Q3 usage surge thanks to the e-Penjana campaign, Malaysians were seen to be using an average of 2 to 3 e-wallets, whereas only 1 to 2 e-wallets was used by Malaysians on average during the e-Tunai Rakyat campaign. This suggests that consumers were claiming their e-Penjana credit with a different provider, and also indicates that consumers are opening up to the idea of going cashless and exploring the different promotions and benefits that different e-wallets can provide.

These benefits include attractive bonuses whenever payments are made via the e-wallet, such as cashback for F&B payments and vouchers for usage at certain retailers.

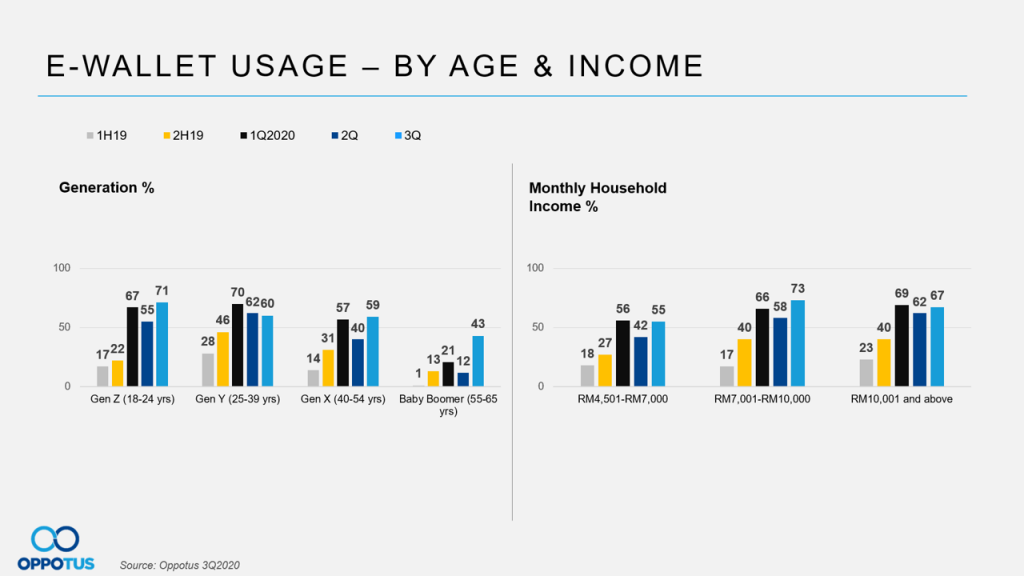

Looking at e-wallet usage in Malaysia across different generations, we see increases in usage incidence across the board beginning of 2020, while the strongest increase in the usage of e-wallets was seen between now and the 2nd half of 2019 among the Gen Z and Baby Boomer groups.

When it comes to usage across different income groups, the largest increase in usage was seen in the upper M40 income group.

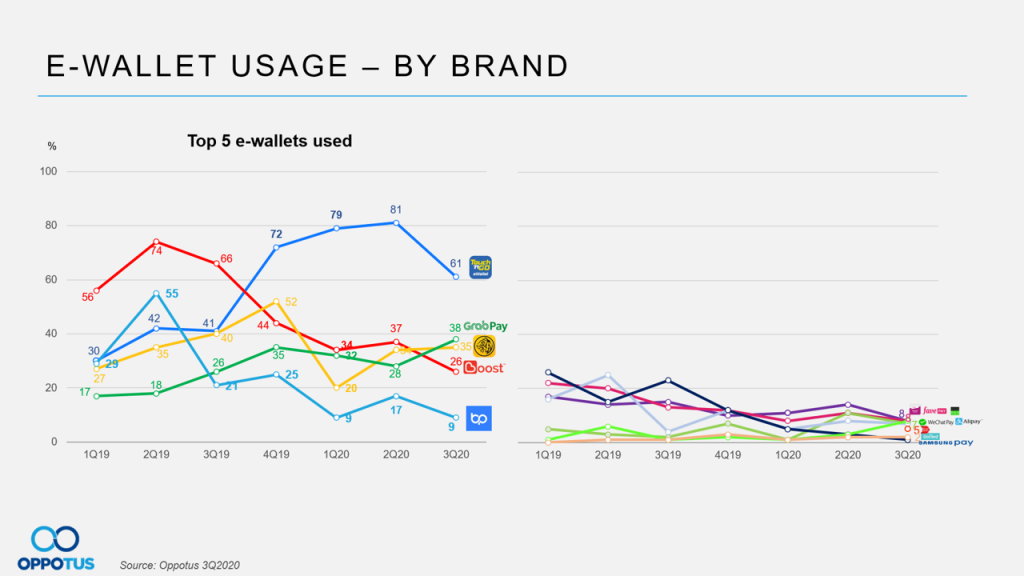

We saw earlier that the average number of e-wallets used by each consumer has risen from 1 e-wallet to 2 e-wallets between Q1 and Q3 of this year. As we suggested, this is an indication that consumers are seen to be trying out other e-wallet services or claiming their e-Penjana with another e-wallet provider.

This is supported by the changes that each major e-wallet saw in their rate of usage, as major partners of e-Penjana such as Touch ‘n Go and Boost recorded a decline in usage; while Grab recorded a surge in usage during the e-Penjana campaign period. Touch ‘n Go is still the market leader in Malaysia by a large margin, and it would be interesting if this dip continues.

With the focus on the three major players during this period, usage of all other e-wallets recorded a noticeable decline. On the bright side for new e-wallets in the landscape, CIMB QR Pay is seen to be making somewhat of an impact since it’s introduction in the middle of 2020, obtaining a 5% share of the total e-wallet usage.

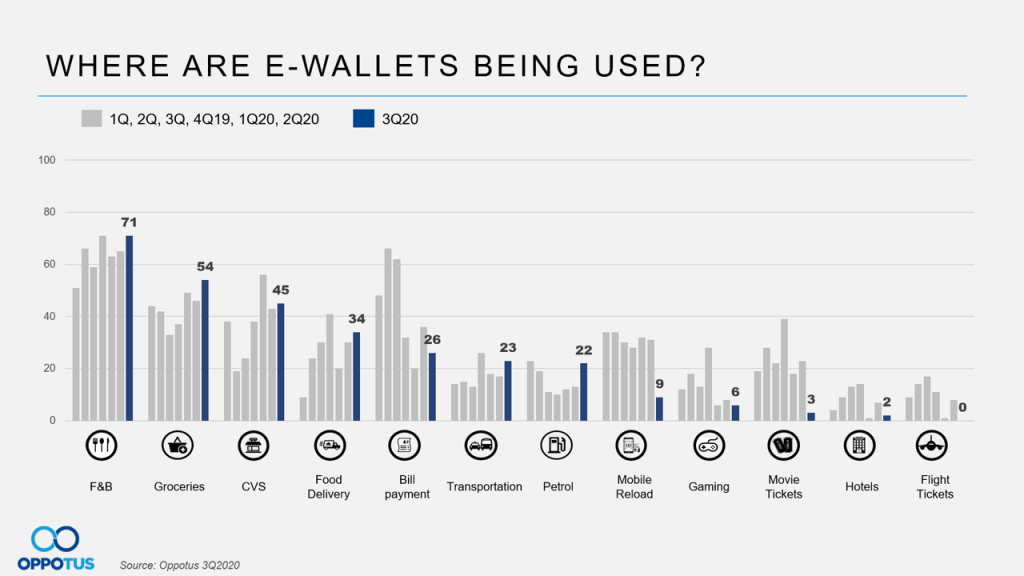

The usage of e-wallets continues to surge in the categories of F&B, Groceries and Convenience Stores (CVS), owing to the various promotions that have been coming and going all year round in these categories, not to mention the additional flux of promotions that came inline with the e-Penjana campaign.

With everyone trying to stay indoors as much as possible, the usage of e-wallets for food delivery services was even more prominent in Q3 than it has been before – steadily increasing since Q1’2020, which coincides with the initial instatement of the Movement Control Order (MCO) in March.

Beside food delivery, other areas where e-wallets are gaining usage include petrol payment and Transportation services.

On the other hand, the usage of e-wallets for movies and hotels have understandably recorded a huge drop in usage since the start of the MCO, as these industries have been hardest hit in the market due to the pandemic situation.

Towards the end of 2019, a large majority of users said they would continue to use e-wallets if there were no incentives, at 77%. At the start of 2020, the number dipped to 55%, but thanks to the advent of the “new normal”, 70% of consumers are now saying that they will continue to use e-wallet services even if there were no incentives. This is a strong indication that consumers are adapting to making e-wallet payments on a regular basis and opting to go cashless more frequently as part of their daily habits – the safer option for transactions rather than exchanging cash during this pandemic.

As of now, it remains uncertain how long Malaysia will continue to implement the CMCO in the different districts across the country. However, regardless of how long the MCO lasts, it’s safe to say that the “new-normal” is something that will continue to affect everyone’s lifestyles moving forward, particularly for city folk.

As F&B and retail outlets continue to suffer from reduced sales, it’s likely that these vendors will continue to offer online promotions in order to attract consumers. As we have seen so far, the major e-wallet providers such as Grab, Fave, Boost and Touch n’ Go have always been more than happy to collaborate with these vendors and provide a platform where consumers can make transactions and place orders with these vendors while taking advantage of the myriad of promotions and incentives that are available. Given that 70% of consumers are already willing to use e-wallets without the presence of any incentives, it wouldn’t be unreasonable to expect a further increase in the usage of e-wallets, or repeated surges during promotional periods/another government e-wallet campaign.

All in all, e-wallets appear to be one of the few services that have actually benefited from the effects of the pandemic. The functionality of e-wallet to serve as payment for almost any product or service both online and in person is already a major convenience, while the ongoing pandemic serves as further incentive for individuals to go cashless and make the switch over to e-wallets – a truly contactless payment service. Once the CMCO runs its course and consumer confidence has the chance to recover again, it will be interesting to see whether e-wallet usage in Malaysia will continue to rise in conjunction with any increase in consumer spending.

If you would like to take a deeper look at e-wallet usage in Malaysia, e-commerce, and the habits of Malaysian consumers, feel free to contact us at theteam@oppotus.com.