Welcome to Malaysians on Malaysia: our quarterly report on Malaysian sentiments, featuring essential insights into consumer confidence, media trust, behavioural, tech and esports trends in Malaysia.

This study is the first wave as we welcome 2019, continuing our efforts to capture the essence of Malaysians on Malaysia. Essentially, this study aims to measure and take a deeper look at Malaysian’s sentiments in the areas of confidence and capturing current and future economic prospects.

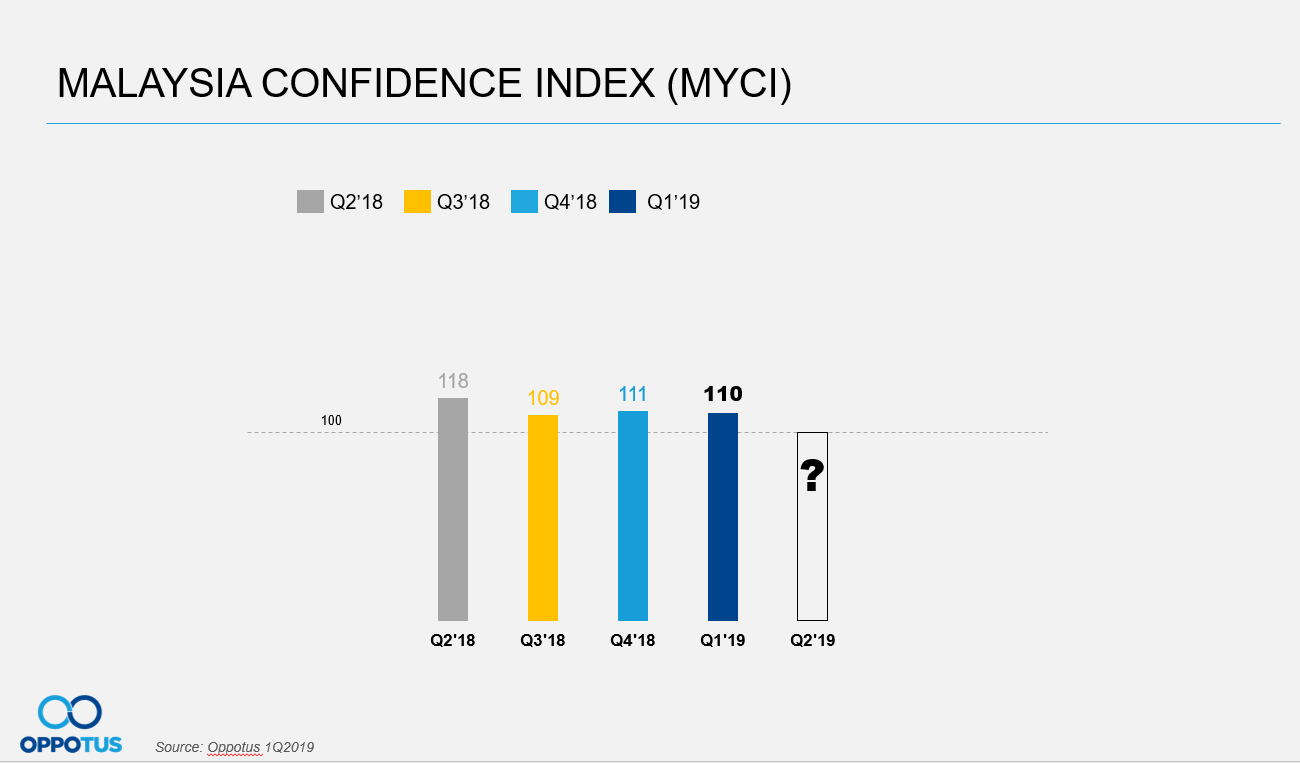

In this quarter, we see steady overall confidence as the index pattern continues to be at a stable rate, indicating a healthy confidence levels and positive sentiments and outlooks for financial well-being among Malaysians.

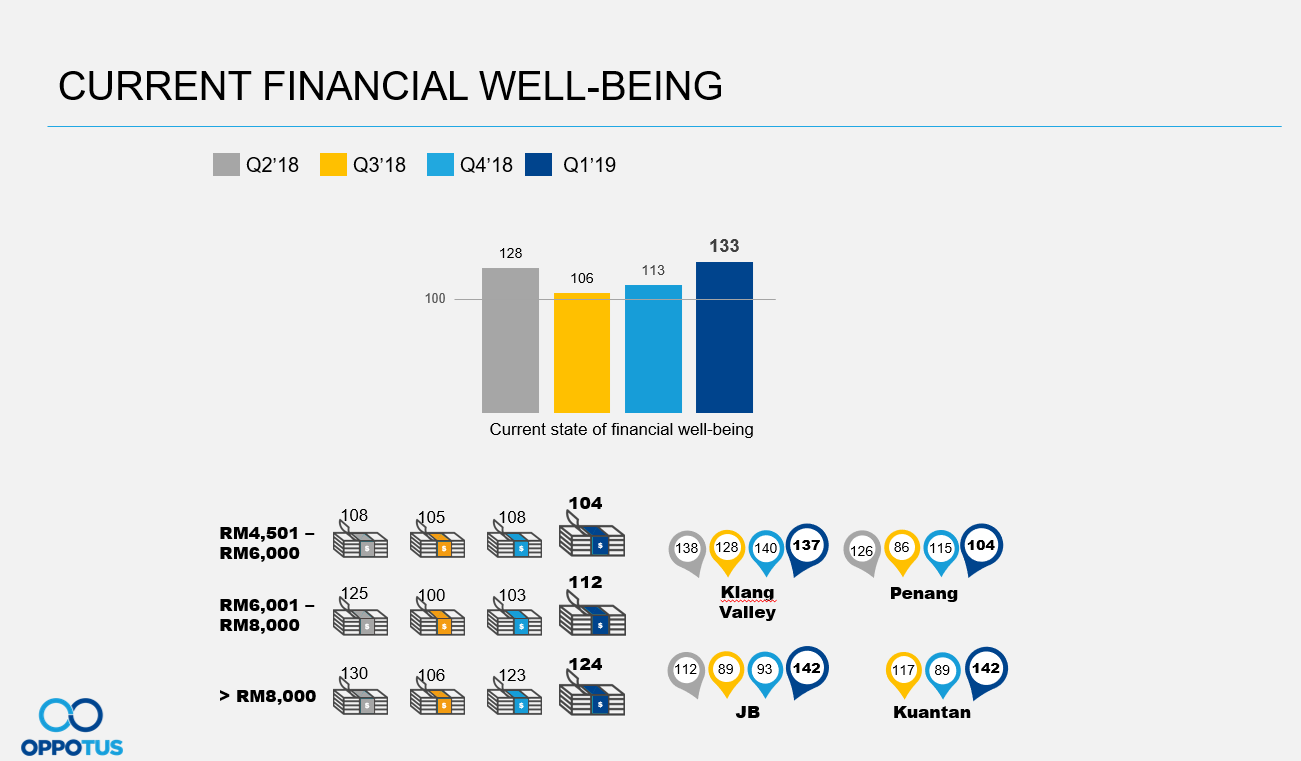

Financial well-being is also seeing healthy growth as this latest wave shows an incremental rate in how people are perceiving their current and future financial well-being.

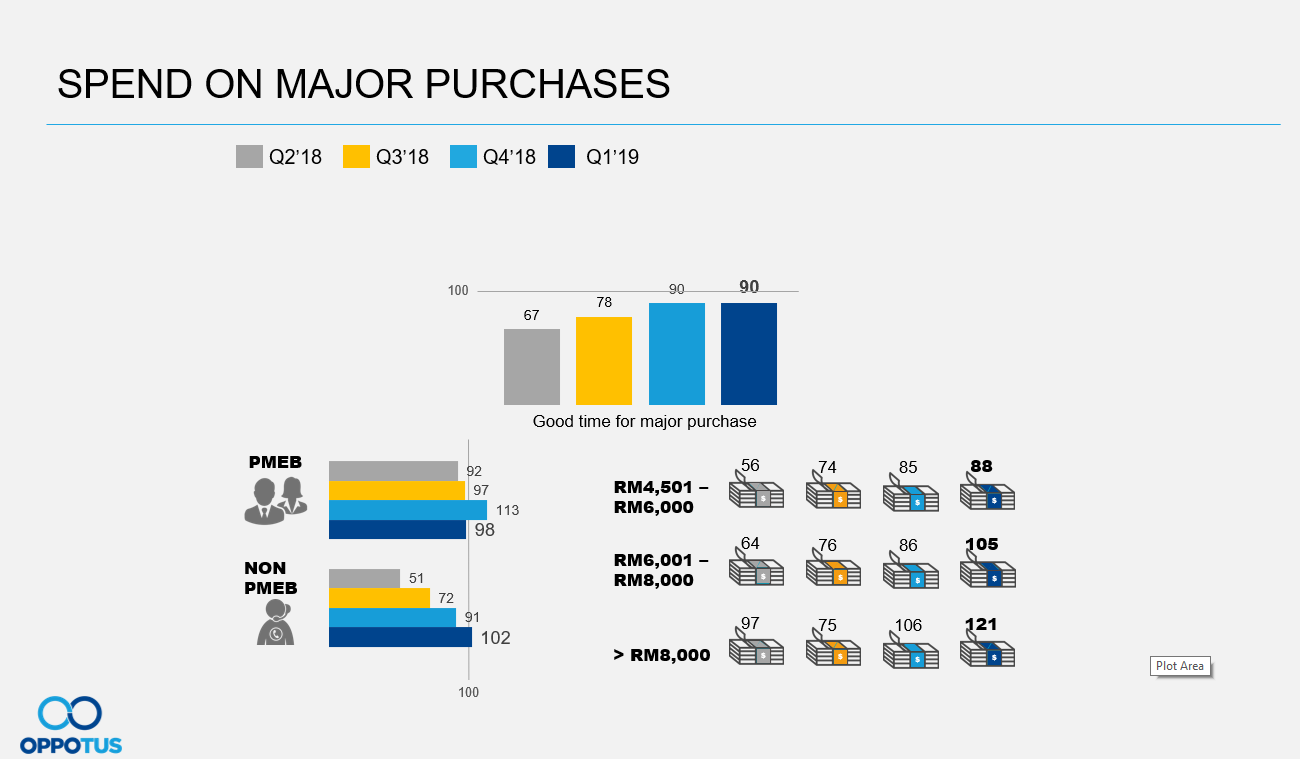

With the implementation of Budget 2019, people are more conscious of their finances and spending on major purchases has not moved since the last wave.

In this round, we continue to cover interesting topics such as tech trends, e-wallet usage, esports, and other interesting stats.

If you would like to dig deeper into the numbers, please do reach out to us here: theteam@oppotus.com

For the first wave in 2019, the consumer confidence index level continues to hold steady in positivity.There are a number of factors contributing to this positive index level, one of which is the government’s new stamp duty exemption policy which is part of an initiative to encourage home ownership amongst Malaysians. It can also be attributed to the increased minimum wage and the new car launch by our national carmaker.Will we see a change in patterns as we enter the remaining quarters for this year? It will be interesting to uncover them as we progress.

For the first wave in 2019, the consumer confidence index level continues to hold steady in positivity.There are a number of factors contributing to this positive index level, one of which is the government’s new stamp duty exemption policy which is part of an initiative to encourage home ownership amongst Malaysians. It can also be attributed to the increased minimum wage and the new car launch by our national carmaker.Will we see a change in patterns as we enter the remaining quarters for this year? It will be interesting to uncover them as we progress.

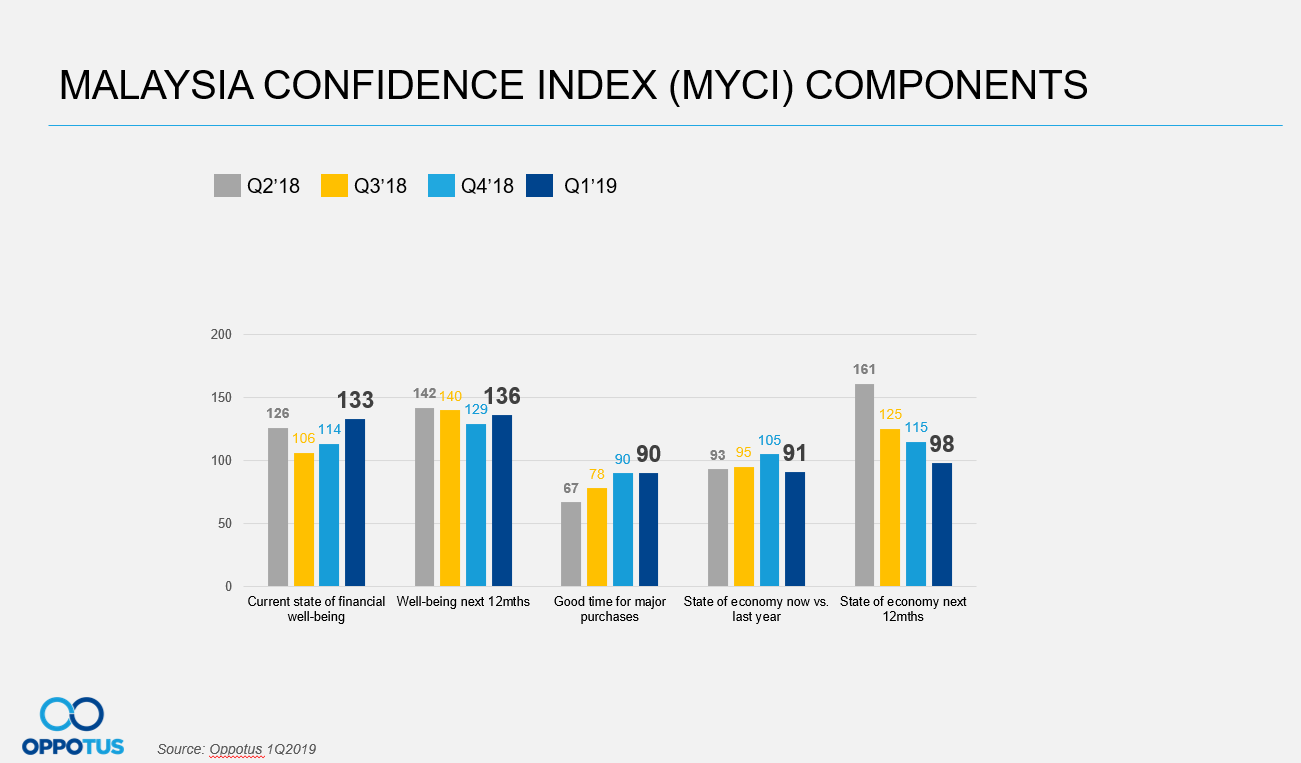

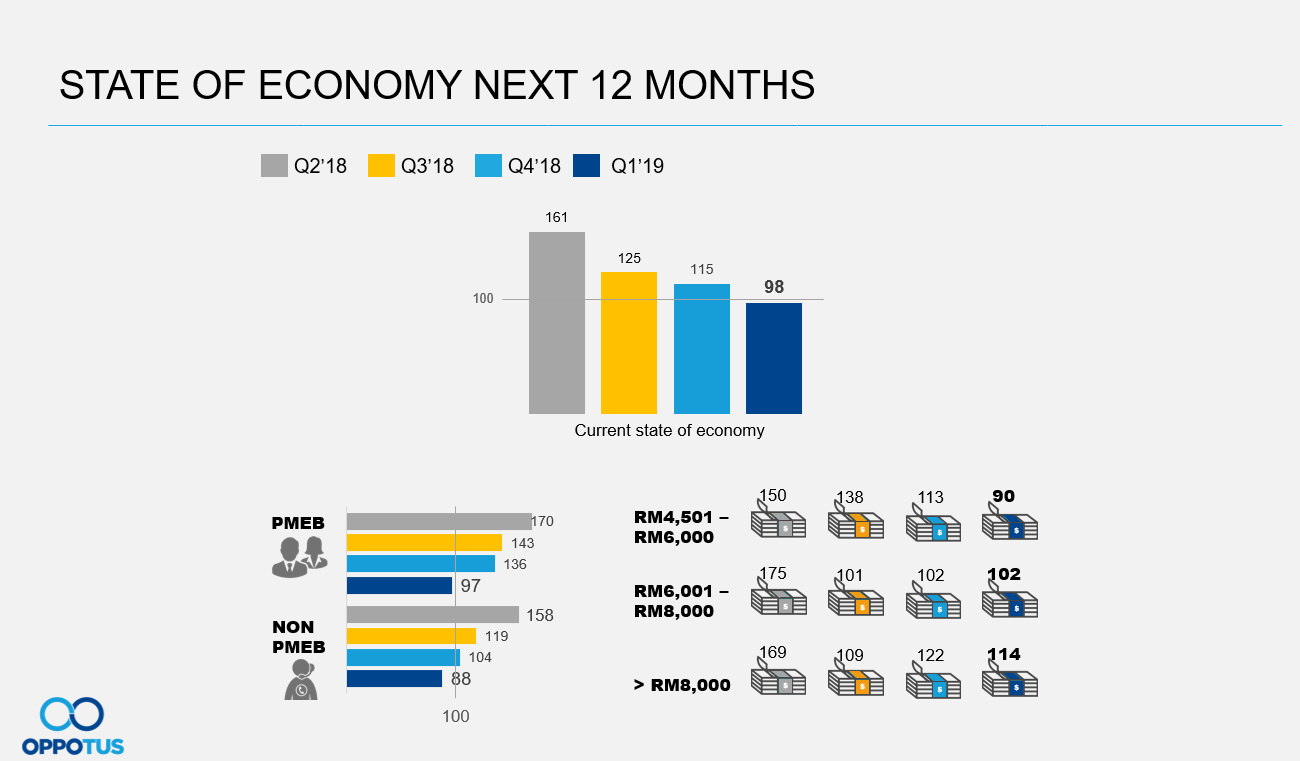

At the start of 2019, Malaysians have seen a lift in optimism with their state of financial well-being for now as well as in the near future. However, 1Q2019 also saw the sharpest drop in sentiment towards the state of the economy due to external factors such as the trade war, volatility of the ringgit and a general slowdown in global growth – all of which have negatively affected the overall optimism of Malaysians.Nevertheless, the index level for major purchases remains the same, albeit still below the 100 point mark, indicating that people are again cautious on their spendings.

With a 20 point jump, this wave saw the highest incremental rate for the current financial well-being of Malaysians, mainly driven by people from JB and Kuantan.Those within the middle income group bracket are also showing signs of higher optimism to go with their current financial well-being. This indicates that people are more informed and are making better choices with their expenditures, partially due to efforts by the government to ensure that Malaysians step up their financial literacy and learn smarter ways to manage their finances.

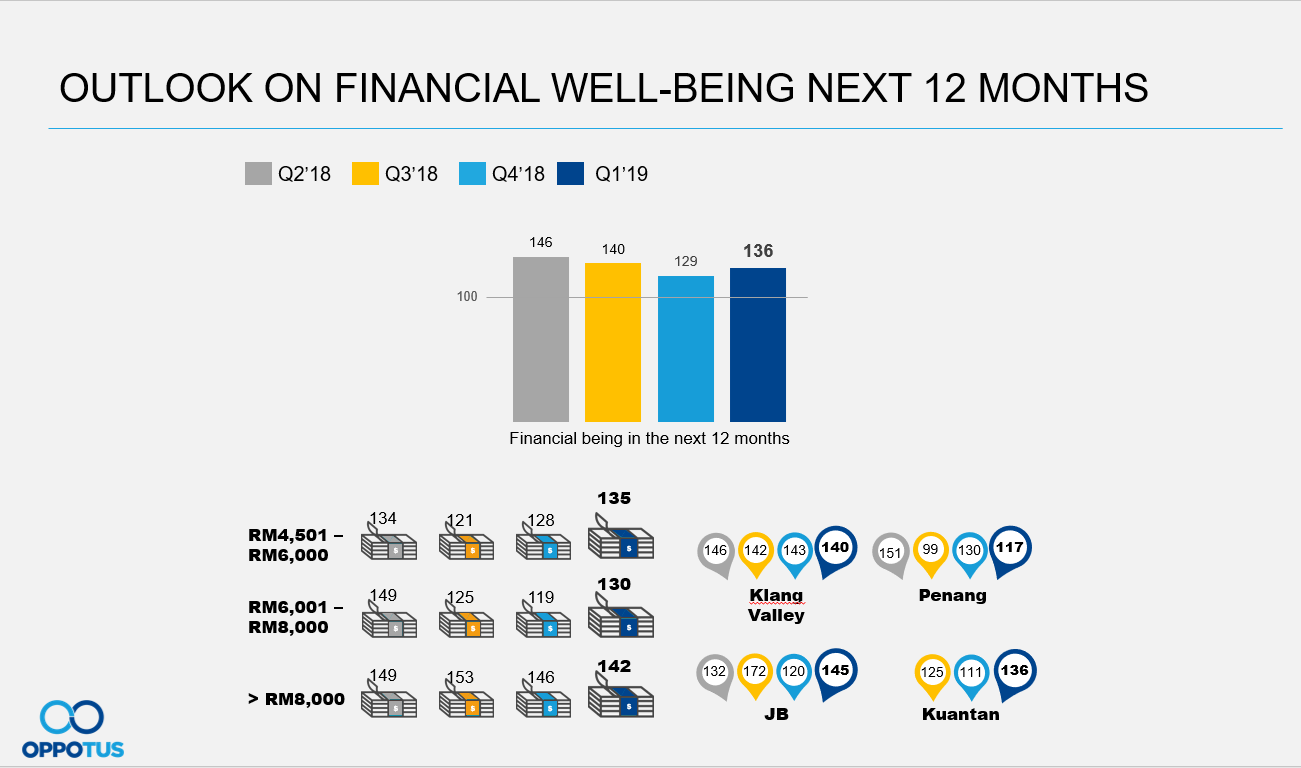

People are also showing more optimism towards their financial well-being over the next 12 months with regards to Budget 2019 take effect at the beginning of the year. There is also a notable spike in optimism amongst the B40 and M40 groups, particularly those from JB and Kuantan.

People are also showing more optimism towards their financial well-being over the next 12 months with regards to Budget 2019 take effect at the beginning of the year. There is also a notable spike in optimism amongst the B40 and M40 groups, particularly those from JB and Kuantan.

The Johor Real Estate and Housing Developers Association (REHDA) has been encouraging Johor folk to take advantage of their Home Ownership Campaign that will end on June 30th – one of the factors which has led to the increased optimism amongst the Johor population in 1Q2019.

This index remains unchanged even with the Chinese New Year season taking place during this quarter.

The Non-PMEBs and mid to high income group bracket are showing steady growth in optimism since 2Q2019. This can be attributed to the exemption of stamp duty for first time homeowners for homes costing RM500,000 and below for a period of two years until the end of 2020.

The main focus of the Budget 2019 was on the lower to middle income groups through affordable housing to encourage more home ownership. It will be interesting to see if there’s an upward pattern amongst the lower income group in the next wave.

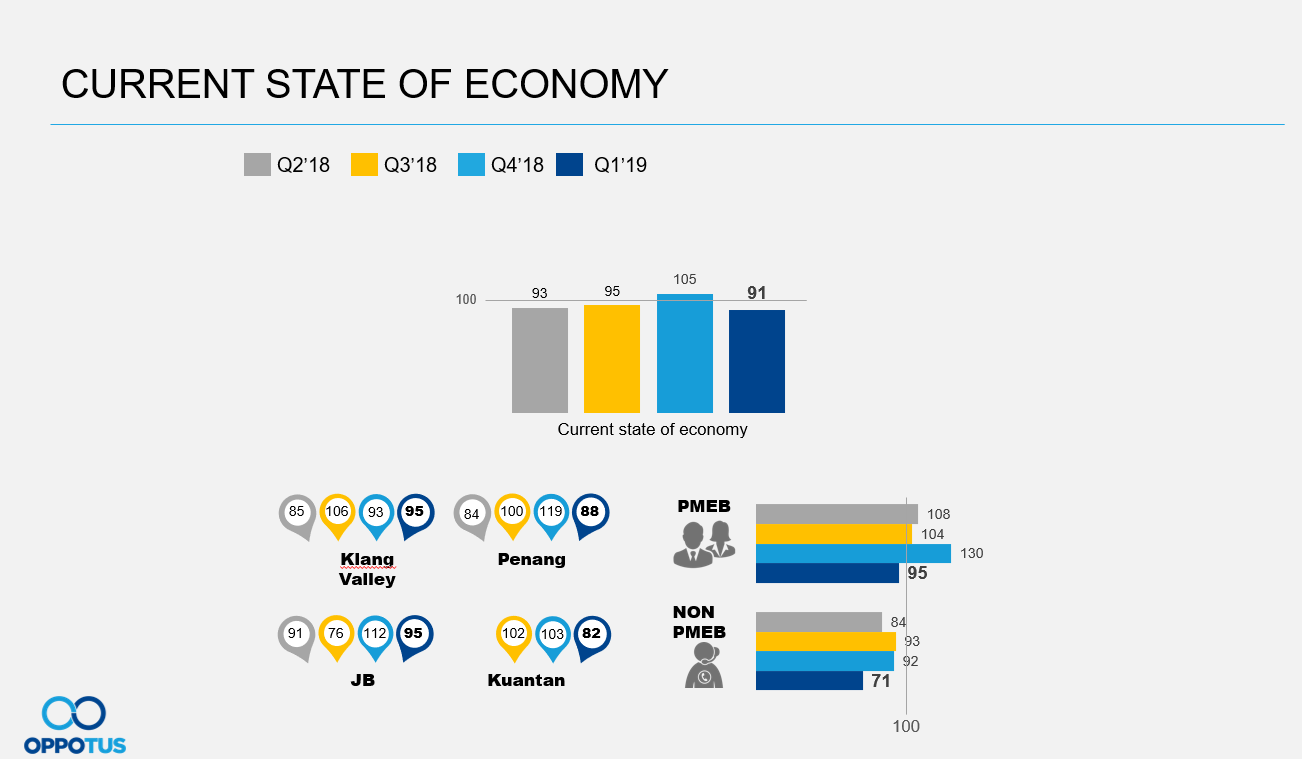

The overall sentiment regarding the current state of the economy dipped the lowest in this wave due to the sluggish improvements to economic fundamentals, weak ringgit and several major infrastructural projects that have either been cancelled or postponed.

Malaysia also has not been spared from the volatility of the external environment that may pose challenges and affect sentiments as a result of the current trade war and slowdown in global growth.

After the earlier high from GE14, Malaysians’ outlook for the near future has slipped below the 100-point mark. This corresponds to how they currently feel about the state of the economy now that the new government has had time to settle in.

Malaysia is still observing the current on-going US-China trade war, which has seen global monetary tightening and swings in oil prices. This affected both PMEB and Non-PMEBS as they are equally uncertain about the future despite the Malaysian government’s effort to re-introduce petrol subsidies, capping of the electricity tariff and the introduction of public transport subsidies to fuel spending.

This trend of decline is seen across all segments except for the mid income group, where their optimism remain unchanged.

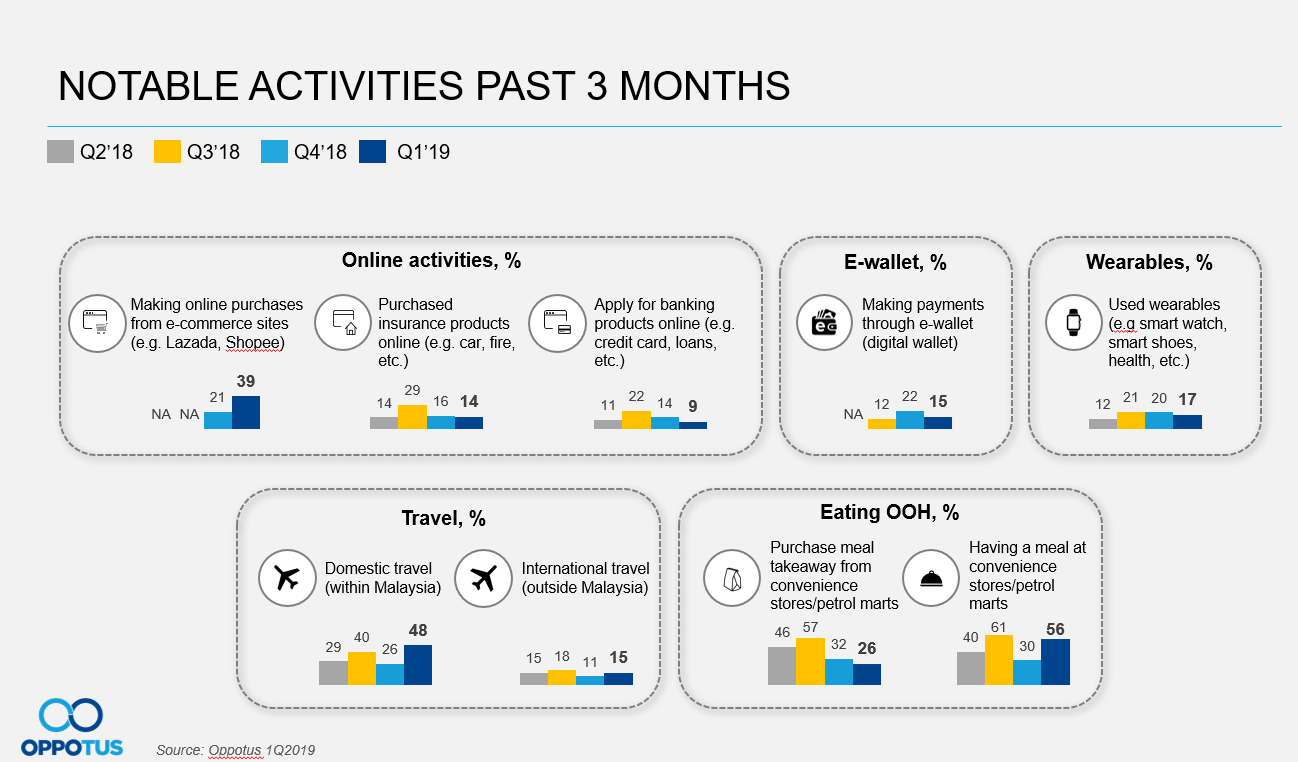

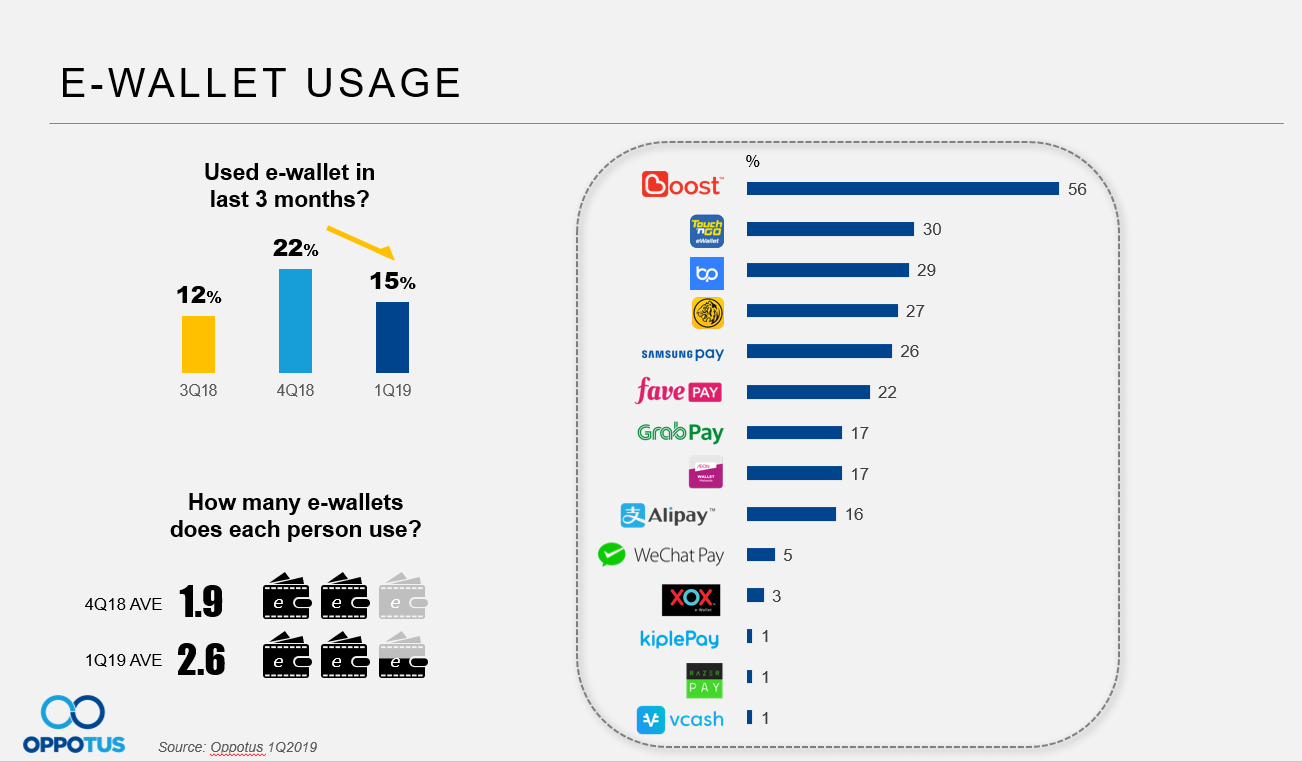

The purchase of insurance products and applying for banking products online continue to decline in 1Q2019, along with the prevalence of people who have made e-wallet payments. However, domestic travel has seen a large spike amongst Malaysians, who also seem to making more online purchases from e-commerce sites such as Lazada and Shopee.

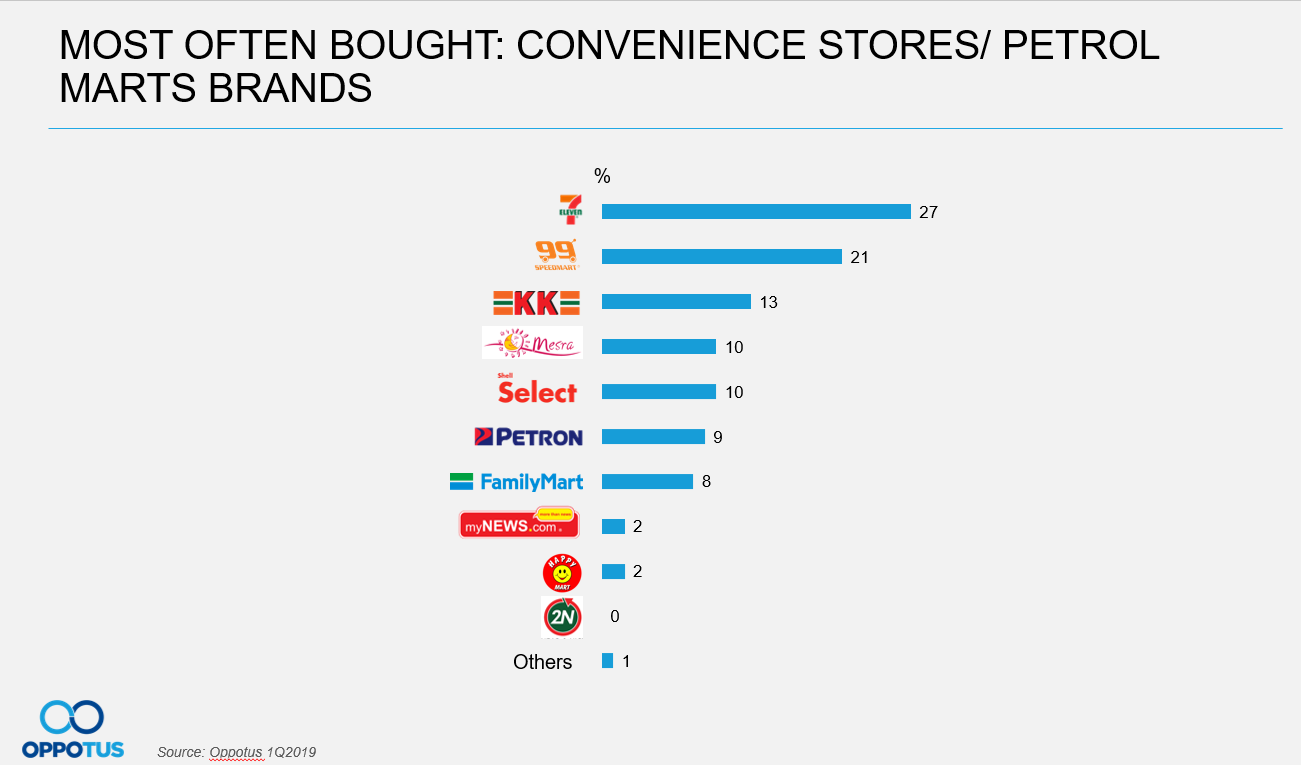

In our new segment for MOM 1Q2019, we can see that 7-11 and 99 Speedmart currently dominate amongst convenience stores/petrol marts. Stay tuned for our next MOM report to see if new brands such as Family Mart will continue to grow in popularity as the year goes on and more outlets open around Malaysia.

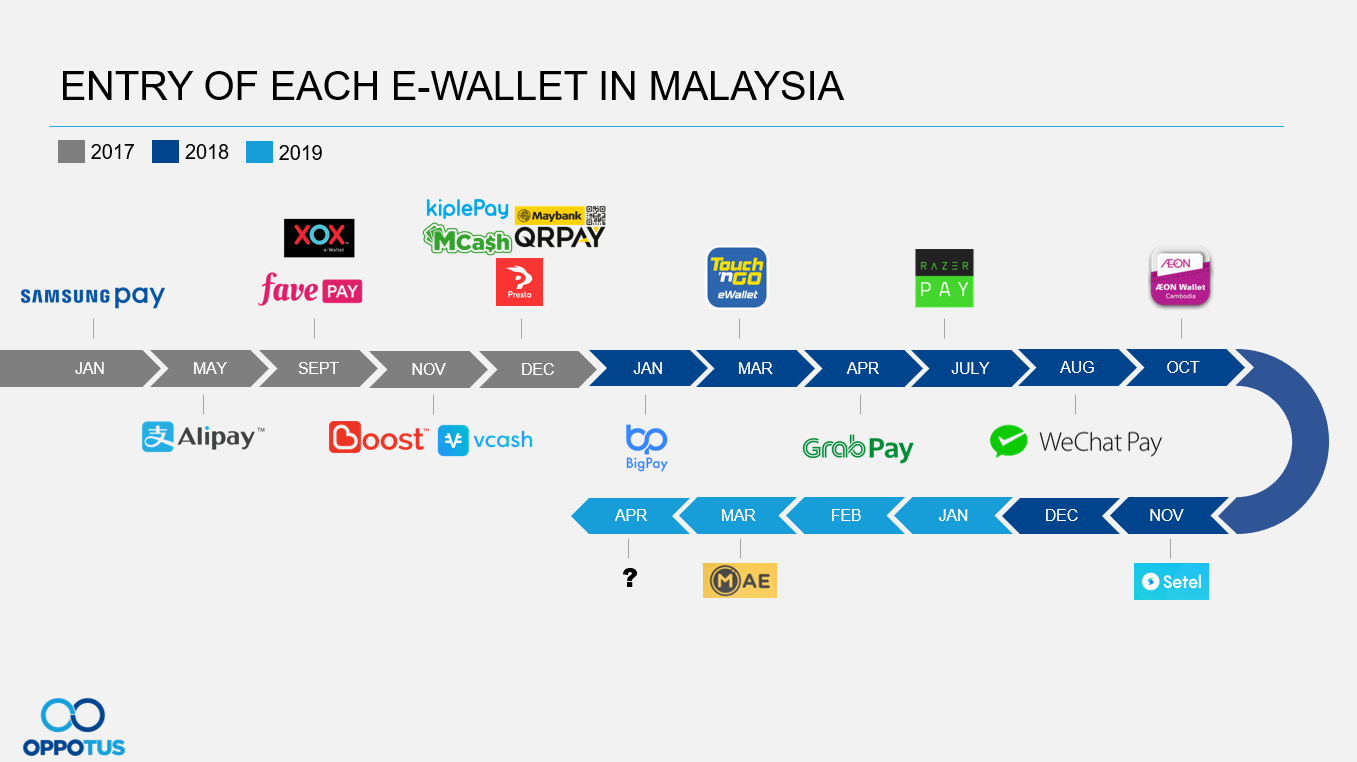

In our study of e-wallet usage for 1Q2019, Boost has emerged as the most used e-wallet service in Malaysia, while several other offerings such as Touch ‘n Go, BigPay, Maybank and SamsungPay have also built significant user bases for themselves.

With all the options in the market now and the payment channel become more familiar and acceptable, E-wallet users are becoming more “educated”, experimental and open to using the medium. We observed that e-wallet users are now utilising an average of 2-3 wallets as opposed to the previous average of 2 – no doubt helped along by all the money thrown into the promotions by the various providers since their introduction. It’d be interesting to see if adoption rate picks up, as well as depth of involvement by users.

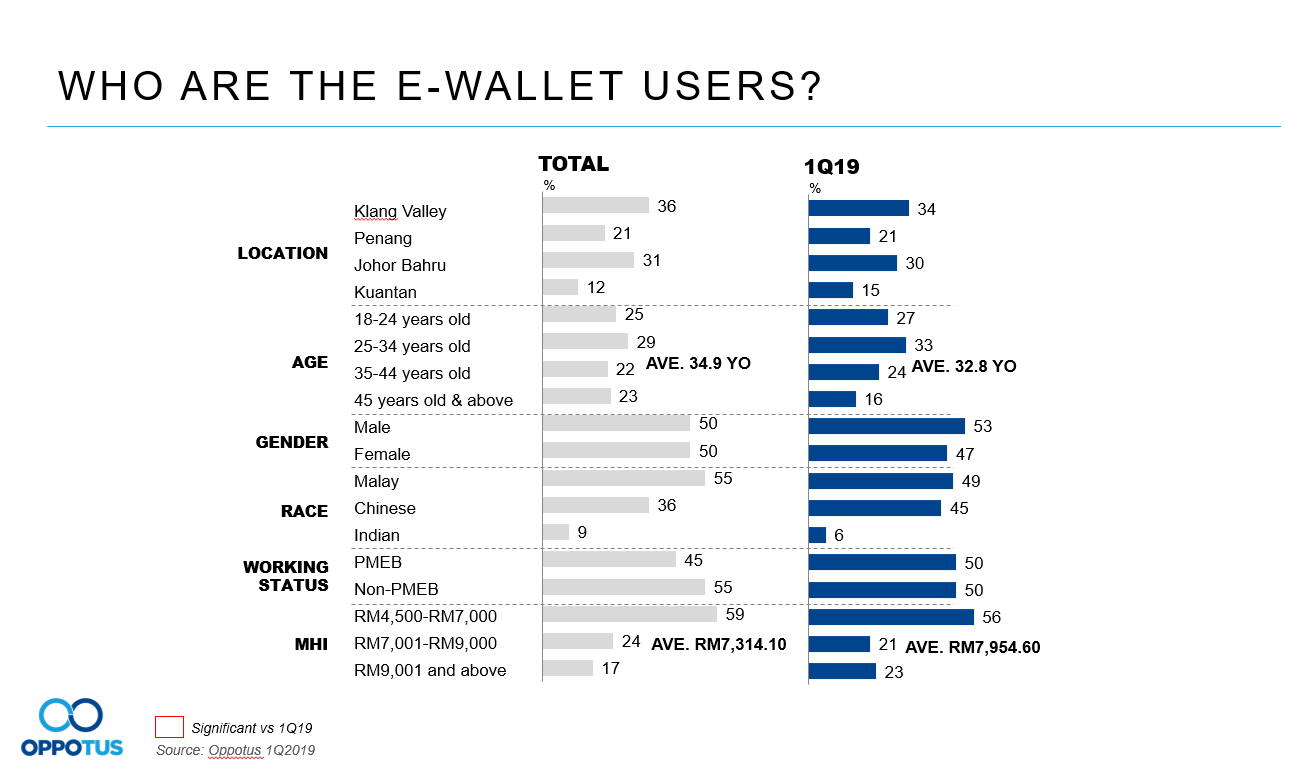

E-wallet users are seen to be marginally skewed towards 25-34 year-olds Chinese that are within the PMEB group from higher income groups of RM9,000 and above.

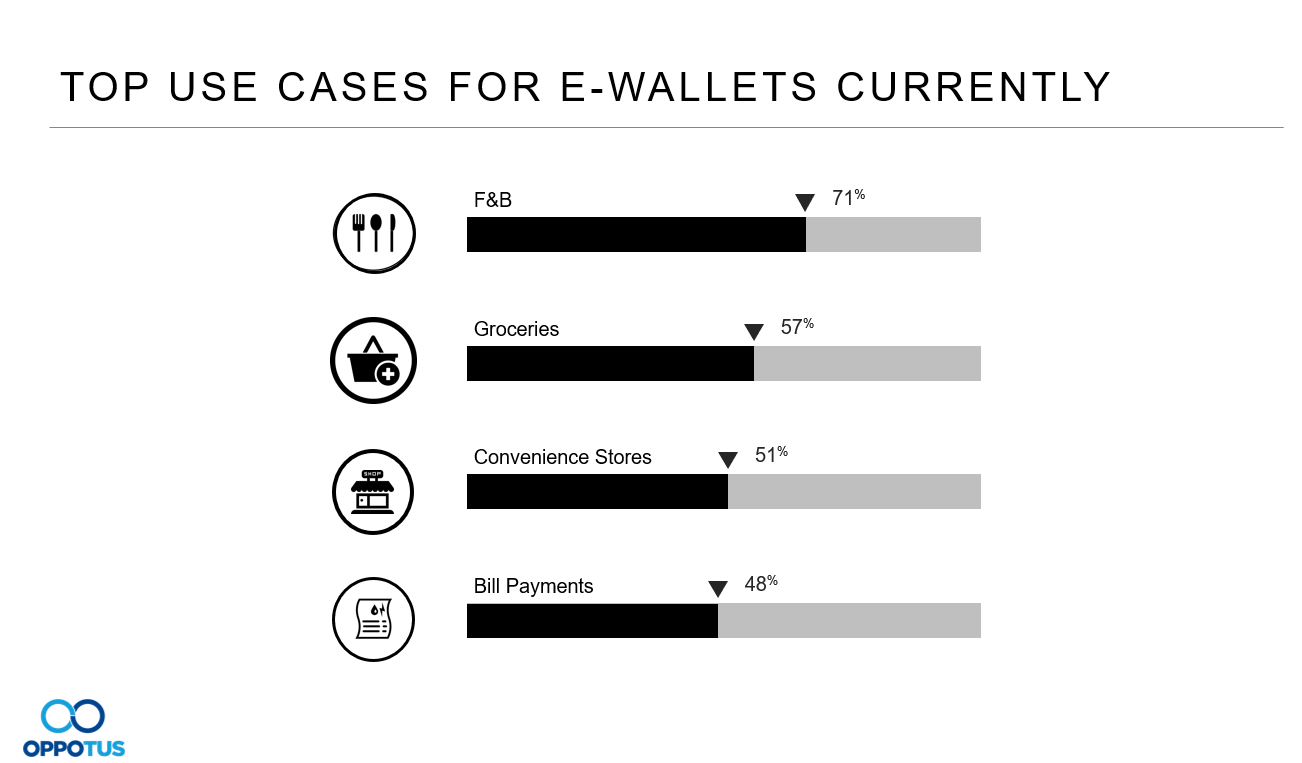

Currently, e-wallet usage is also skewed towards F&B, perhaps owing to the multitude of deals and promotions that have been on offer for e-wallet users at major F&B chains around the country. It will be interesting to see how usage rates change amongst different industries as they start to take up e-wallet functionality and introduce incentives for e-wallet users in a similar way.

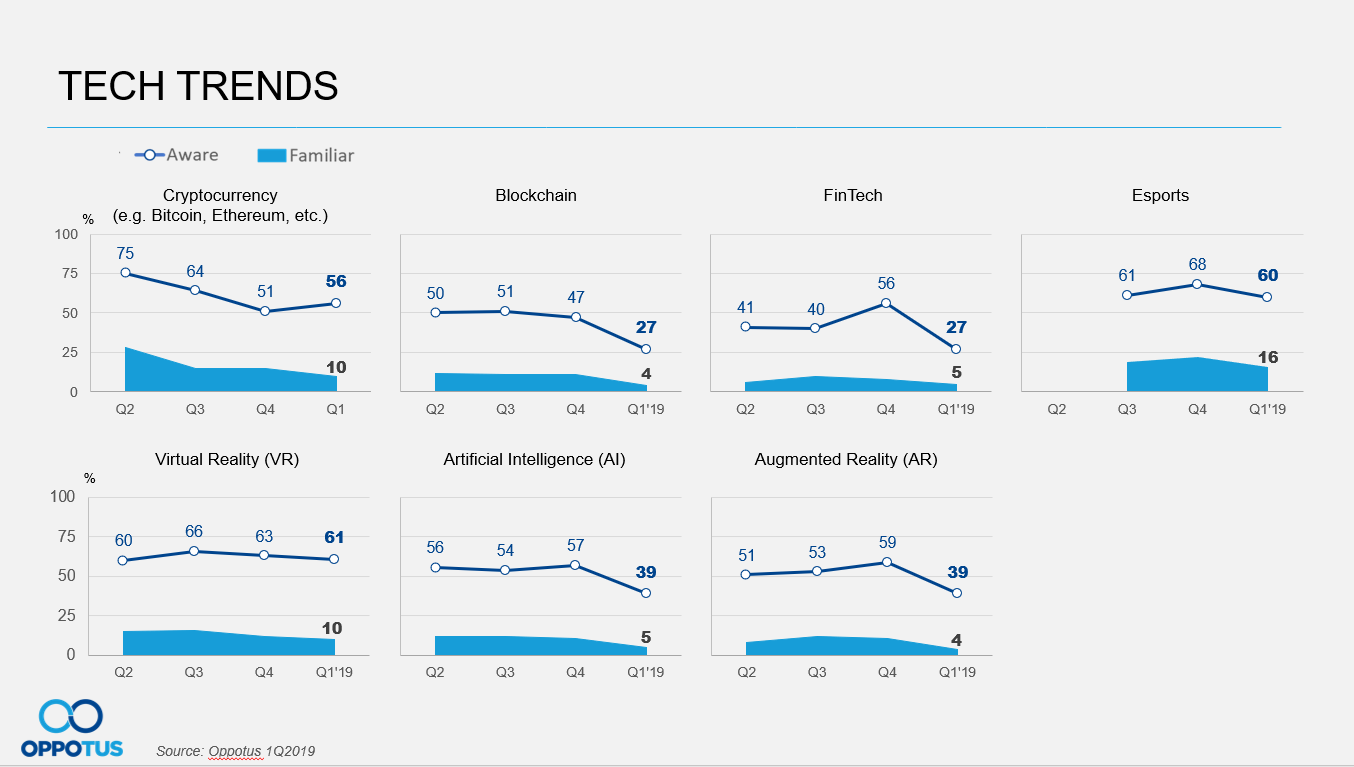

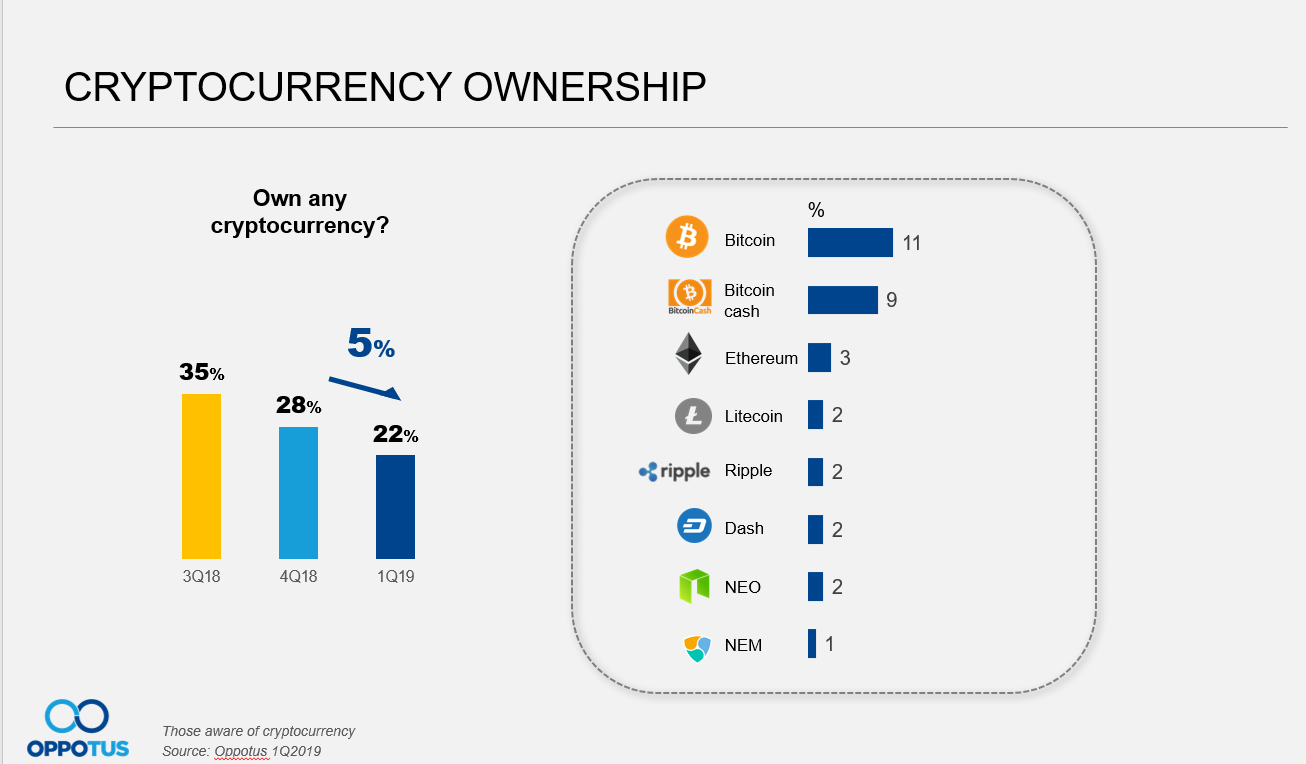

In our tech trends segment, awareness of emerging tech appears to have momentarily dipped, while cryptocurrency ownership amongst Malaysians continues to fall, a continuation of the crypto-winter

Conclusion

Now that we are well into 2019, Malaysian sentiments have stabilised towards a steady overall confidence with a positive outlook while being generally more conscious of their financial situations.

The landscape of e-wallet usage is transforming rapidly as more consumers and vendors catch on to the benefits of the technology, and it will be interesting to see if things will continue to be shaken up as we move into the second half of 2019.

Contact us at: theteam@oppotus.com if you would like to take a deeper look at these numbers, learn more about business opportunities in esports, or find out what other key insights a specialised market research agency could provide for your business.