11.11 is officially behind us, but the sales don’t end there for Malaysians. In fact, we are set for possibly an even more tantalising sales bonanza as we march into the new year. The concept of year-end sales is hardly new, as each year retailers across the country embrace the festive period to offer promotions and encourage customers to purchase more as part of their endeavours to spread holiday cheer. In 2024, Malaysia’s year-end sales are set to be even wilder than usual with Tourism Malaysia themselves launching a year-end sales campaign in collaboration with local shopping malls, retailers, hotels and airlines to push the year-end spending frenzy further.

With spending amongst Malaysians possibly about to go into overdrive, it would serve any business well to be armed with the knowledge of what Malaysians are purchasing and why they are making those purchases to better capitalise on this period of promoted spending. Join us as we dive deep into the numbers surrounding Malaysian purchases in preparation for the inevitable year-end sales promotions that will be popping up from various retailers across different product categories.

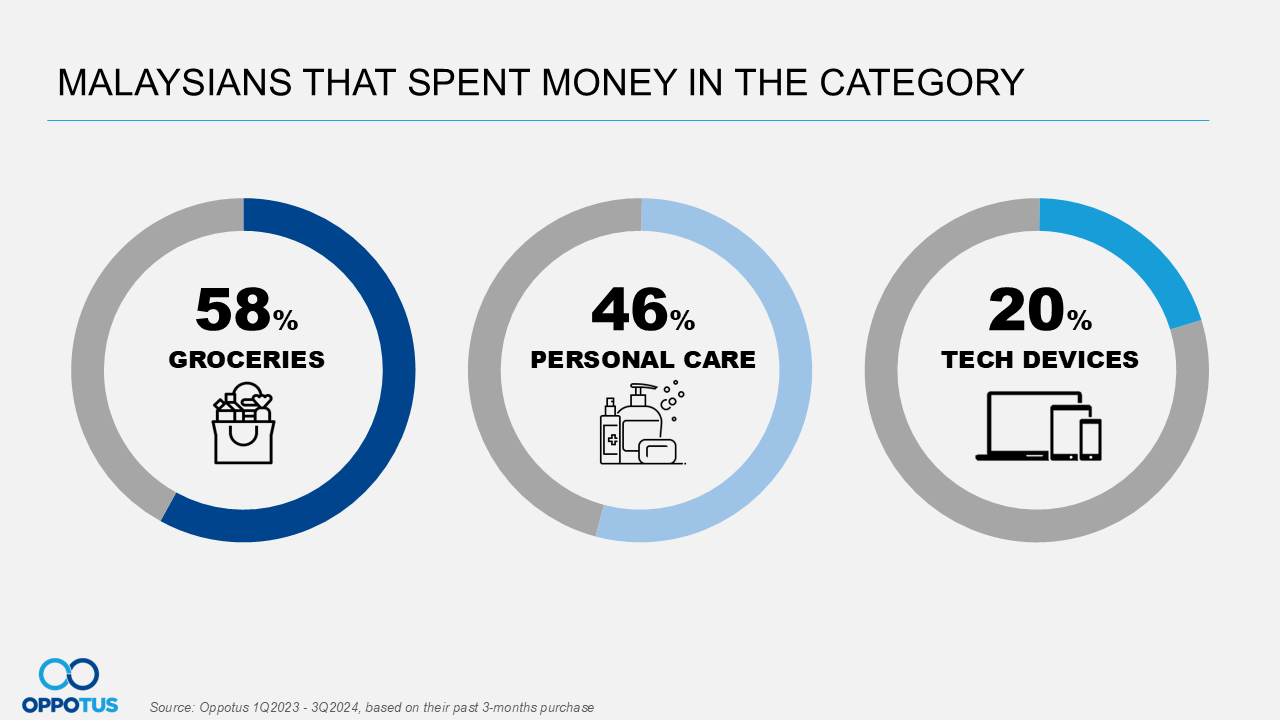

When looking at the different product categories that Malaysians spend money on, we find that the 3 most prominent categories are groceries, personal care and tech devices. Since groceries and personal care can be viewed as everyday necessities, it isn’t surprising to see them being the top 2 categories for Malaysian spending. However, tech devices being the 3rd biggest category paints an interesting picture of Malaysians’ spending habits. It appears that when it comes to luxury goods, Malaysians would prefer to purchase a tech device rather than spend on other categories for enjoyment such as fashion or sports equipment. On the other hand, you could also make the case that we are now in an era where tech devices are actually a necessity for most people’s lifestyles, which means that people now see it as a priority to be spent on rather than a luxury good. This shift signals the integration of tech devices into our daily lives, serving as tools for personal growth, productivity, and entertainment.

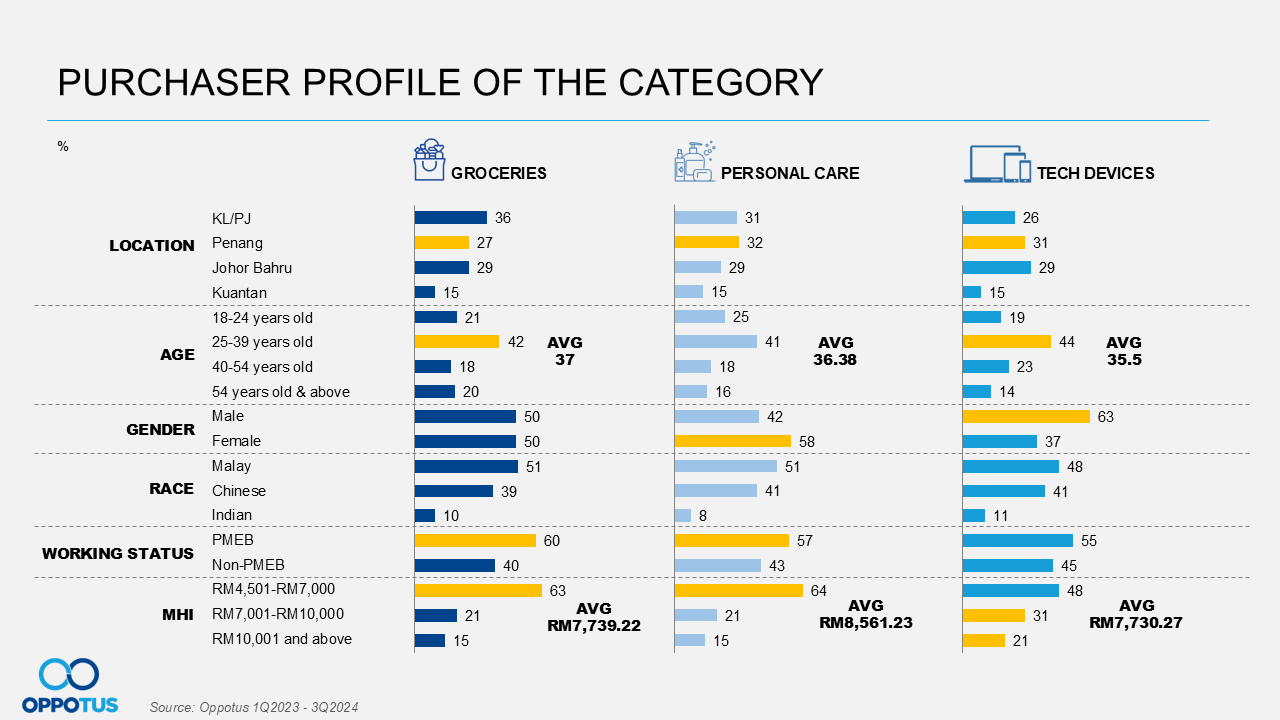

For the purchaser profiles of each category, the age group 25-39 makes up the biggest segment of spenders across all the categories. When it comes to differences between the genders, the amount of males and females who spend on groceries is equal. Still, the other two categories show a significant difference between the spending habits of the different genders, as the purchase of personal care products is skewed towards females, while the purchase of tech devices is skewed even more significantly towards males. Professionals, Managers, Executives, and Businessmen (PMEBs) also generally spend more on all categories than non-PMEBs.

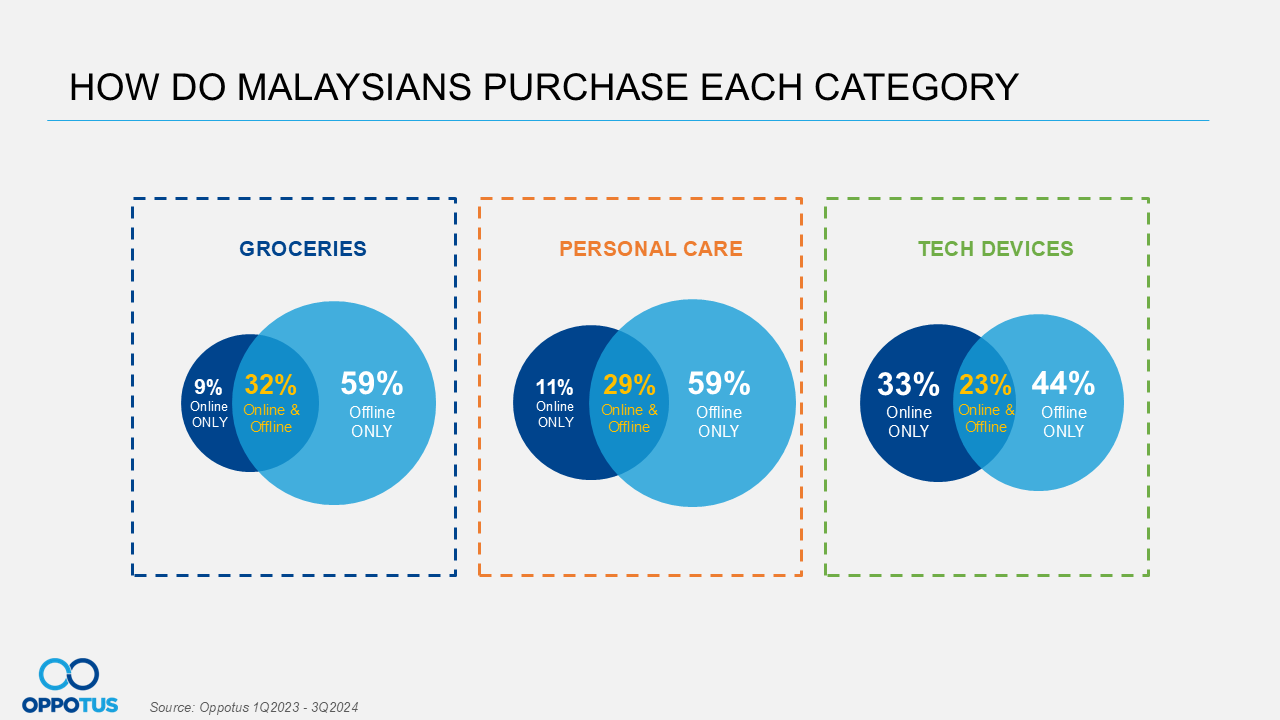

When it comes to the purchasing methods used by Malaysians across each category, offline purchases remain the most prominent method for all three categories. Only a small percentage of Malaysians purely use the online method to purchase groceries and personal care items, but tech devices have a significant proportion of customers that only purchase online at 33%, which is larger than the “online & offline” segment of both the other two categories.

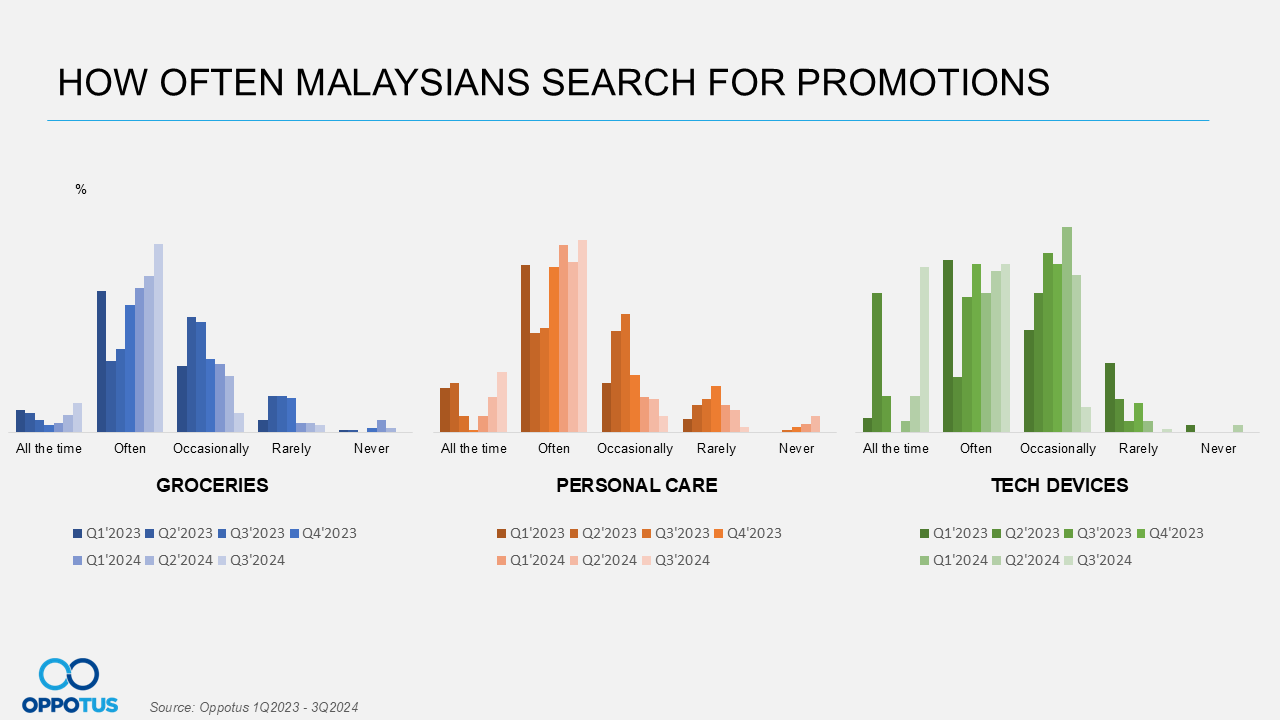

The general consensus among Malaysians is that we all tend to love a good deal, and this is backed up by the data which shows that only a very small segment of customers who purchase from each category claimed to never search for promotions before making their purchases.

One thing to note here is that the tech devices category has the lowest number of purchasers who never look into promotions. This may be due to the price of tech devices generally being higher than the usual purchases of groceries and personal care items. They actively seek promotions and discounts to make these higher-priced items more accessible, reflecting how price sensitivity induces deliberate and conscious purchases.

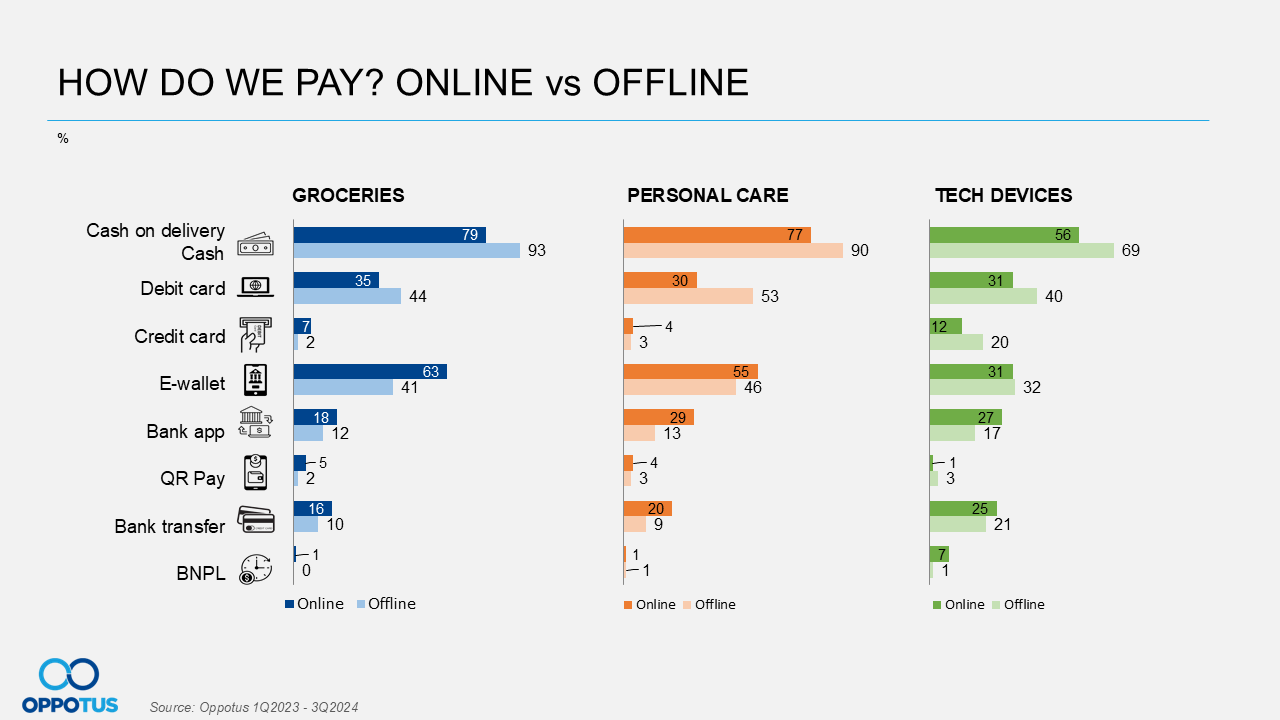

Finally, comparing the usage rate of different payment methods across the 3 categories, we find that cash is still the king, as it is the most prominent payment method regardless of the category.

At present time, credit cards seem to be less favoured, with a much lower usage rate compared to most transaction types in both online and offline purchasing for all categories. Meanwhile, e-wallets have seen increased usage in both online and offline transactions for groceries and personal care, to the point that they have become the second most preferred method for online purchases in both categories.

Overall, a growing number of Malaysians are seeking promotions and making online purchases, particularly in the top 3 product categories. Additionally, an increasing number of these purchases are being made using e-wallets, further backing the changing payment landscape. With this knowledge, perhaps the time is ripe to craft and offer well-considered promotions within these categories and tailor them to appeal to customers favouring e-wallets. By aligning your offerings with consumers’ priorities, you can position your business as attuned to the shifting needs of today’s purchasers.

If you would like to dive deeper into the numbers for Malaysian customers and their purchases going into 2025 and beyond, feel free to contact us at theteam@oppotus.com