Welcome to Malaysians on Malaysia: Our quarterly report on the Malaysian Consumer Confidence Index (MYCI). Positioned at a crossroads of evolving consumer behaviors and rapid technological advancements, Malaysia’s 2023 narrative presents a transformative digital journey. In this edition, we highlight the nuances, trends, and pivotal forces shaping this landscape.

This article delves deep into the latest trends and shifts, highlighting not just the quantitative changes but also capturing the underlying sentiments and driving factors. From e-wallet usage drops to cryptocurrency ownership nuances, the data paints a vivid picture of a nation in digital flux, eager to balance traditional values with modern conveniences amidst a rapidly changing global backdrop. The preceding article on Malaysian consumer confidence in Q2’23 is accessible here.

MYCI Soars to New Heights: A Record-Breaking Highest Score To Date

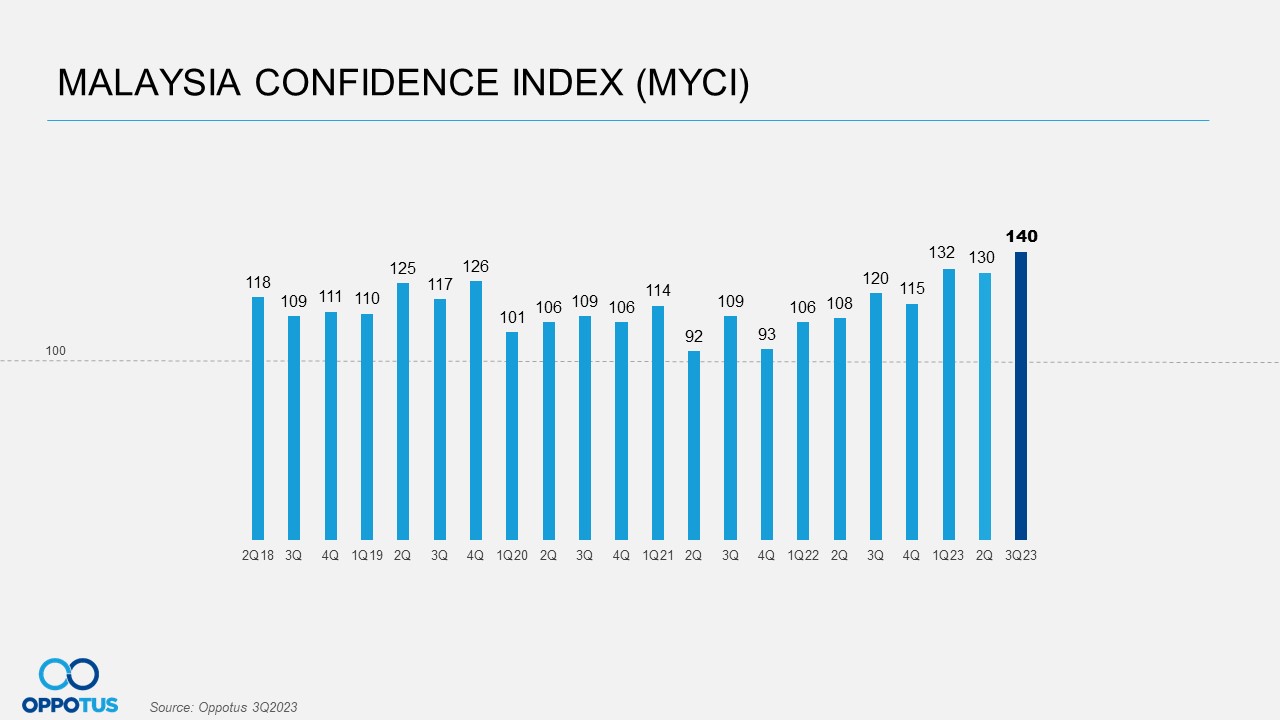

In the current quarter, the Malaysian Confidence Index (MYCI) has surged to an unprecedented high of 140 points, surpassing the previous record of 132 points in Q1’23. This remarkable score reflects a profound and strategic confidence shaped by political and economic shifts. The state elections in six states in August 2023, where the government retained control, highlighted a positive outlook. Commitment to economic growth, exemplified by agreements between Malaysian and Chinese companies, further solidified Malaysia as an appealing investment destination, contributing to the nationwide surge in confidence.

Economic Indicators Hits New Heights

Embarking on Q3, Malaysia’s economic tapestry continues its vibrant story. The MYCI, standing strong at 130 points in Q2’23, reflects the nation’s resilience and commitment to growth. Bolstered by financial well-being indicators and strategic government moves, Malaysia anticipates a future characterized by sustained progress and economic vitality.

E-Wallet Dynamics in Flux

In this quarter, a significant downturn unfolds in e-wallet usage, dropping to 34%, mirroring trends akin to those seen in Q1’23. The ongoing ebb and flow since Q3’22 persists, indicating a potential shift towards alternative payment methods and digital solutions. Notably, despite the decline, 11% of digital payment users still opt for e-wallets. This nuanced pattern suggests users are exploring varied payment methods based on their unique needs and preferences. As the digital landscape transforms, providers must adapt to remain pivotal in Malaysia’s evolving financial ecosystem.

If you’re eager to dive deeper into the numbers and gain a more nuanced understanding of the forces shaping the future of business and finance, don’t hesitate to contact us at theteam@oppotus.com

The Malaysian Confidence Index (MYCI) continues its historic climb, reaching a record-breaking high of 140 points in the current quarter, surpassing the previous milestone of 132 points achieved in Q1’23. This unprecedented score signifies a profound sense of strategic confidence, rooted in perceptions and faith shaped by political and economic shifts.

On the political front, the recent state elections in six states – Penang, Kedah, Kelantan, Terengganu, Selangor, and Negeri Sembilan – in August 2023, where the current government retained control over three states, showcased a resounding confidence in the Malaysian sentiment. The outcome, though not leading to a change in government, reflected a positive outlook. The government’s commitment to fostering economic and social growth through collaborations with neighboring countries was evident. Prime Minister Datuk Seri Anwar Ibrahim’s involvement in the signing of RM19.84 billion worth of agreements between Malaysian and Chinese companies solidified Malaysia’s standing as an attractive destination for investments. This concerted effort to showcase Malaysia as an opportune investment hub likely contributed to the nationwide surge in confidence.

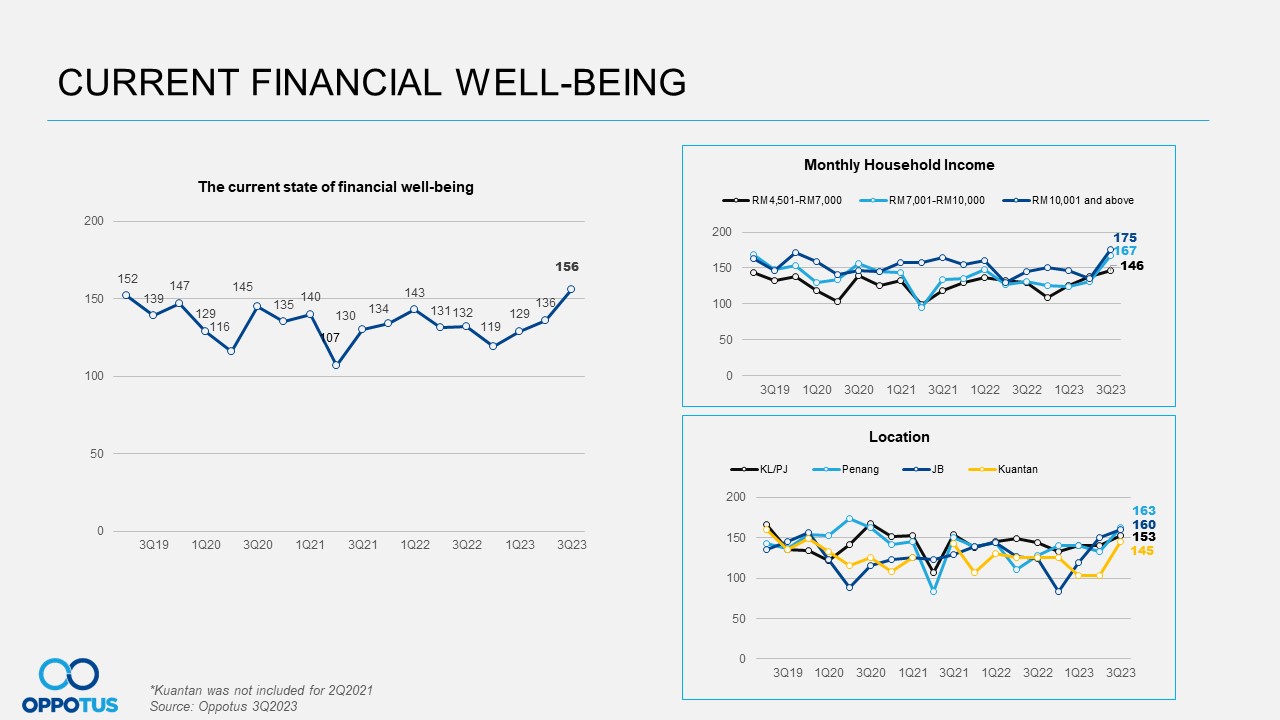

In tandem with overall confidence, the Current Financial Well-Being Index has not only maintained but strengthened its positive trajectory since Q3’22. This quarter, it achieved another remarkable milestone, reaching an all-time high of 156 points, a substantial 20-point increase from the preceding quarter. The driving force behind this impressive surge is the growing trust among the rakyat in the government’s ongoing initiatives.

As the global economic conditions remained uncertain, Malaysia’s domestic demand took center stage, driving the GDP to a commendable 3.3% growth in the current quarter. This adds to a cumulative growth of 3.9% over the first nine months of 2023, aligning with the government’s forecast of around 4% for the entire year. Notably, this growth stands as the most substantial expansion in five quarters, indicative of a resilient recovery amid global challenges and the government’s accommodative monetary policy stance.

The impetus behind this economic growth lies in robust domestic demand and stock replenishment activities, reflecting the ongoing efforts of the MADANI Government to breathe vitality back into the Malaysian economy. The initial stages of fiscal reforms have yielded savings and increased revenue, strategically redistributed for the direct or indirect benefit of the rakyat. This sustained recovery, coupled with a supportive monetary policy, underscores the effectiveness of ongoing economic strategies.

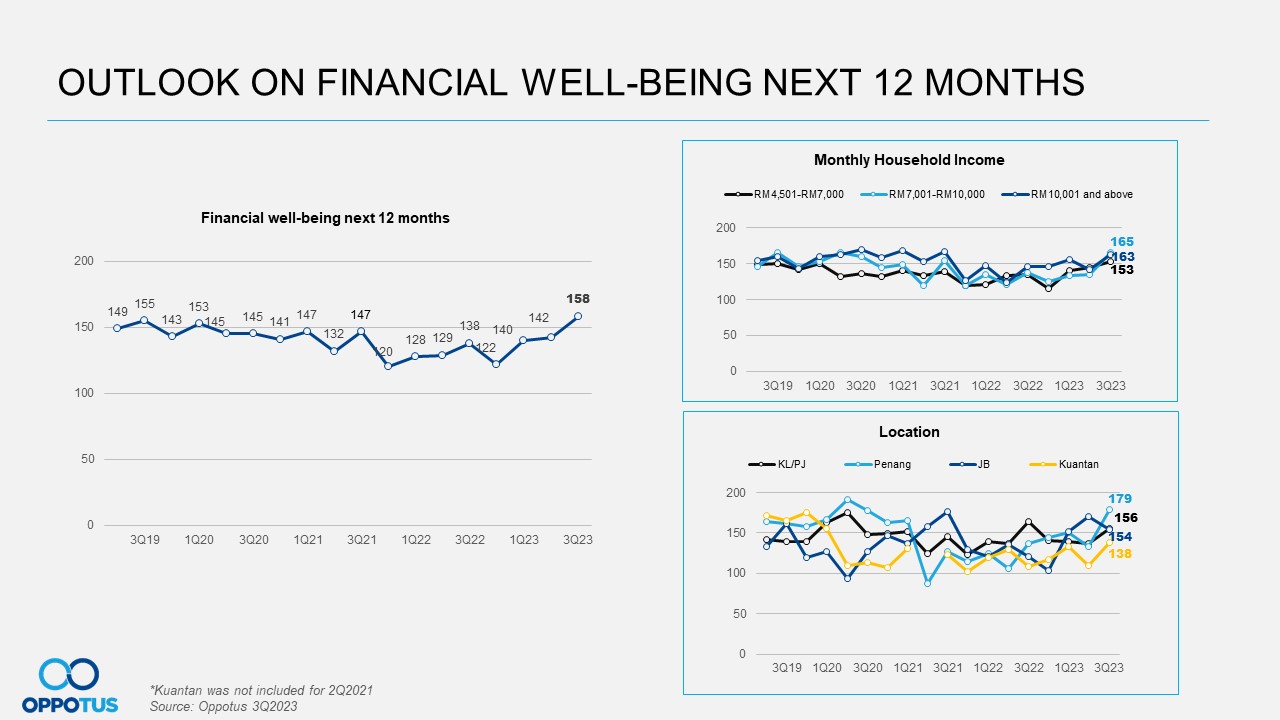

Navigating through the economic landscape, the resonance of the rakyat’s confidence permeates their outlook on financial well-being for the next 12 months. Witnessing a steadfast upward trend since Q3’22, the current quarter scales new heights at 158 points, surpassing pre-pandemic levels. This surge may be attributed to the cumulative GDP growth of 3.9% in the first nine months of 2023, signifying a sustained recovery in the economy for 4Q’23 and instilling hope and trust in its ongoing improvement. Notably, the upper M40 income bracket records a remarkable 30-point increase, reaching 165 points, while the T20 income brackets also witness a robust surge, surpassing 20 points to reach 163 points.

The buoyancy in confidence within these income brackets could be linked to improvements in the labor market, marked by increased job opportunities and a decline in the unemployment rate to 3.4% in Q3’23, reflecting a 1.4% reduction in unemployed persons from the previous quarter. Inflation, meanwhile, shows moderation, easing to 2% from 2.8% in Q2’23, facilitated by the Government’s consumption subsidies to mitigate services and food price increases. This consistent approach to ensuring price stability is evident in the notable decline in the poultry inflation rate to 0.9% in September.

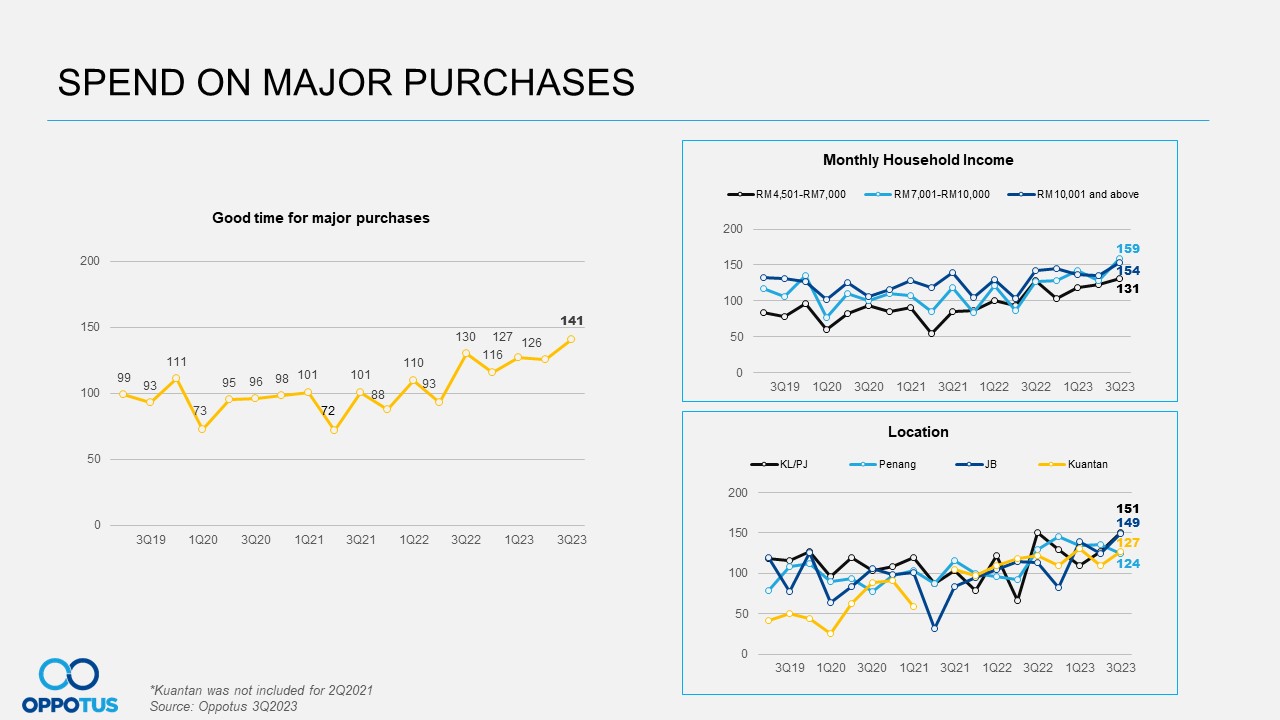

Reflecting robust consumer confidence, the Spend on Major Purchases index marks a significant 15-point uptick from the last quarter, reaching an impressive 141 points. This surge signifies the rakyat’s positive outlook on their financial capabilities, buoyed by several contributing factors. Malaysia’s domestic growth stands out favorably among regional peers, attributed to strong macroeconomic policy frameworks, fiscal prudence, and a credible monetary policy framework. Thus, household spending remained supported by continued growth in employment and wages. Additionally, the consistent monitoring of the ringgit by Bank Negara Malaysia, with potential adjustments to the Overnight Policy Rate (OPR), adds a layer of stability and confidence to the economic landscape. As the nation navigates these positive trends, consumers find themselves more inclined toward major purchases, contributing to an optimistic economic narrative.

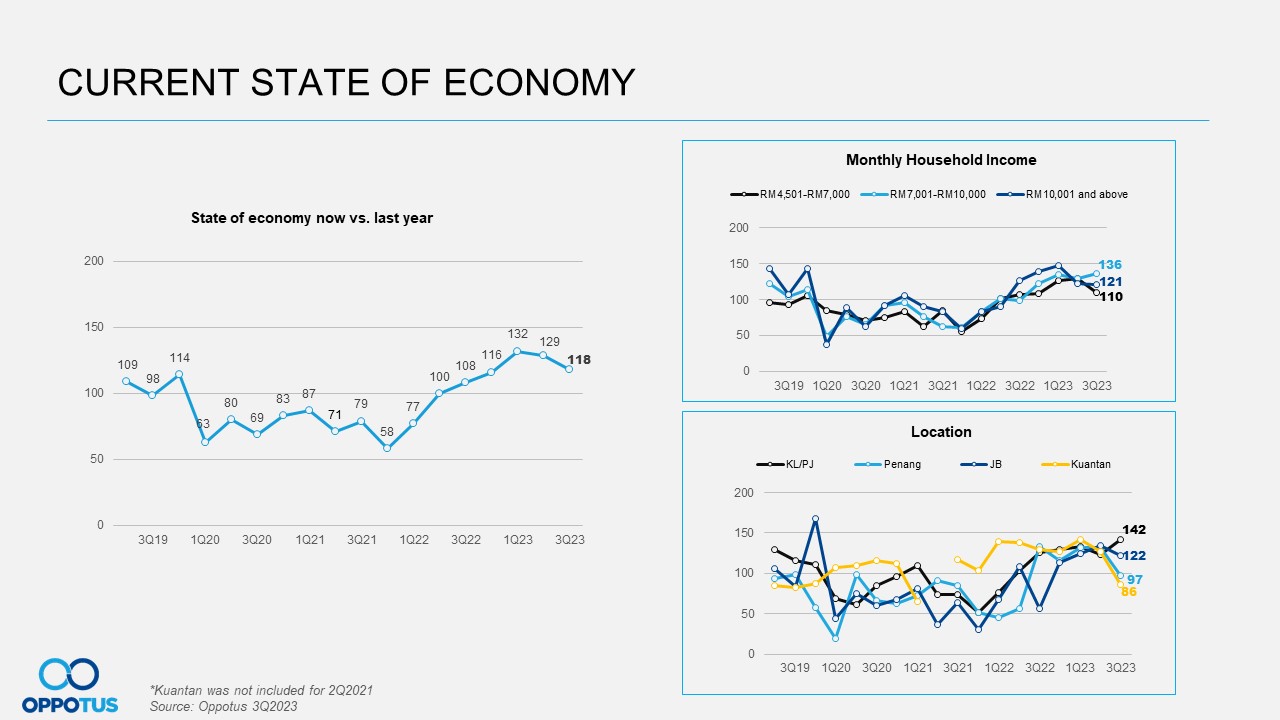

While many aspects show improvement, concerns about the country’s economy contracted from 129 to 118 points this quarter. This decline, especially among the upper M40 income bracket, may be influenced by changing expectations about the global monetary policy path.

The robust performance of the US job market has fostered expectations of a prolonged tight monetary policy by the US Federal Reserve, leading to higher interest rates globally. Conversely, the People’s Bank of China has implemented additional monetary policy measures to counter weaker-than-expected growth, affecting investor sentiments in the region.

Against this backdrop, the US dollar gained strength throughout the quarter, resulting in a marginal depreciation of the Malaysian ringgit by 0.2% against other regional currencies. However, against a basket of major trading partner currencies, the Malaysian currency was seen to actually appreciate by 1.4%.

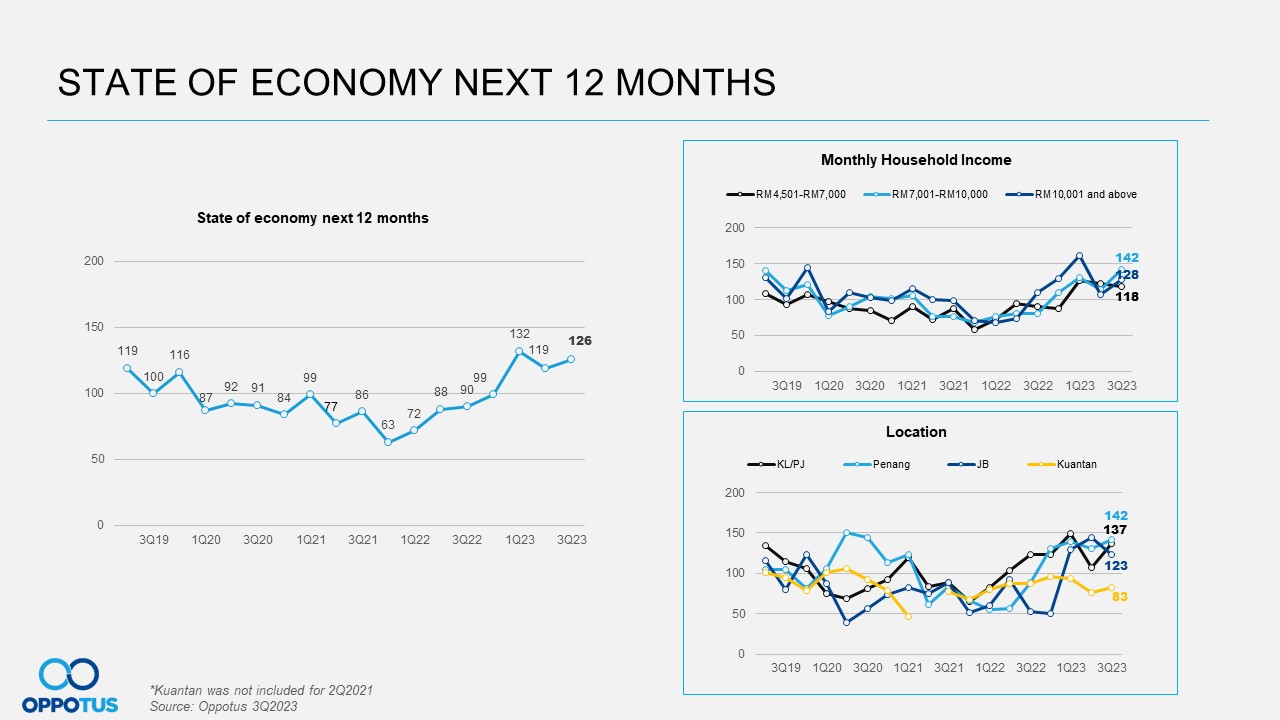

Contrary to the optimistic outlook on Malaysia’s current economic state, expectations for the economy in the next 12 months are heading in a more cautious and reserved direction. After a dip to 119 points in Q2’23, the sentiment has rebounded positively to 123 in the current quarter. Notably, this positive trend is echoed in two key income brackets, the M40 and T20 segments, which show a substantial increase of up to 20 points, reflecting heightened confidence. These groups now stand at 142 points and 128 points, underlining their most significant positive outlook. This could stem from evolving expectations about the global monetary policy path and the associated economic uncertainties, particularly notable among the upper M40 income bracket.

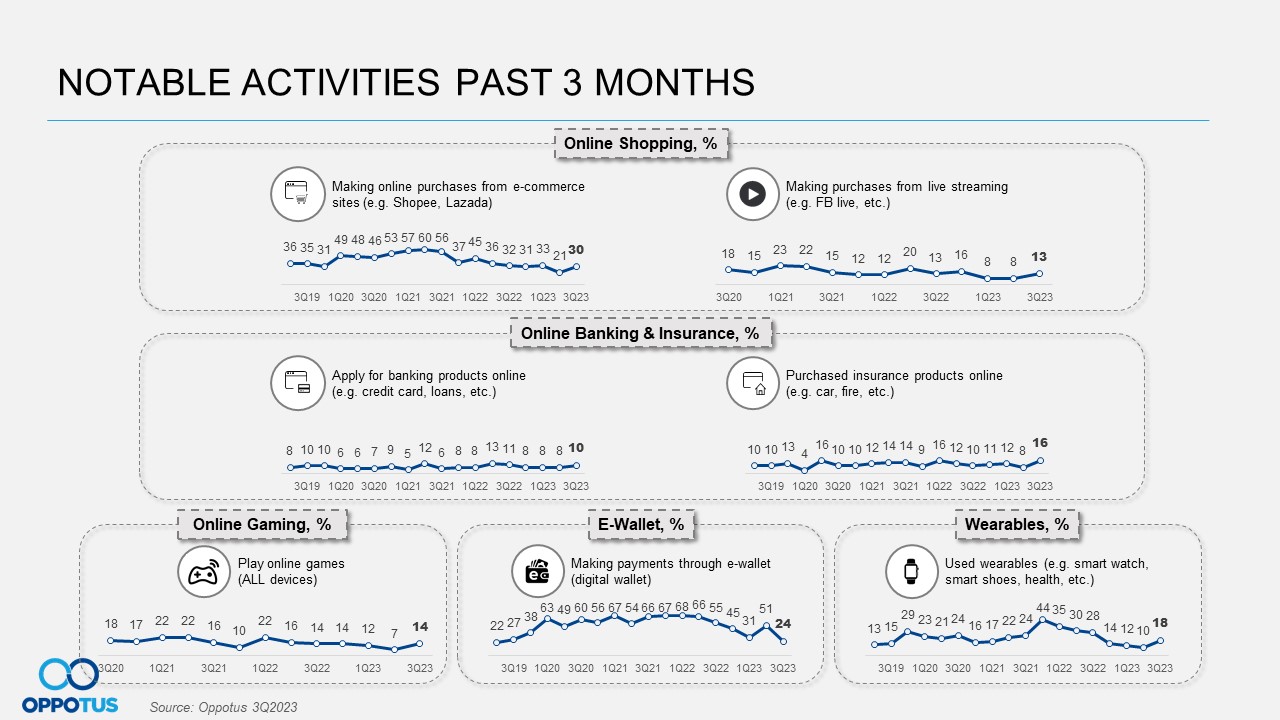

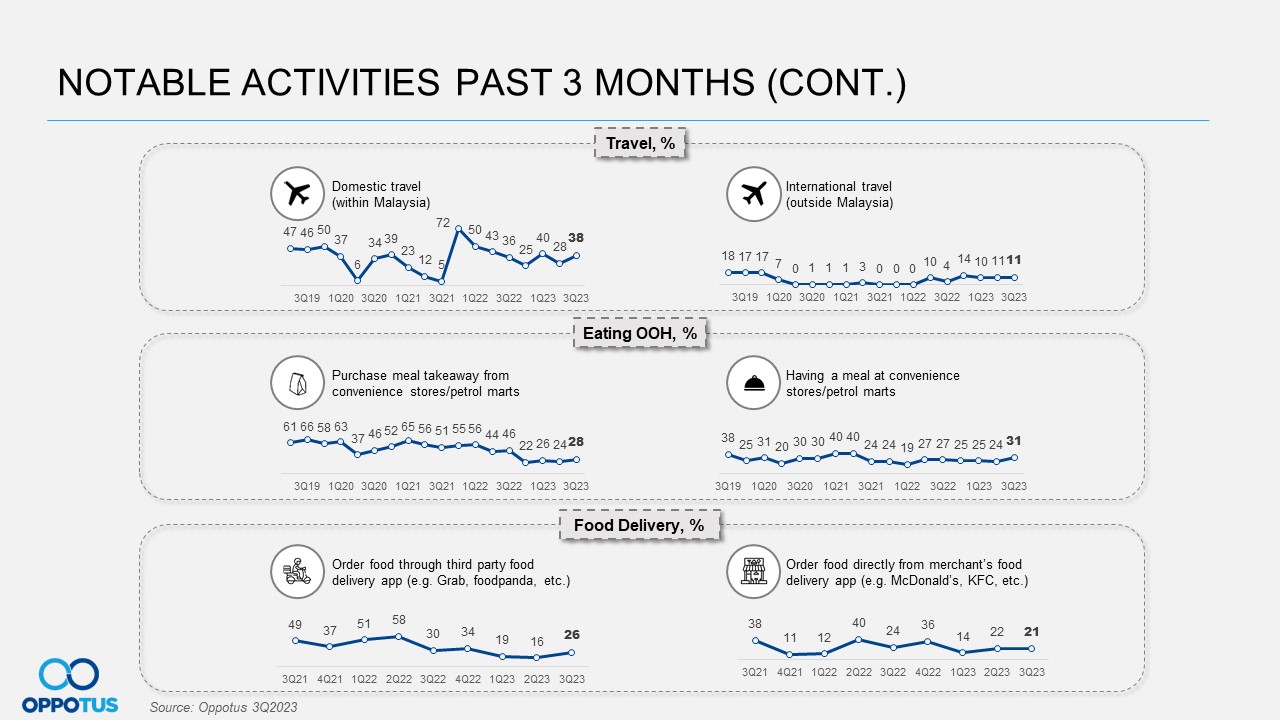

The past three months unfolded a discernible consumer shift, signaling a positive trend across various segments in the study. Key findings shed light on noteworthy macro and micro lifestyle changes, witnessing significant upticks in online shopping, travel, and dining out, shaping the contemporary Malaysian consumer landscape.

The surge in e-commerce purchases, hitting 30%, and the rise in live streaming platform usage, now standing at 13% after a stabilization period, highlight a growing inclination toward digital consumption. This digital shift extends to online banking, experiencing a modest 10% increase, and a substantial 16% surge in insurance uptake.

In the travel domain, domestic travel registers a remarkable 10% surge. This uptick may be attributed, in part, to the six state elections in August, the additional post-election public holiday, and the National Day celebration aligning with school holidays. Malaysia Airports Holdings Bhd (MAHB) notes a traffic trend resembling pre-pandemic periods, signifying a gradual normalization of travel habits. A similar trend is observed in dining out.

The newfound confidence in the economy reverberates into more substantial and long-term investment patterns. Interest in wearables witnesses a notable uptick to 18%, breaking a three-quarter subtle decline trend. This resurgence hints at a renewed focus on durable and significant investments among Malaysian consumers.

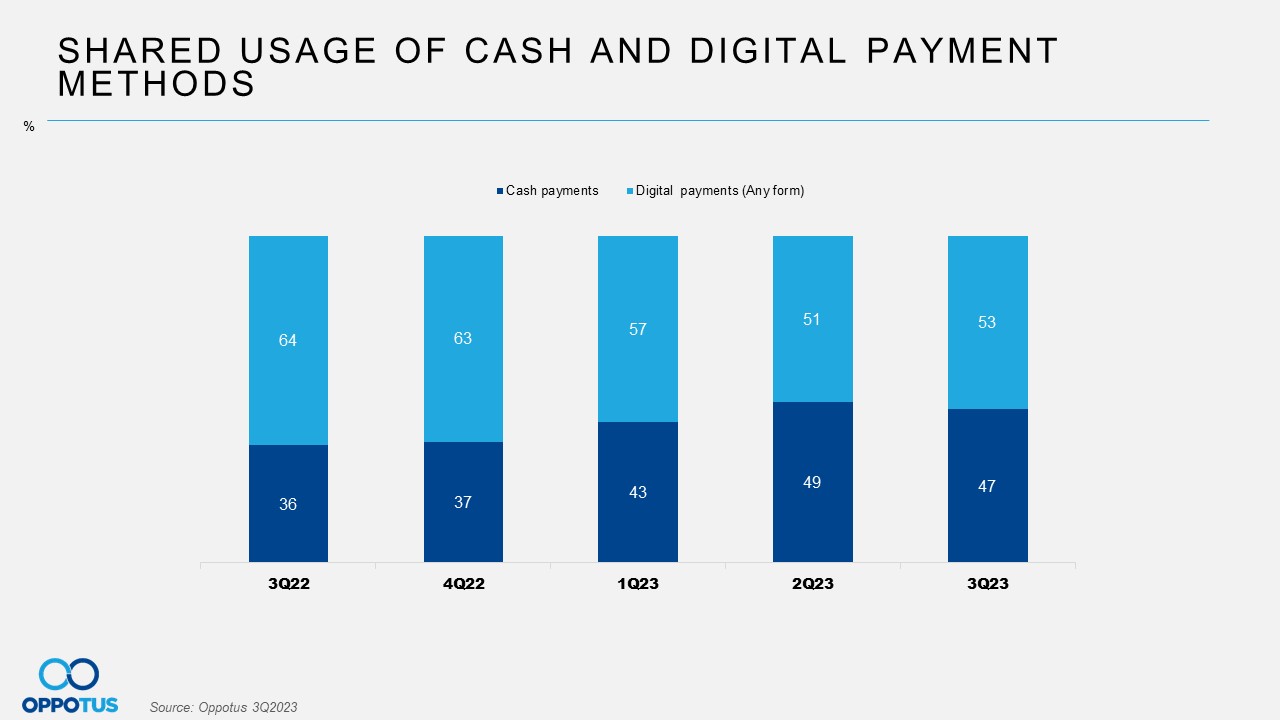

Pivoting to the realm of Malaysians’ payment choices, the data paints an intriguing picture, with 53% of individuals expressing a preference for digital payment methods over the 47% who lean towards cash. This nuanced insight sparks curiosity. However, when observed from a bird’s-eye view, the usage of both payment methods has remained relatively consistent over the past four quarters. This suggests that individuals’ choice of payment may not have undergone significant shifts or changes. It indicates sustained confidence among individuals in their chosen payment methods, emphasizing the reliability and stability of their preferred financial transactions.

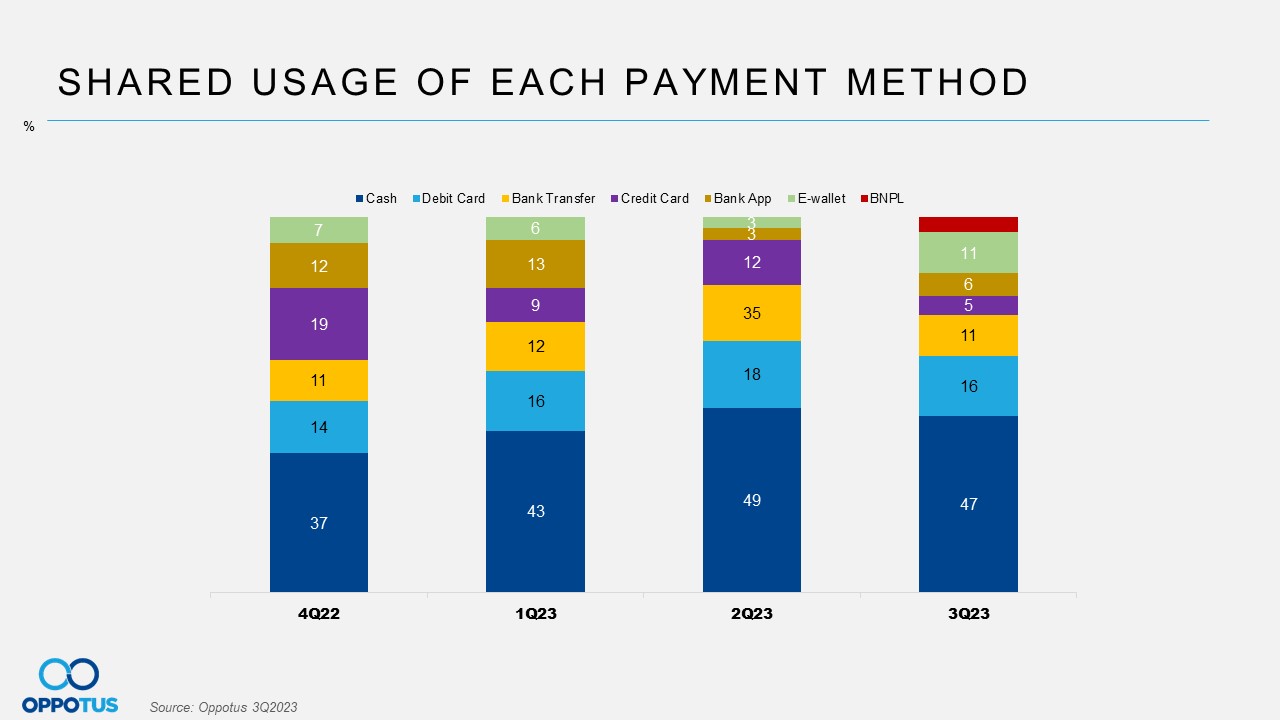

Breaking down individual payment methods reveals a noteworthy revelation – cash is favored over various digital payment methods. Notably, the emergence of Buy Now Pay Later (BNPL) as a new entrant deserves keen attention. While installment payment plans are not novel, BNPL modernizes the concept by enabling any retailer, online or in-store, to offer installment payments for products of any size. The data for this quarter shows BNPL standing at 4%, signifying its integration into individuals’ digital payment options, albeit still very nascent.

The introduction of this new player has triggered a domino effect on other payment methods. Despite witnessing declines in debit card, bank transfers, and credit card usage, cash remains steadfast at 47%, experiencing only a marginal 2% decline from the previous quarter. This resilience underscores that individuals still rely on cash as a preferred means of payment, showcasing the enduring prominence of traditional payment methods in the evolving financial landscape.

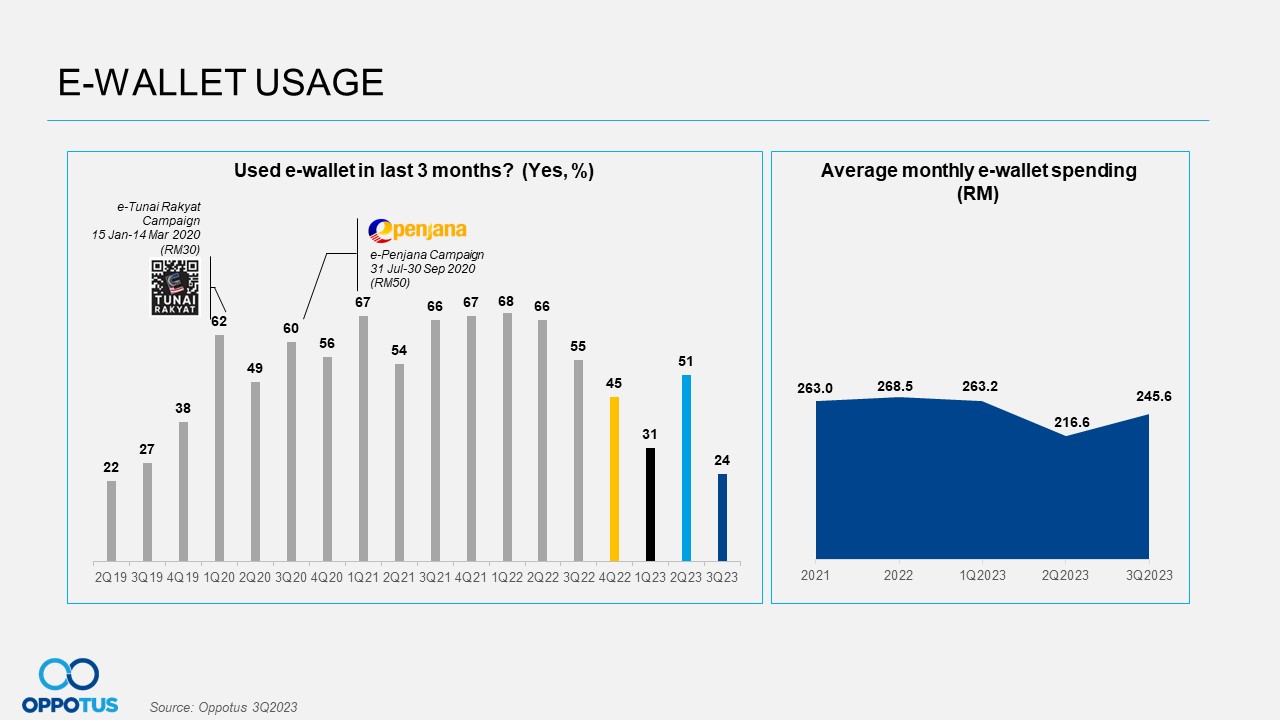

Building upon this, while 11% of the 53% digital payment method users opt for e-wallets, this quarter unveils a significant decrease in e-wallet usage, reminiscent of the trends observed in Q1’23. The persistent ebb and flow in E-Wallet adoption, observed since Q3’22 continues its pattern of ups and downs. The current decline to 34% suggests potential gravitation towards or exploration of alternative payment methods and digital solutions.

A noteworthy counterpoint to this adoption trend emerges as an intriguing revelation. Despite the reduced frequency of E-Wallet usage, the average expenditure per individual has witnessed an incline, settling at RM245.6. This suggests that individuals utilizing E-Wallets may do so more frequently than other payment solutions, indicating a nuanced approach where different payment methods are chosen based on distinct needs and preferences.

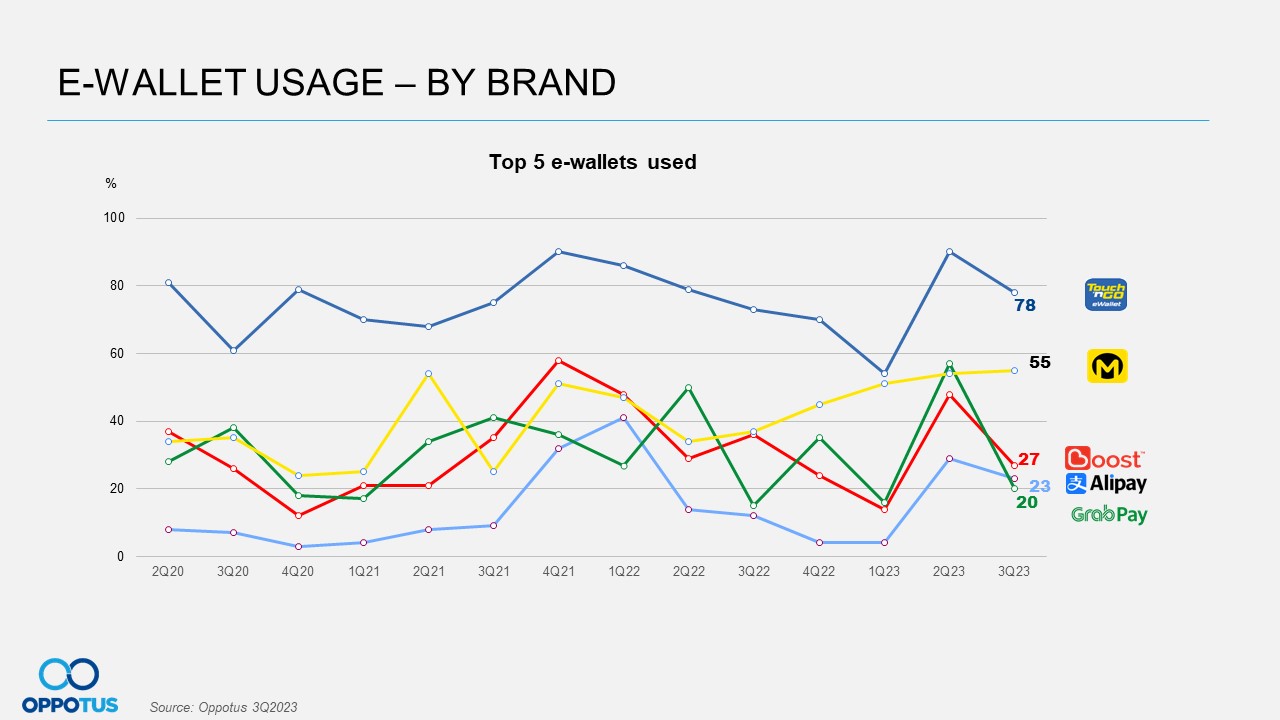

Mirroring the aforementioned trends, key players in the E-Wallet arena have encountered notable adjustments. Three mobile payment services, while maintaining their top 5 positions, have witnessed substantial shifts in adoption rates. Touch ‘n Go, now at 78%, experienced a 12% decline, and Boost, currently at 27% (previously 48%), retained its previous quarter standing despite the drop. In a noteworthy move, the bank-affiliated MAE e-wallet by Maybank has claimed the second spot with a 55% adoption rate, displacing Grab Pay to the fifth position, which dropped by 37% and now stands at 20% usage. The appeal of MAE may lie in its multifaceted features and direct linkage to users’ bank accounts.

Introducing a new entrant to the top list, Alipay, at 23% usage, underscores a trend where 4 out of the top 5 E-Wallets used are mobile payment methods functioning as comprehensive one-stop shops. Consumers are selectively choosing platforms, driven both by the allure of accessible, quick, and hassle-free features and the implicit value of exclusive cost-saving promotions and discounts. This ensures they attain the best user experience and value in their digital transactions.

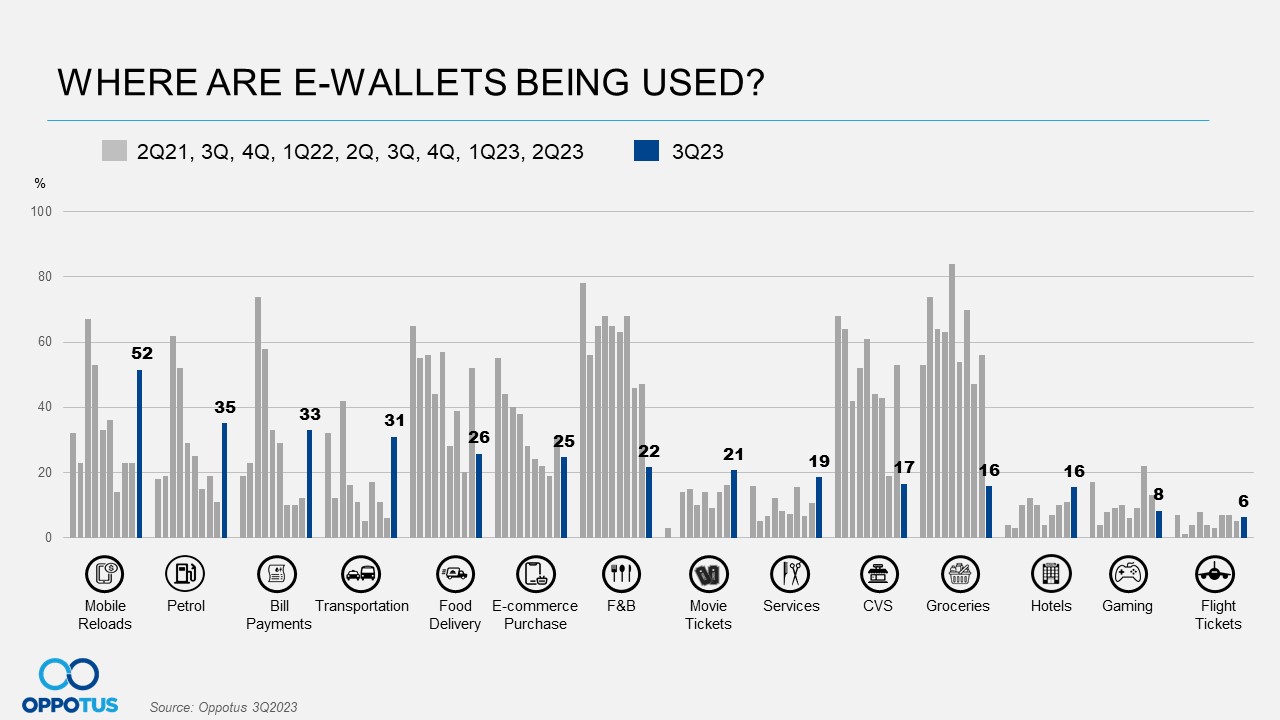

Consumer transaction patterns have undergone a significant transformation compared to the last quarter. While domestic needs such as groceries, CVS, food delivery, F&B, and E-commerce purchases dominated e-wallet usage preferences, this quarter witnessed a notable shift toward day-to-day utility-related services. Mobile reloads claim the top spot at 52%, a substantial increase from its previous 23%, displacing Groceries which held the top position for six consecutive quarters. Petrol purchases follow closely at 35%, with Bill Payments at 33%, and Transport at 31%, emerging as the new preferred choice for e-wallet payments due to the convenience of handling these transactions with a simple click. This shift signifies a more conscious and informed consumer base, leveraging diverse payment methods for various aspects of their lifestyles, fostering a dynamic and adaptable digital payment landscape.

Navigating the dynamic terrain of Malaysia’s mobile payment ecosystem, recent insights reveal intriguing shifts, especially when exploring Malaysians’ future intentions toward e-wallet usage. After a modest uptick to 45% in Q2’23, there’s a significant leap, signifying a resurgence in potential confidence and utilization of e-wallets, with intentions for e-wallet use in the upcoming six months soaring to 65%. This remarkable intention may be intricately linked to the visible and growing use of e-wallets by the government for cash aid and incentives, such as the “Bantuan e-wallet 2023”, “RM200 e-belia Rahmah 2023”, “e-wallet RM100 Madani”, and more. Notable e-wallet reward plans like GOrewards by Touch ‘n Go, Treatspoints by MAE, and Boostup by Boost E-Wallet contribute to this trend, showcasing the perceived benefits of loyalty programs and user incentives.

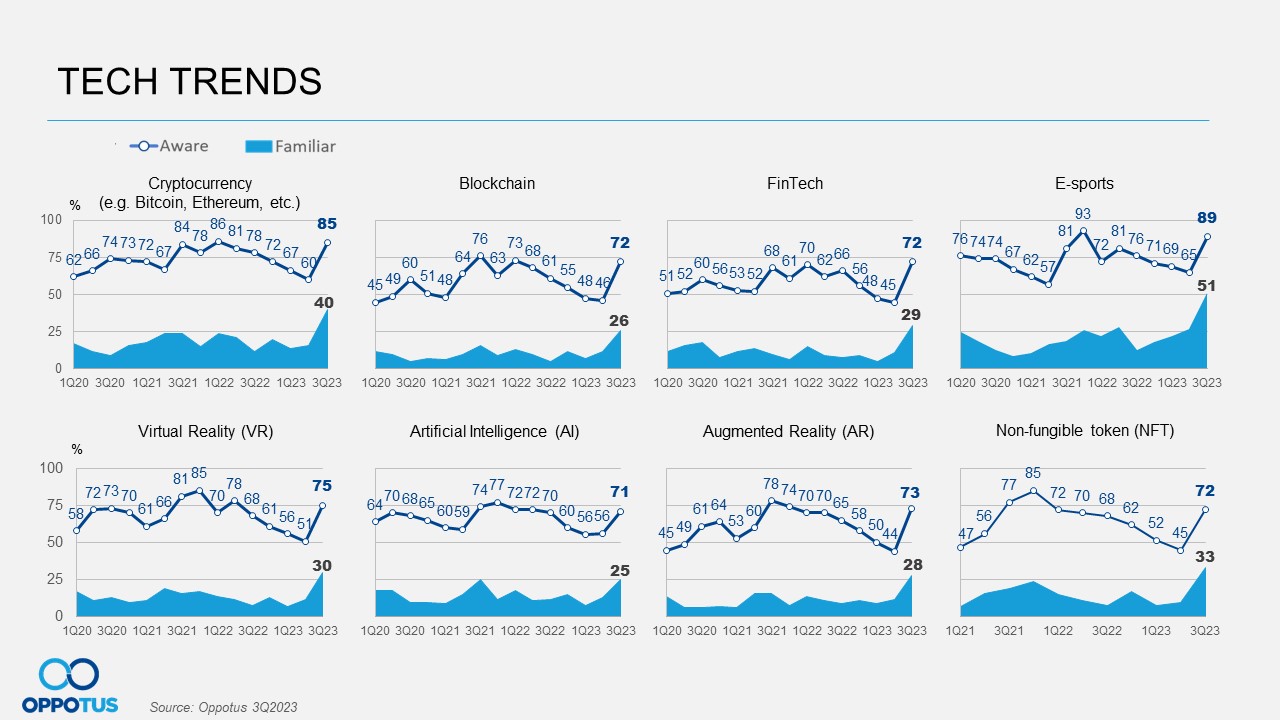

Embarking on a new wave of technological advancement, Malaysia stands at the forefront of global recognition, propelled by emerging innovations. In alignment with this vision, the current Tech Trends shine a spotlight on E-Sports, Cryptocurrency, Artificial Intelligence (AI), and Virtual Reality (AR) while also recognizing the surging significance of NFTs as a pivotal growth area.

In a momentous development, all tech sectors in the study exhibit an impressive uptrend of almost 10% and above from the previous quarter. This surge could be attributed to the government’s commitment to bolstering the tech industries, by securing over RM37.4 billion in investment commitments in the digital technology sector as of August 2023.

E-sports maintains its leading position among Malaysians for the third consecutive quarter, rising to 74% from the previous quarter’s 65%. This comes as no surprise, given the government and, Youth and Sports Ministry’s unequivocal support for the industry, evident in their endorsement of the third Malaysian Esports League 2023 (MEL23), creating a sustainable electronic sports ecosystem. An ecosystem that has also aided the Malaysia e-sports team in making history by winning the country’s first medal at the Hangzhou Asian Games.

Other noteworthy upward trends include Cryptocurrency at 71% and NFTs at 56%, both experiencing a substantial 11% increase. However, despite maintaining the third spot, Artificial Intelligence shows a more modest 5% incline compared to other tech sectors. This is a surprising revelation, given that 70% of the Malaysian population is aware of AI and holds a positive attitude towards AI and associated products and services. The prominence of this technology is evident, as even the government explores potential regulation, recognizing AI’s inevitable integration into our daily lives. Thus, even with an incline, there may still be reservations about AI among the general public.

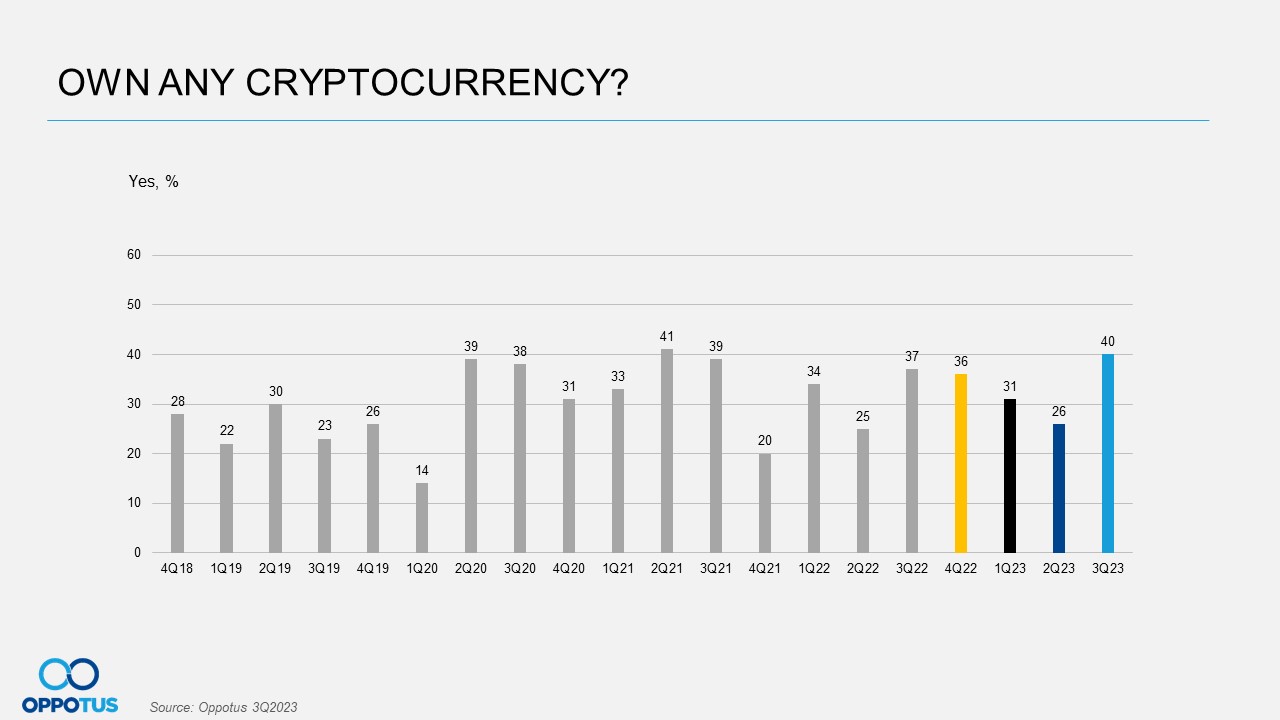

In the realm of Cryptocurrency Ownership in Malaysia, our latest findings underscore a significant surge, witnessing ownership climb from 26% in Q2’23 to an impressive 40% by Q3’23. The notable rise during what is historically recognized as one of Bitcoin’s robust months adds a compelling layer to the narrative. July’s subdued phase, marked by range-bound fluctuations and a modest 0.03% average daily gain, did not deter ownership, persisting through August’s upward trend, despite acknowledged fluctuations and an “August low.” September brought its set of challenges, earning the dubious distinction of being “the worst month in 2023 (so far) for crypto-related exploits.“ Despite the quarter indicating a gradual cooling of the crypto market, the overall quarterly trajectory reflects a positive shift, signaling the potential for a market revival that continues to captivate user interest.

This resurgence unfolds amidst significant global developments within the cryptocurrency domain. Navigating these nuanced trends reveals the market’s resilience, showcasing the intricate dance between market forces and user sentiment. This surge in ownership not only signifies a departure from the recent decline but also hints at a renewed interest, marking a pivotal period for cryptocurrency enthusiasts in Malaysia.

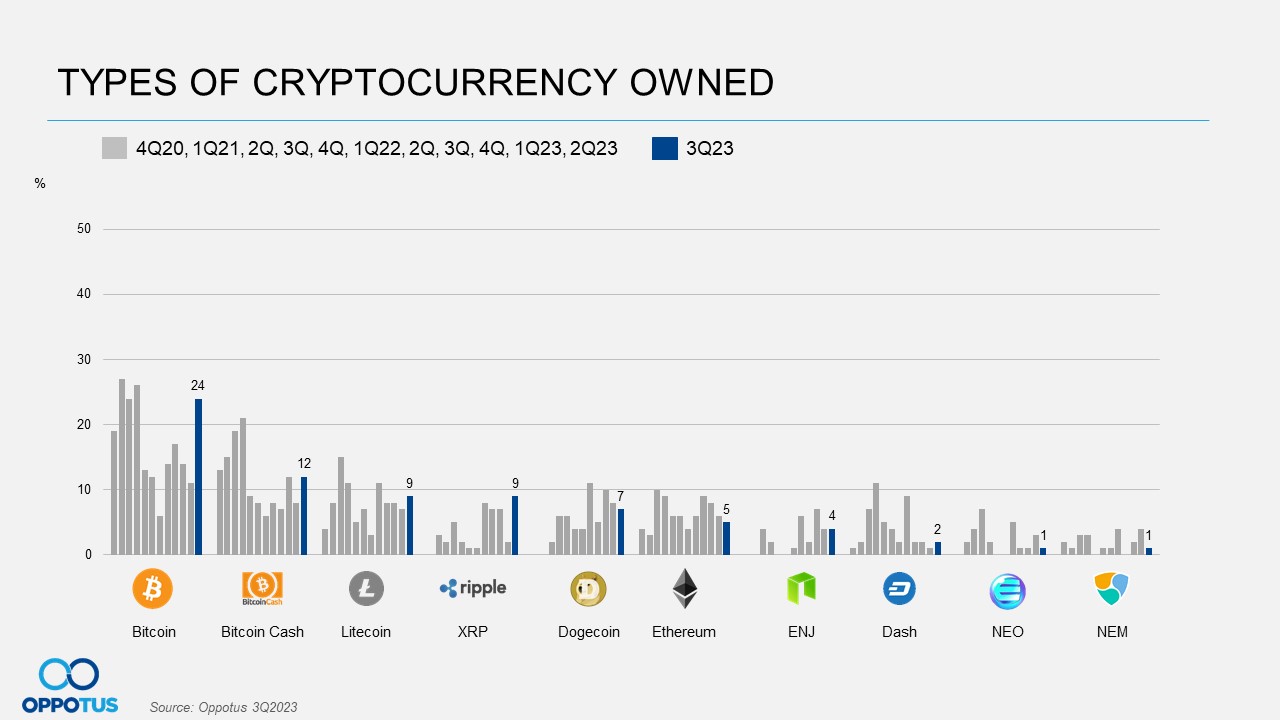

In cognizance of Bitcoin’s tumultuous first half, culminating in a downward note at the close of Q3 ‘2023 and marking its initial quarterly decline in the year, a renewed sense of optimism emerges as it experiences a noteworthy upswing to 24%. This significant shift breaks a three-quarter-long decline trend that persisted since Q4’22. A pivotal factor contributing to this resurgence is Bitcoin’s triumph in a U.S. court ruling. This victory not only instills newfound confidence in its long-term outlook but also sets the stage for retail investor-friendly funds, sparking a remarkable recovery of more than 7% and propelling it towards its best day since March. This turnaround effectively mitigates some of the substantial losses incurred over the previous quarters.

In tandem with this upward trajectory, Bitcoin Cash commands a notable presence at 12%, joined by Litecoin. Surprisingly, a newcomer to the top 5 most owned cryptocurrencies, XRP Ripple, claims a significant 9%, displacing Dogecoin by three spots and edging Ethereum out of the top 5. The rising star in the crypto realm, XRP Ripple, reportedly commands 5% of trade volume in U.S. exchanges, with over 892 million XRP units sold. This dynamic reshaping of the cryptocurrency landscape underlines the ever-evolving nature of investor preferences and the shifting dynamics within the digital asset market.

Note that the opinions presented regarding Malaysia and its people reflect the views of Malaysian citizens aged 18 and above, from both the M40 and T20 income segments, residing in key cities of the Peninsula, and selected in a representative manner.

For a more granular analysis of the data above, we invite you to contact us at theteam@oppotus.com. Our team of experts would be pleased to facilitate a comprehensive review and offer customized recommendations tailored to your specific needs.