To date, over half of Malaysia’s population is using e-wallets on a daily basis, making it one of the fast growing payment trends in the country. The adoption of cashless transactions has been increasing over the years with the advancement of technology and its growth was further driven with the emergence of COVID-19.

Oppotus has kept a close eye on the volatile landscape of digital wallets and once again delves into the latest data regarding e-wallets in Malaysia, this time taking a look at how COVID-19 has transformed consumer behaviours and preferences.

The E-Wallet Landscape

Revisiting the e-wallet landscape in Malaysia, we can see the peak of companies diving into the digital wallet trend through 2017 and 2018 with big names such as Samsung Pay, Alipay, Boost, Touch ‘n Go, GrabPay, and WeChat Pay. Many of which are still going strong in the market now. However they do face increasing competition with newcomers that joined later such as MAE in 2019, and CIMB QRPay and ShopeePay in 2020.

Despite the strong competition in the digital wallet landscape that deterred most companies from entering the market, Sunway introduced their own Sunway Pay in late 2021, being the youngest player in the field. Moreover, as in line with the theory of survival of the fittest, some companies such as vcash and Razer Pay that could not compete as well in the game had to exit the scene.

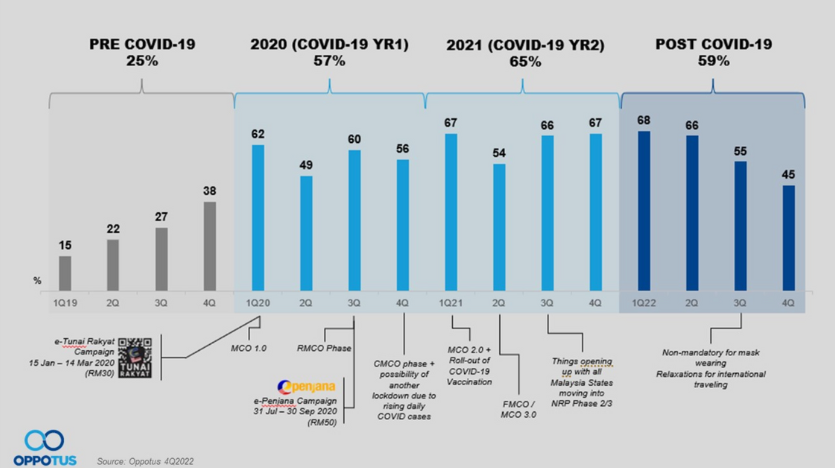

E-Wallet Usage Over The Pandemic Period

Looking into the data of e-wallet usage since 2019, we find that prior to COVID-19, the usage of e-wallet was steadily gaining traction quarter-on-quarter with an average of 25% penetration rate. When COVID-19 hit Malaysian shores in the year 2020, the usage of e-wallet rose to as high as 57% – double the rate of pre COVID-19. This increase was largely spurred on by e-wallet initiatives such as e-Tunai in 1Q’2020 and e-Penjana in 3Q’2020 by the Malaysian government, where Malaysians could get free credit for signing up to use e-wallets. This was coupled with implementation of the different Movement Control Order (MCO) stages which forced non-essential workers to stay at home, with the closure and/or limited work hours of most businesses. The buzz about contactless payment, which was deemed more safe than physical cash transactions in light of the pandemic, further boosted the usage of e-wallet for the year. With all of these ongoing events, e-wallet were seen as one of the better choices for consumers to make payments while confined to their homes.

This trend is seen to spill over to year 2021 where e-wallet usage continued to record a high growth up to 65% in usage. Come year 2022, when things were loosening/opening up, the usage of e-wallet started to record a dip quarter-on-quarter, going as low as 45% in 1Q’2022. With businesses/schools being allowed to operate as usual, no more MCOs, and the opening of international borders, e-wallet usage dropped as consumers could opt for other payment options.

The Demographic of E-Wallet Users (Pre vs During vs Post COVID-19)

During pre COVID-19 times, e-wallet users were skewed towards Working Adults (25-39 years old) and those in the Upper M40 and above. This is inline with the nature of how e-wallet operates as this is the group that are most tech savvy and have higher preference for cashless transactions.

At the time of COVID-19, Youth (18-24 years old), Older age groups (55 years and above), and Lower M40 saw a higher adoption of e-wallet which could have been encouraged by the e-Tunai and e-Penjana initiatives. Surprisingly the usage in Johor Bahru steadily increased to 31% in Post COVID-19 despite other areas such as KL/PJ and Penang seeing drops.

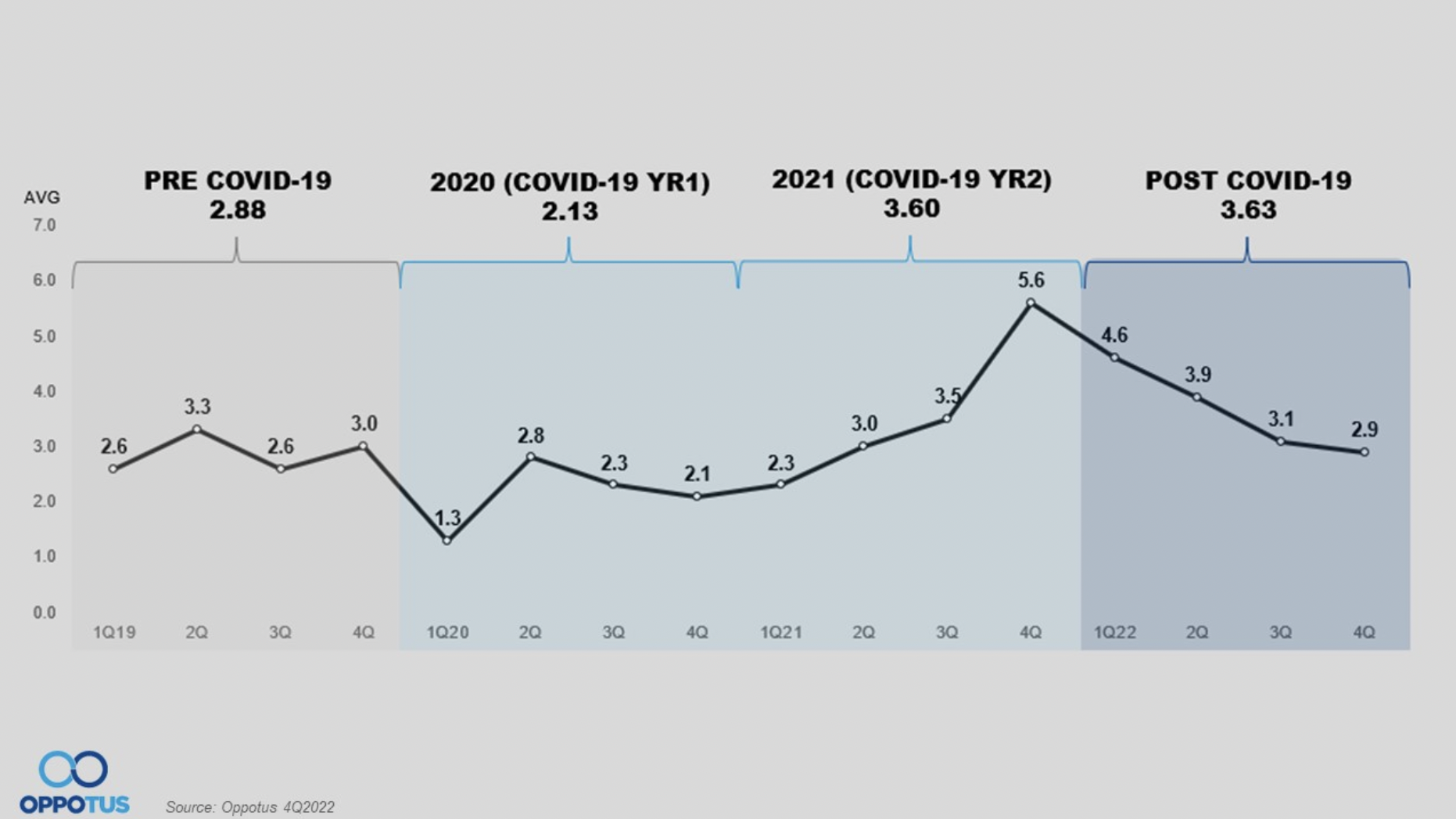

The Number of E-Wallets Used

On average, Malaysians are seen to be using 3-4 e-wallet brands at a time. The low average count seen in 1Q’2020 (the start of COVID-19) could potentially be due to the e-Tunai initiative where Touch ‘n Go e-wallet doubled up the amount of credit which users would receive for free, which could have driven consumers to opt for one e-wallet at the time. The number of e-wallets used continued to grow during the 2 years of COVID-19 period and reached its peak of 5-6 e-wallets in 4Q’2021. However, just like the usage statistics, the average number of e-wallets saw a declining trend as Malaysia moved to the Post COVID-19 period.

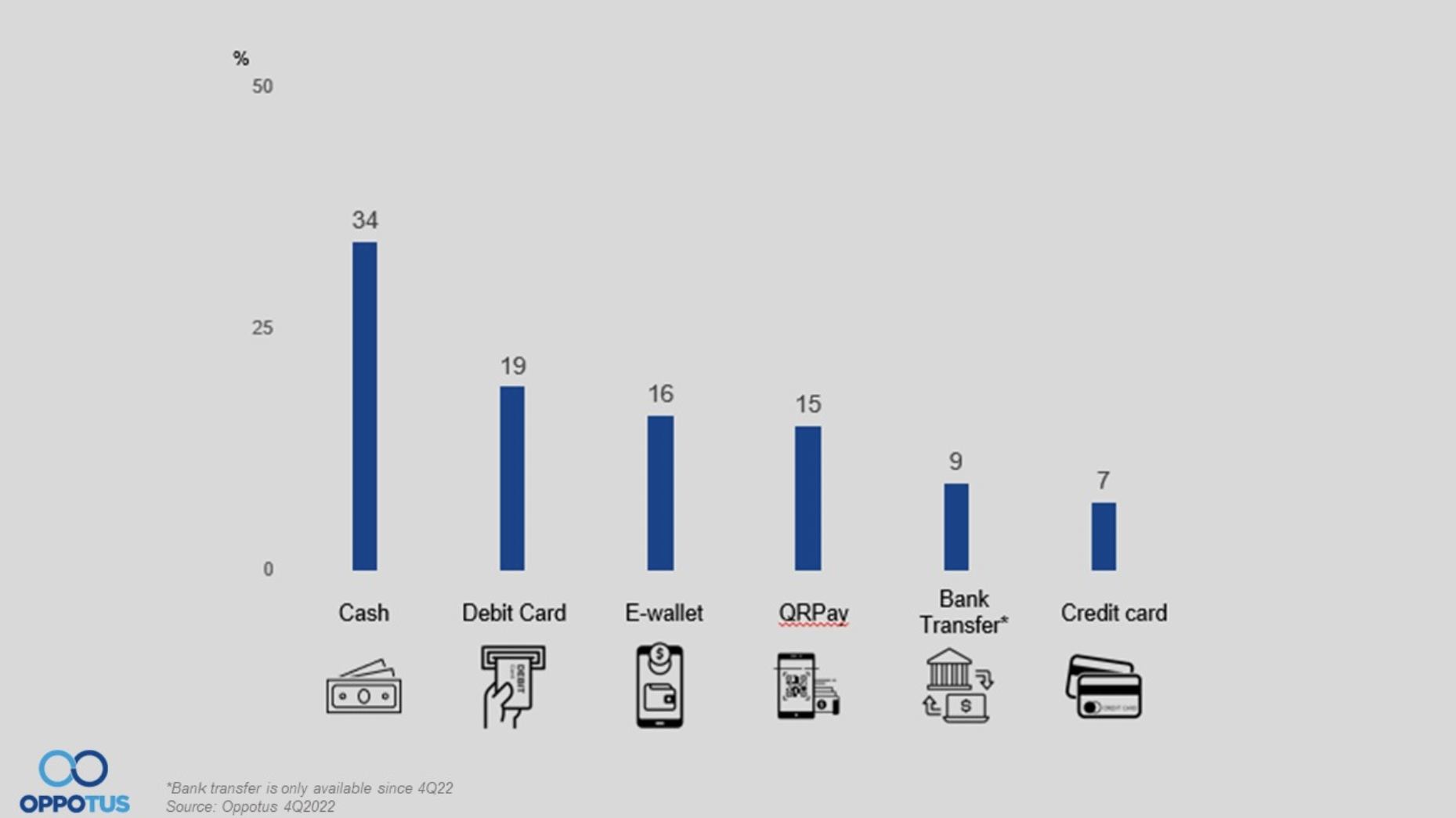

Payment Mode in Physical Transactions

Looking into the typical payment modes used, Cash is still the most preferred payment mode at 34% among all Malaysian consumers, followed by Debit card at 19%. The preference for Cash may also be due to some small businesses that have yet to adopt digital wallets as a payment option. Meanwhile, e-wallet and QRPay payment modes have a similar preference level of 15% as their operations are alike.

Despite the changes in overall e-wallet usage, e-wallet spending on average remained steady at about RM265 during COVID vs Post COVID-19.

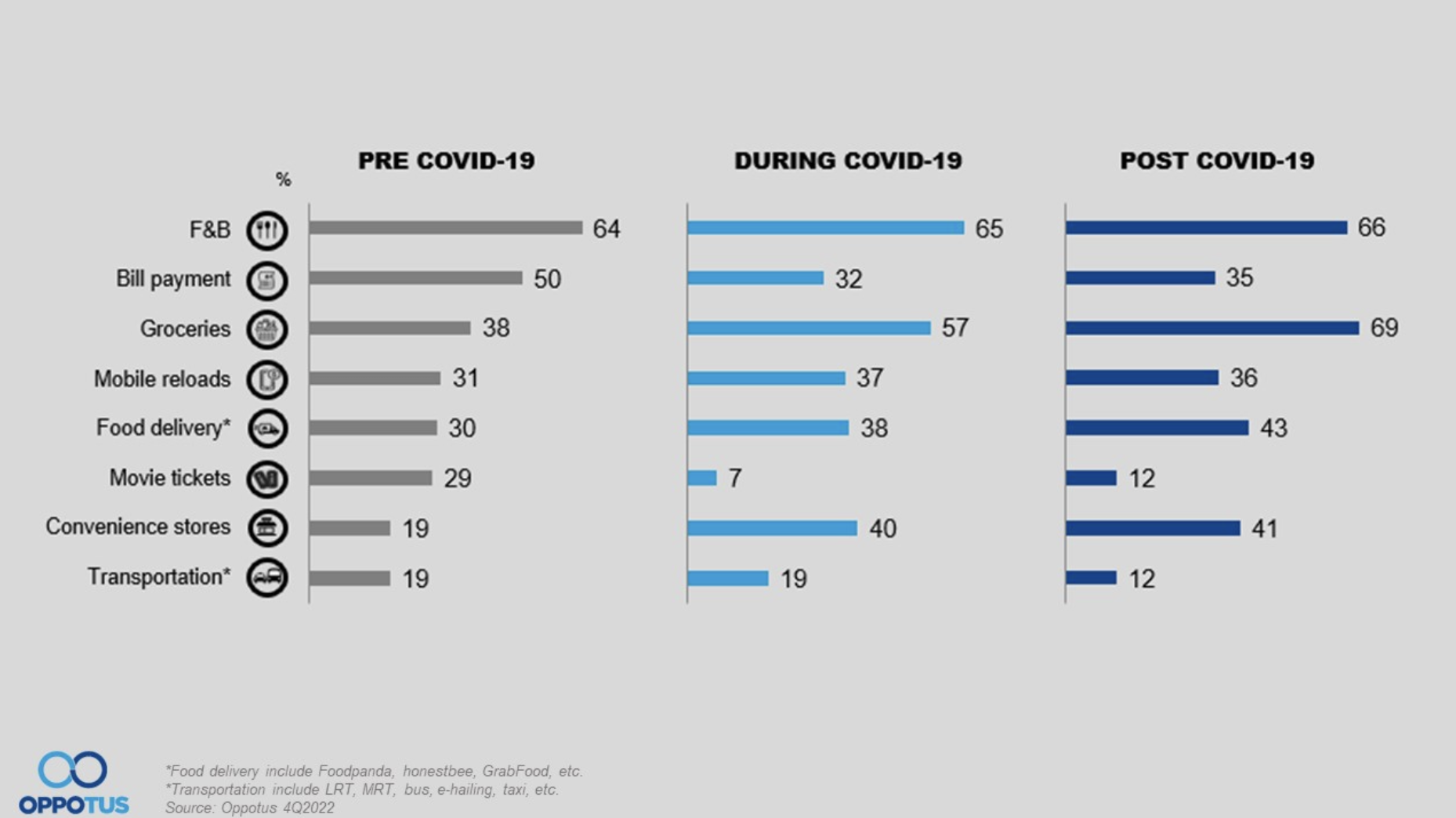

Where E-Wallets Are Used

F&B is by far the most popular place where the e-wallet is used considering the promotions and rewards it offers. When it comes to F&B sector, the usage remains high at above 60% regardless of which time period we observe. The usage of e-wallet has grown in light of COVID-19 for Groceries, Food delivery, Convenience stores and Mobile reloads. Post COVID-19 Groceries is seen to surpass F&B at 69%, likely due to large supermarkets such as AEON offering delivery services.

Additionally, with cinemas opening up and starting to play new titles recently, purchasing movie tickets via e-wallet recorded an uptick to 12%. However, the usage of e-wallet for Bill payment is not as popular as it used to be before the COVID-19 period.

Impact of COVID-19 On The Usage of E-Wallet Brands

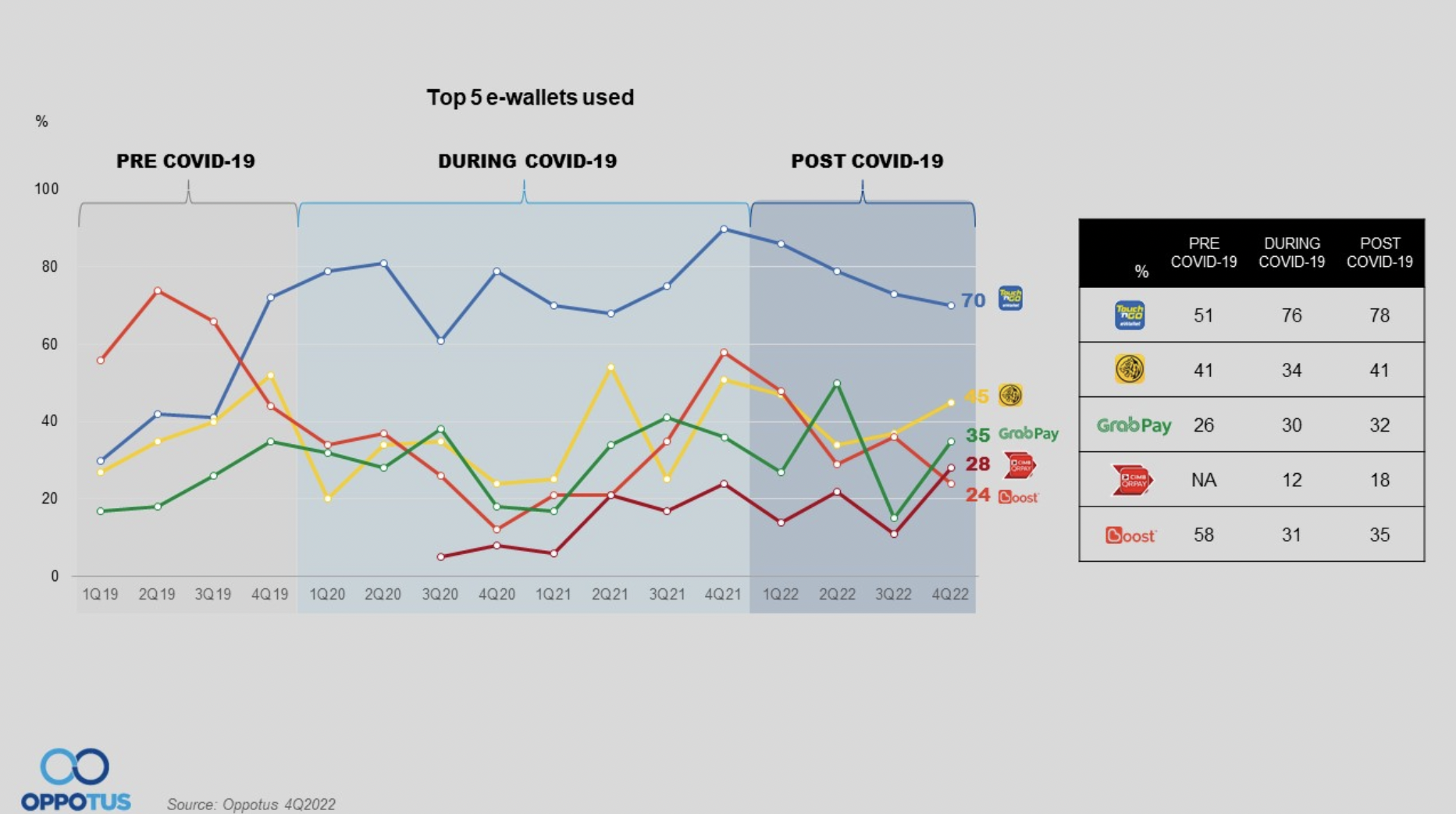

Touch ‘n Go e-wallet gained popularity when COVID-19 hit Malaysia, their e-Tunai initiatives greatly driving their popularity to first place, overtaking Boost which was No.1 during the Pre COVID-19 period to become the overall leading e-wallet.

As Malaysia moved towards contactless payment during the COVID-19 period, banks’ QRPay platforms also gained traction. This was especially true for Maybank QRPay which now stands as the No.2 e-wallet with 41% usage. Despite its instability, GrabPay is the No.3 player followed by CIMB QRPay which gained traction in 4Q’2022.

Share of Wallet Based on Segment

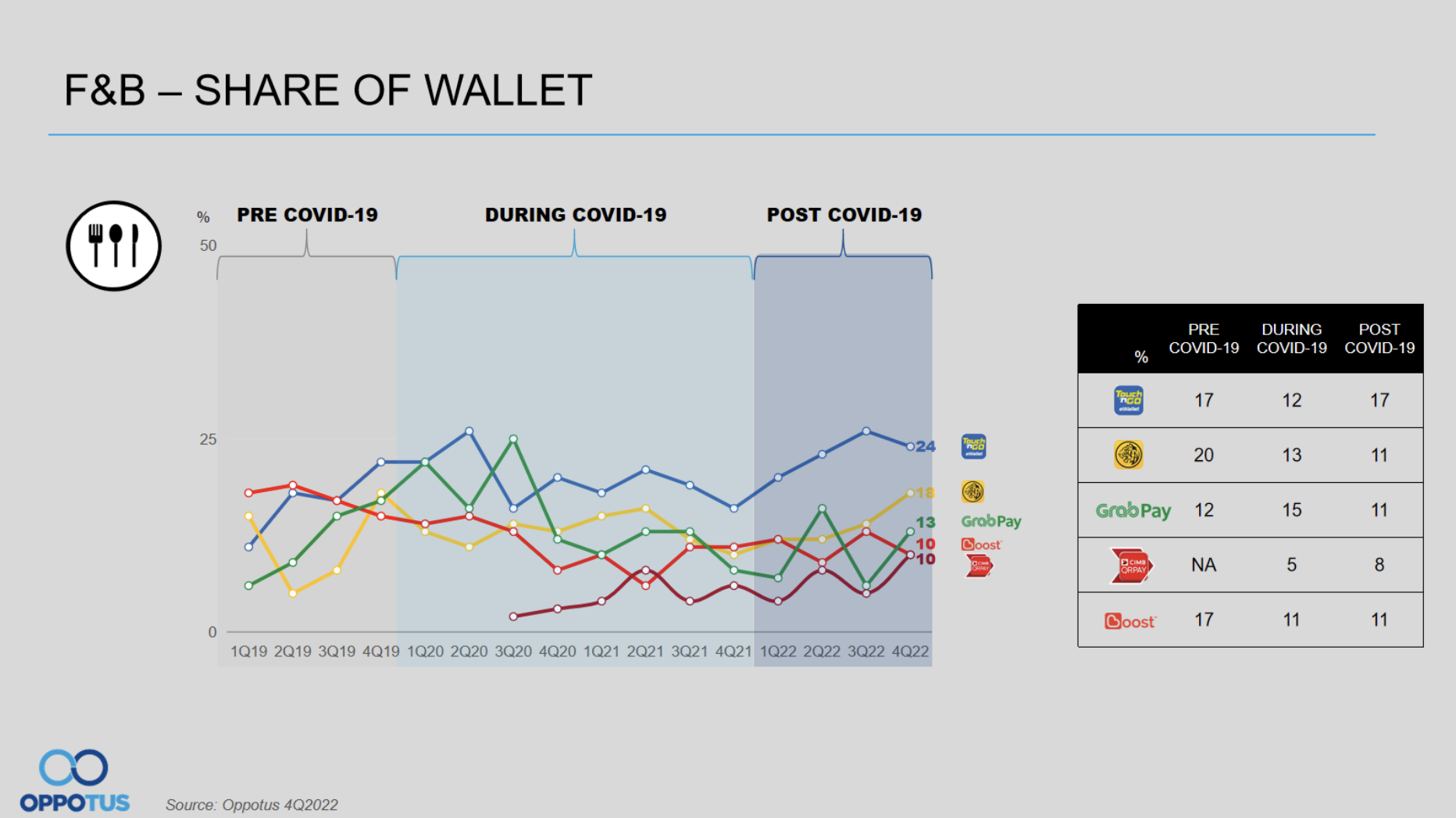

Within the F&B space, GrabPay was a strong player during the COVID-19 period, but slowed down in 2022 (Post COVID-19). Towards the end of 2022, Maybank and CIMB QRPay gained traction while Touch ‘n Go e-wallet and Boost recorded a decline.

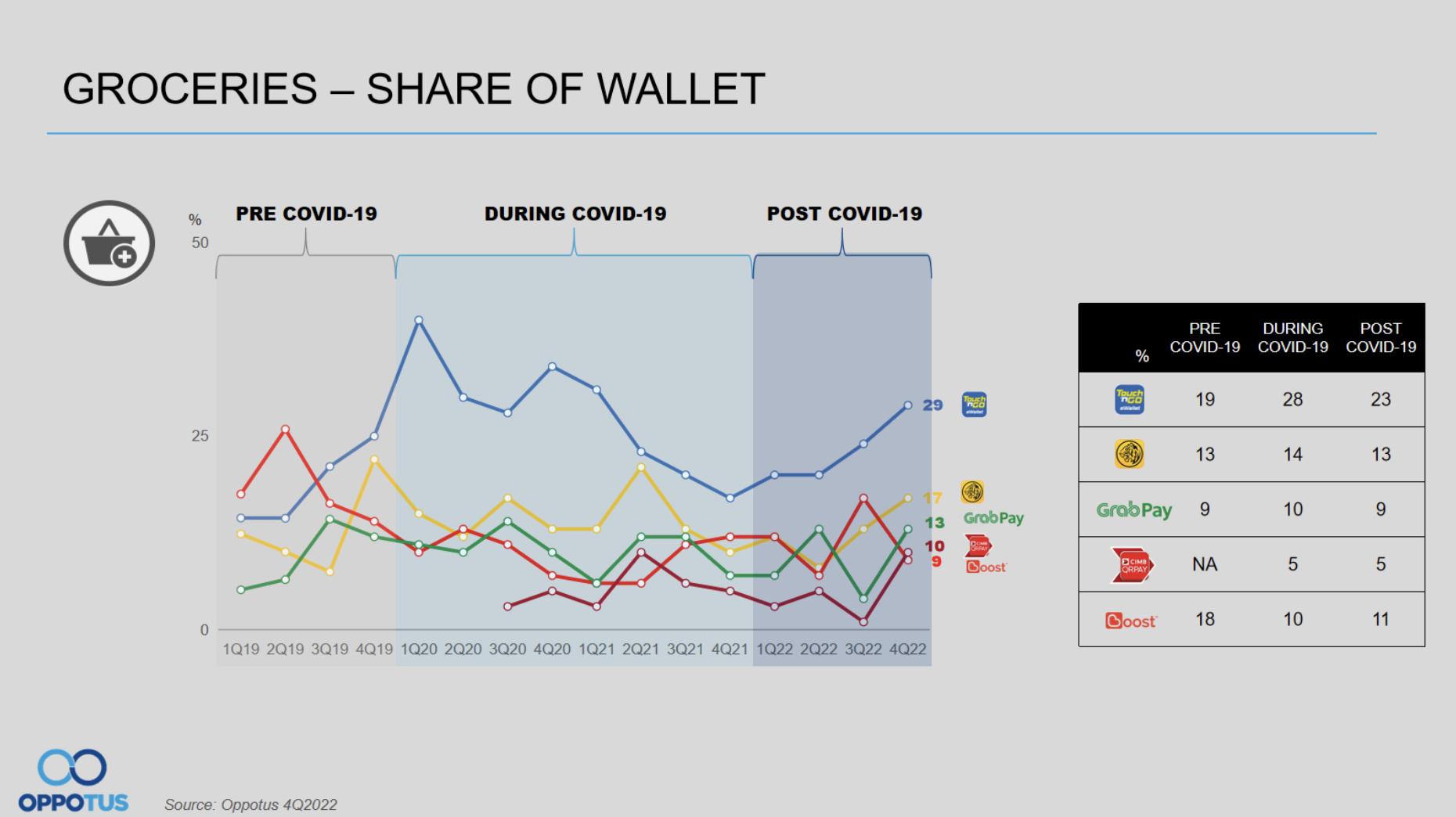

In the Groceries space, a more stable performance is seen here as Touch ‘n Go e-wallet remains a strong leader regardless of the COVID-19 events, followed by the two closely competing Maybank QRPay and GrabPay.

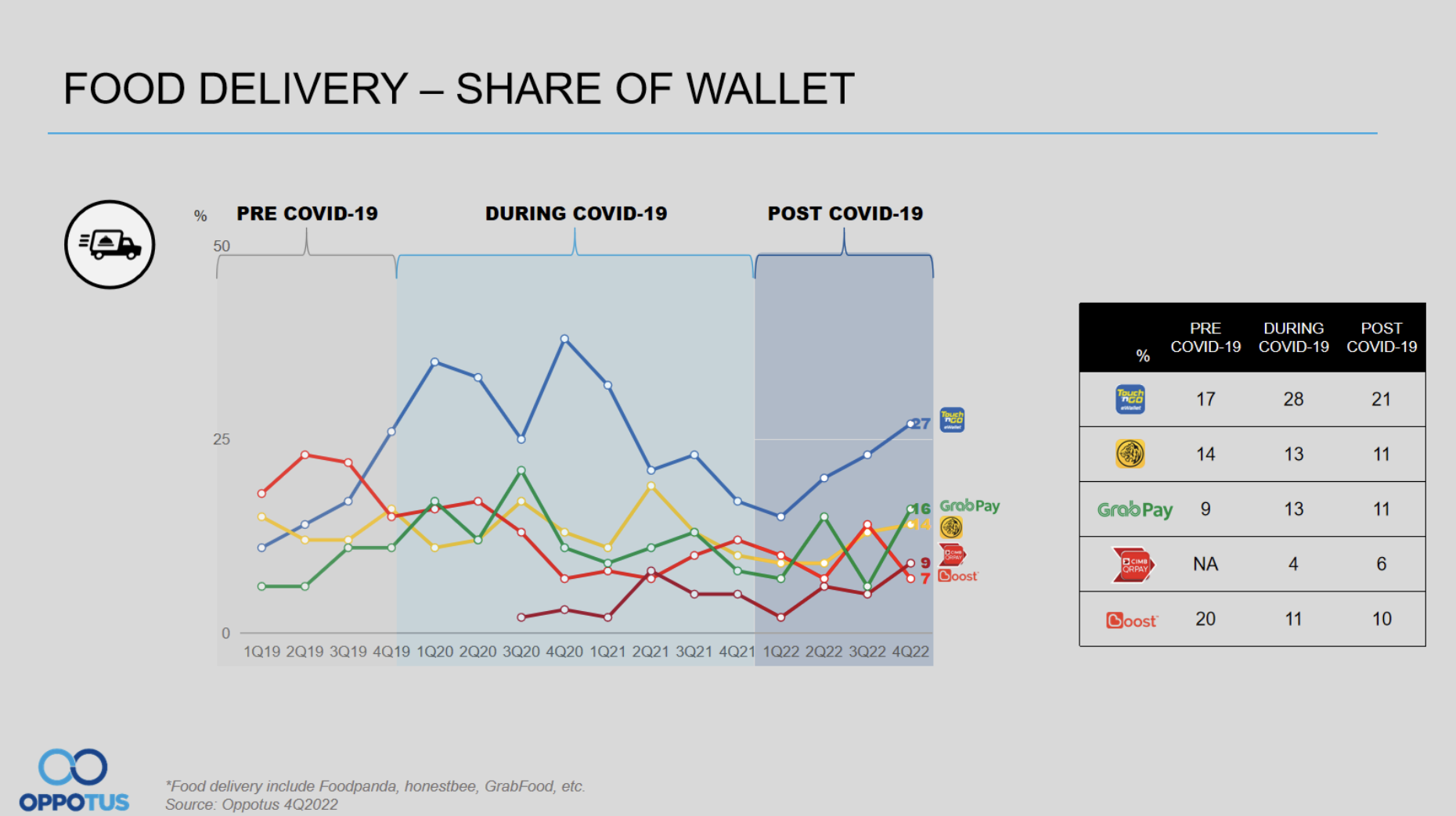

Looking at Food delivery, Touch ‘n Go e-wallet continues to grow reaching its peak during COVID-19. Although it dropped during 2021, it has since regained its share to 27% by the end of 2022. Meanwhile, GrabPay and Maybank QRPay – much like in the Groceries space, have been competing for No.2 since COVID-19 timing.

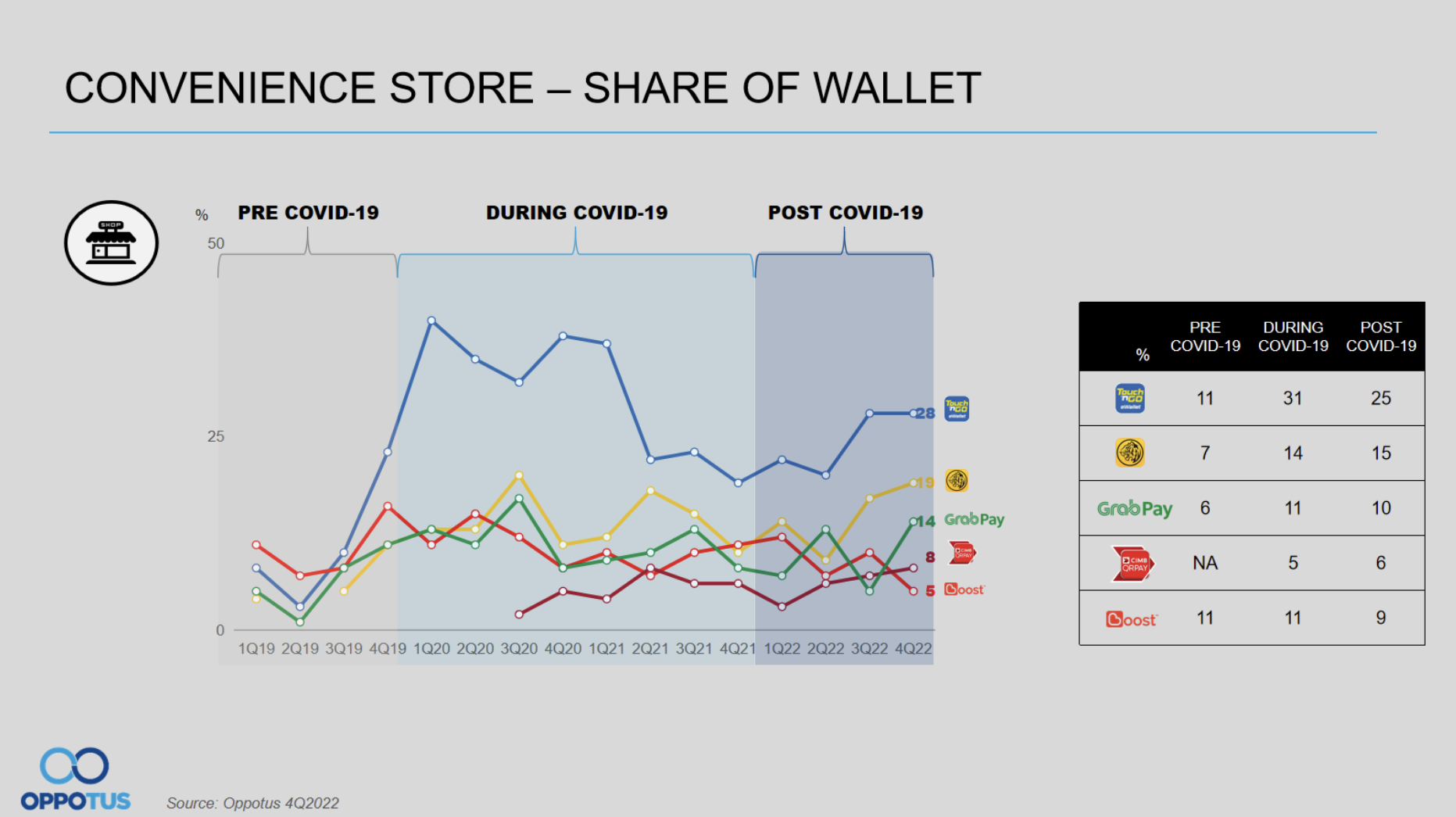

Usage of Touch ‘n Go e-wallet recorded the highest growth in Convenience stores during COVID-19 but slowed down in 2022 while still leading in the space. As for GrabPay, after a shortfall in 3Q’2022, it made a come back in 4Q’2022.

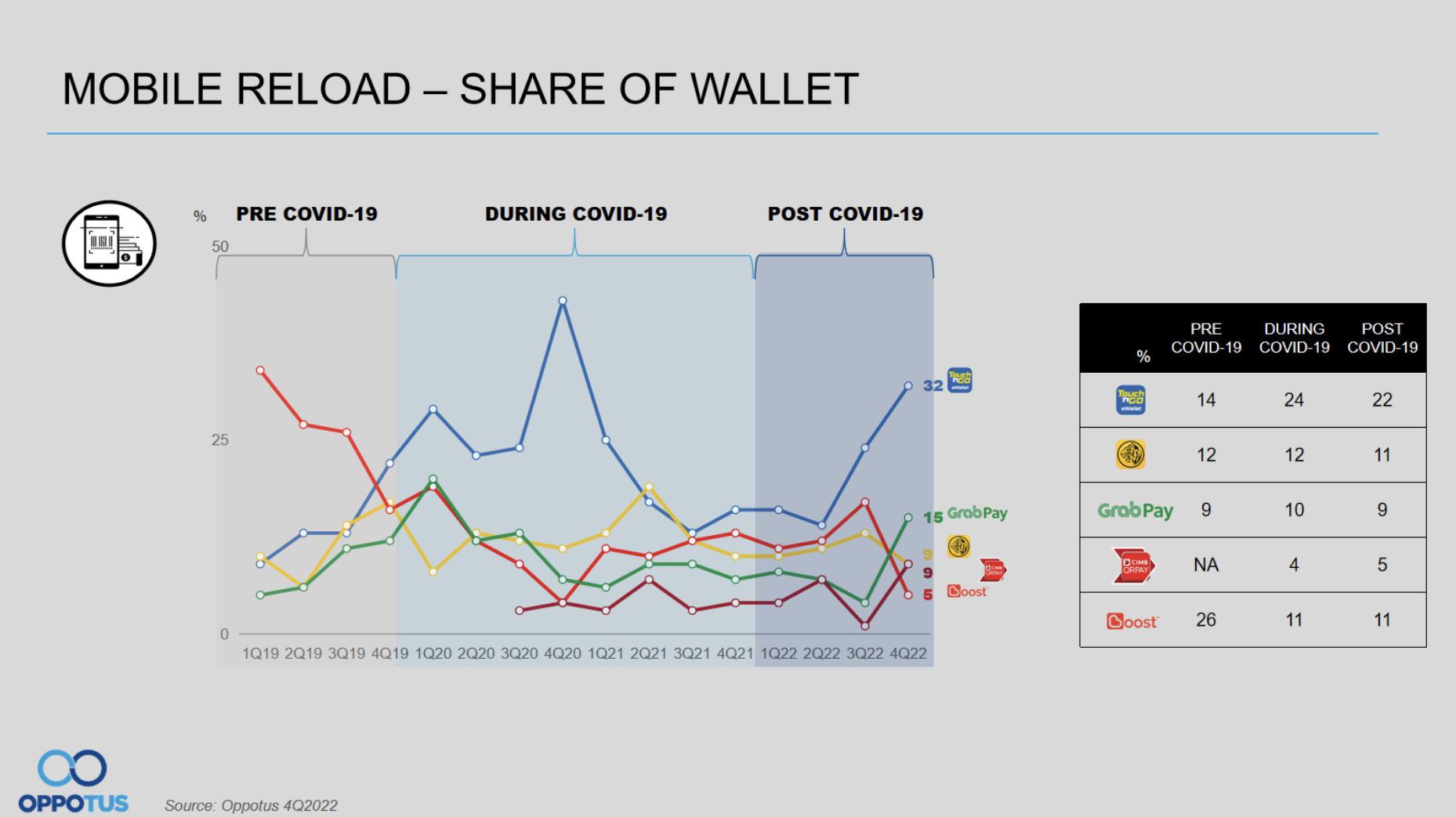

Despite the instability and large fluctuations, Touch ‘n Go e-wallet remains the leader in the Mobile reload space, followed by GrabPay.

E-Wallet Brands User Profile

In terms of gender, Touch ‘n Go e-wallet, Maybank QRPay, and CIMB QRPay users are slightly skewed towards Males, whereas GrabPay users are skewed towards Females. Moreover, although Touch ‘n Go e-wallet has shown its dominance in market share based on the various segments, its user profile in areas such as Penang and Johor Bahru is less than its competitors.

Other than Maybank QRPay with an equal 42% between PMEB and Non-PMEB, all other key players are inclined to Non-PMEB users.

Would Malaysians Still Use E-Wallets If There Are No Incentives?

With consumers getting used to the utilisation of e-wallets during the COVID-19 period and given the events that it occurred during the moment, Malaysians indicated their optimism to use e-wallet even when there are no incentives provided with a record high of 91%.

However, now that things are back to normal, intention to use e-wallet regardless of incentives is high at about 85% despite having declined in comparison to 2021. This suggests that there is a need for e-wallet players to provide some form of incentive every now and then to keep encouraging consumers to use the platform considering how consumers have other payment options to use.

With the intention to use e-wallet seeing continuous growth since COVID-19 times, these incentives are an important aspect for e-wallet operators to consider. With consumers having equal preference for e-wallet and QRPay, there is a need for differentiation between these two payment modes. As e-wallets are often known for its incentives, promotions, rewards, and offerings, it is still a viable strategy to have these kinds of benefits every now and then to further boost the usage of e-wallet and maintain its market share.

In order to capture brand loyalty and make consumers choose you over other competitors, brands have to offer more value, not only with rewards and benefits but also to engage and grow with the customers. Consumers nowadays prefer the aggregation of vital services in a single app for better convenience. In addition to rewards, looking into other mechanics such as timely notifications, location awareness, advanced analytics and other value-added services could provide e-wallet operators, or brands working in conjunction with e-wallets with an edge over their competitors.

To dive deeper into the information regarding e-wallets in Malaysia, feel free to contact us at: theteam@oppotus.com.