Welcome to Malaysians on Malaysia: Our quarterly report on Malaysian Consumer Confidence Index (MYCI). Malaysia’s MYCI slightly dipped in the last quarter of 2022. The arrival of COVID-19 has created Malaysians a “New Normal” lifestyle. Not only that, Malaysia had its 15th General Election (GE-15) and we ended 2022 with a new government. Scroll down to see more essential insights during this period on consumer confidence, behaviour, e-wallet, tech, crypto, and E-sports trends.

With the uncertainties towards the recently formed Malaysia government, it somehow affected Malaysians’ overall sentiments. As Malaysians are slowly adapting to the “New Normal” lifestyle, we’re looking forward to Malaysia recovering its economy in the coming year. Our MYCI study gives us a glimpse of the trends and sentiments. This time focusing on how Malaysians reacted after GE-15. Our previous coverage on Malaysian consumer confidence for 3Q’2022 can be found here.

Our MYCI Slightly Dipped & Optimism on Financial State Dropped

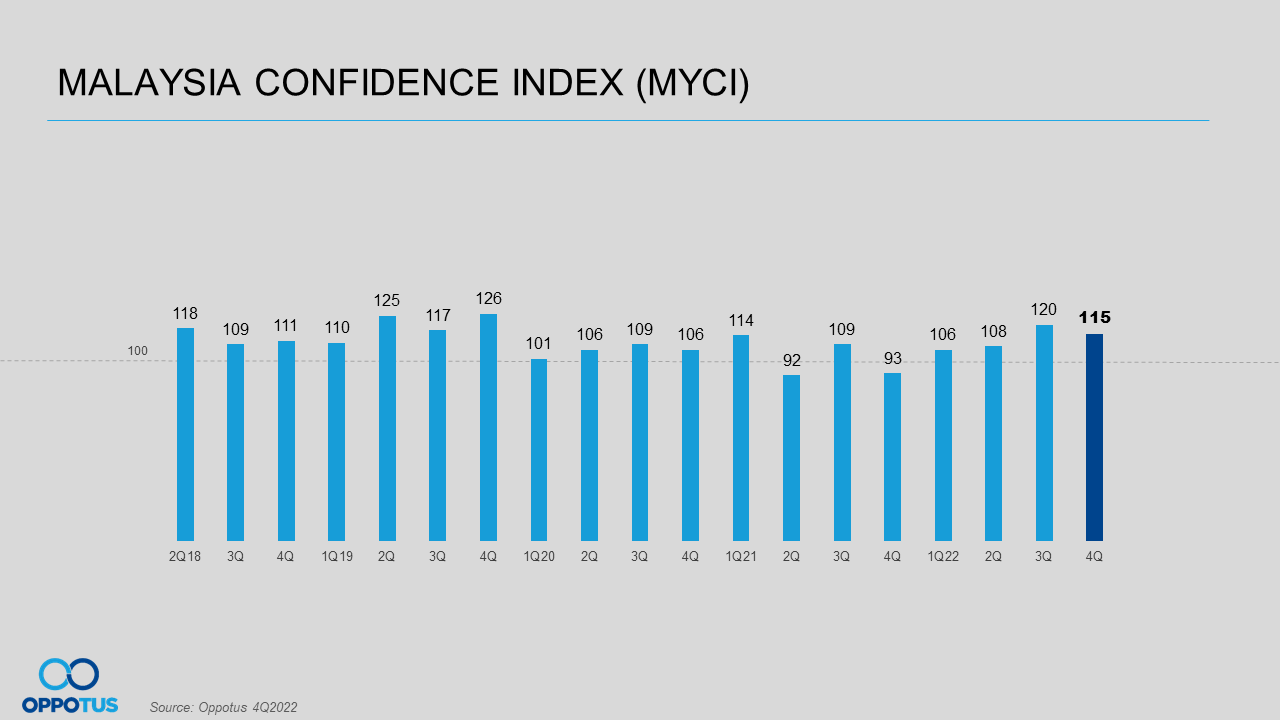

Just when we thought our MYCI will continue to grow after being at a high since COVID-19 in 3Q’2022 (120-point), our MYCI slightly dipped to 115-point in 4Q’2022. Sentiments such as the ever-rising cost of living, the uncertainties towards the recently formed Malaysia government following GE-15, and the looming of new COVID-19 variants could have dampened Malaysians overall confidence. But all-in-all, our MYCI is still at a good place to end the year.

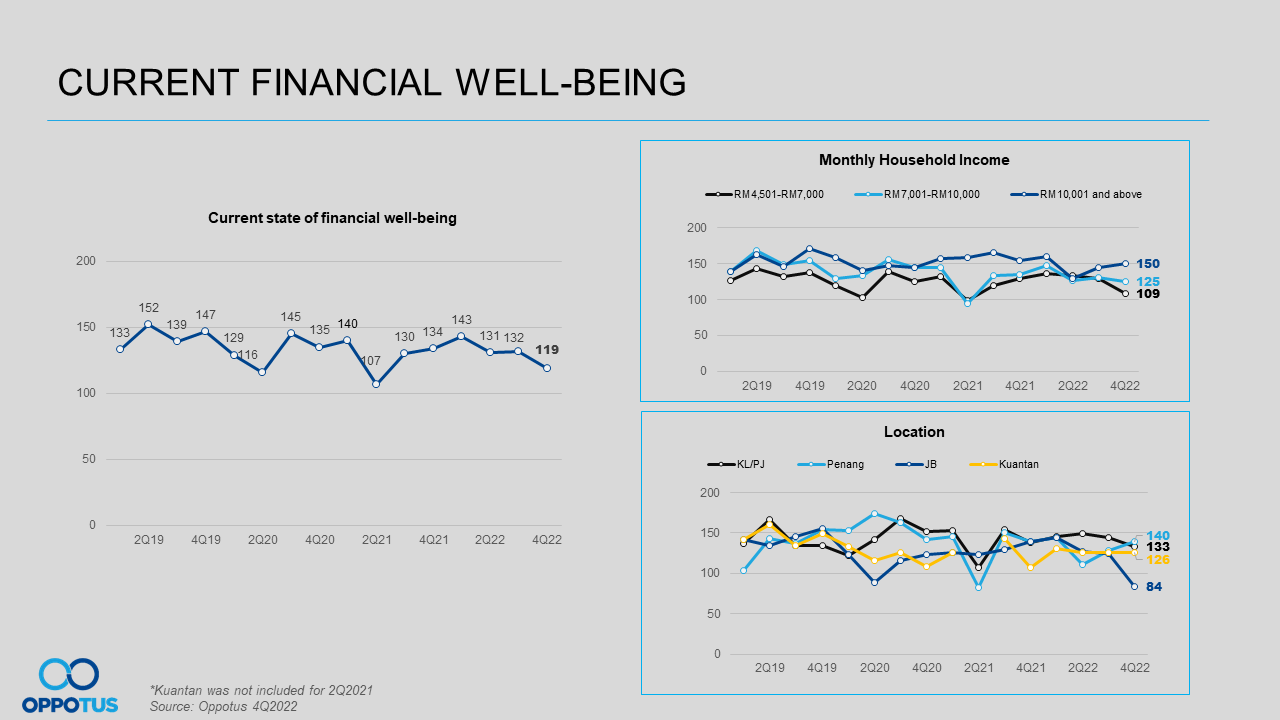

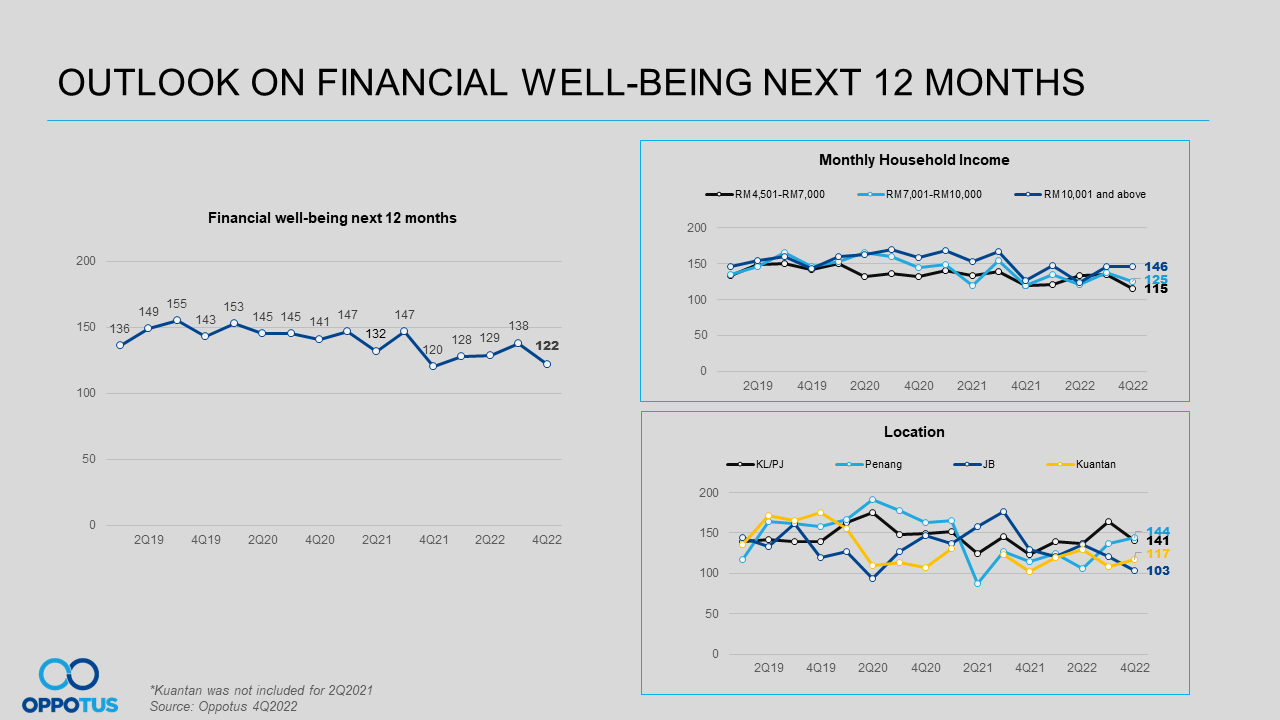

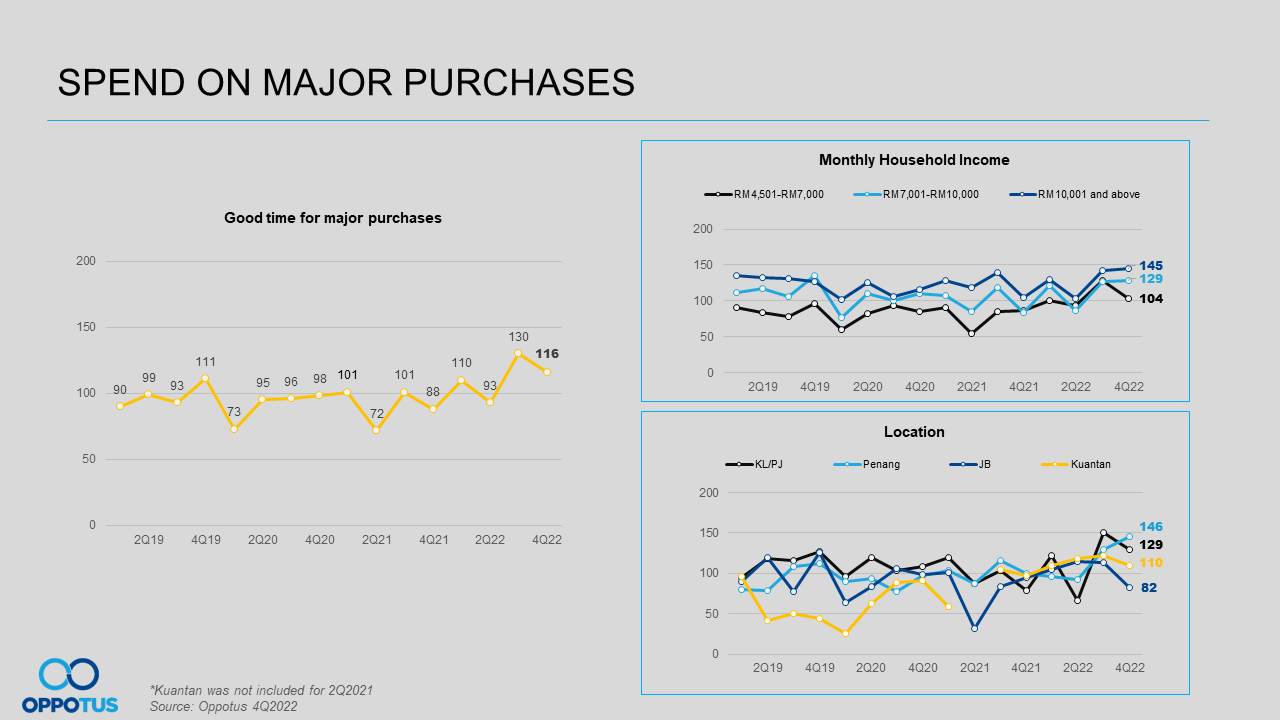

By comparing to 2021’s current financial well-being (upward trend), the index for 2022 is experiencing a downward trend. Malaysians are facing financial issues as the cost of living continues to soar. Hence, Malaysians’ optimism on their current financial status continues to drop this quarter, with our indices hitting almost all-time low (since 2019). Not only that, people are not feeling as optimistic towards their financial status in the near future as well. In line with this, their willingness to spend on major purchases also recorded a drop compared to 3Q’2022.

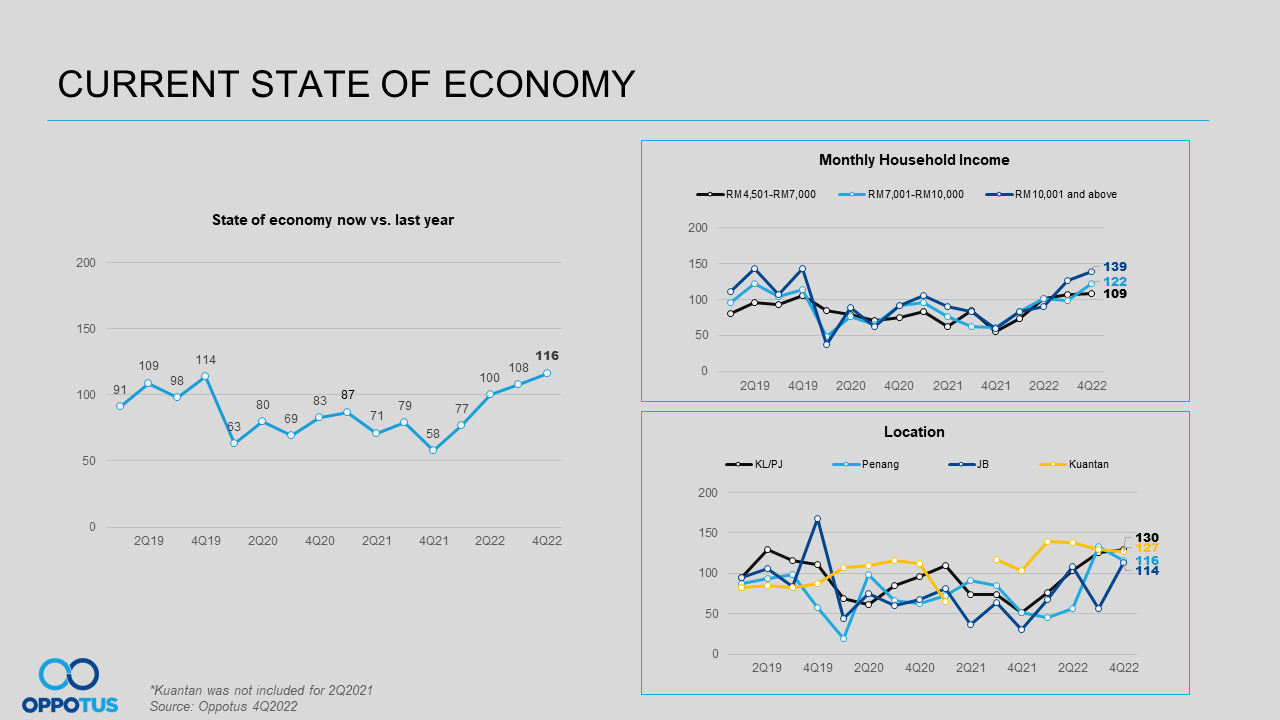

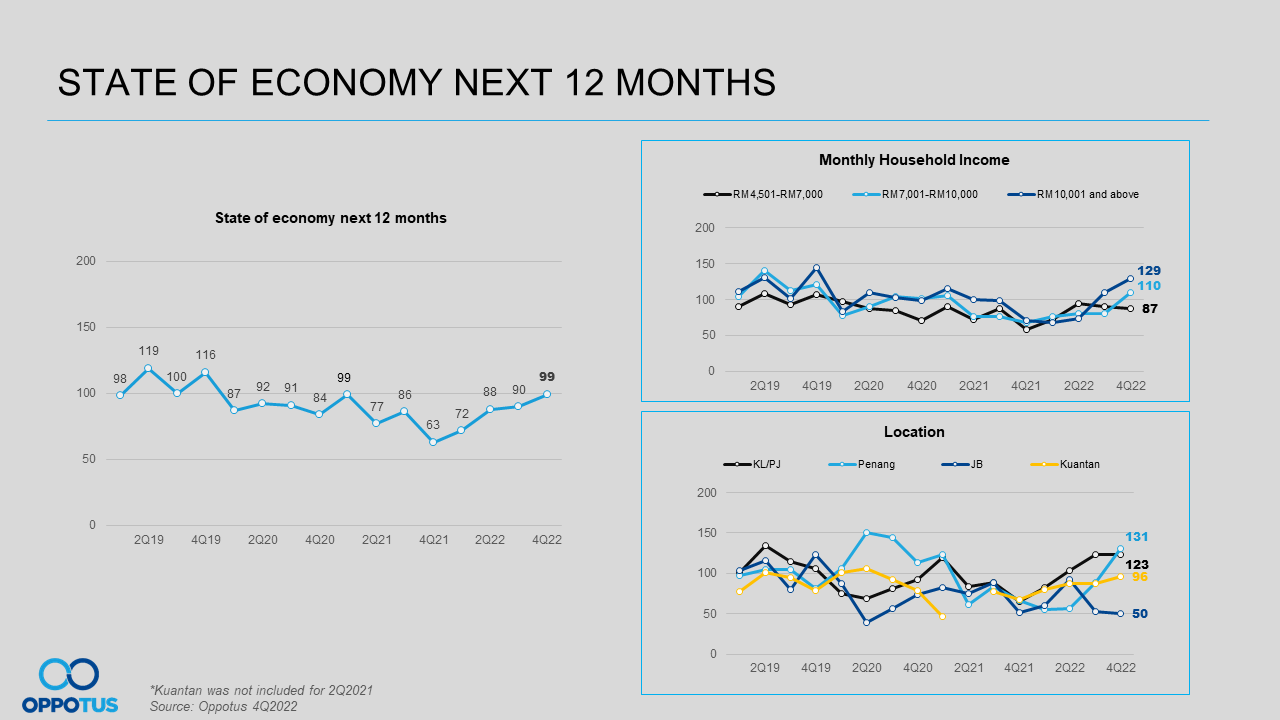

Strengthening of Our Economy Indices

After a shortfall during COVID-19, our indices are consistently on an uptrend throughout the year with 4Q’2022; hitting an all-high since the pandemic. It shows that Malaysians have regained their confidence towards the country’s current economy. Not only that, people are feeling optimistic towards Malaysia’s future economy too. The formation of the new Malaysia government led to our Ringgit value surged following GE-15. It uplifted Malaysians’ spirit that our economy will see a new limelight following these positive vibes, meaning Malaysians are having much confidence in our current government now.

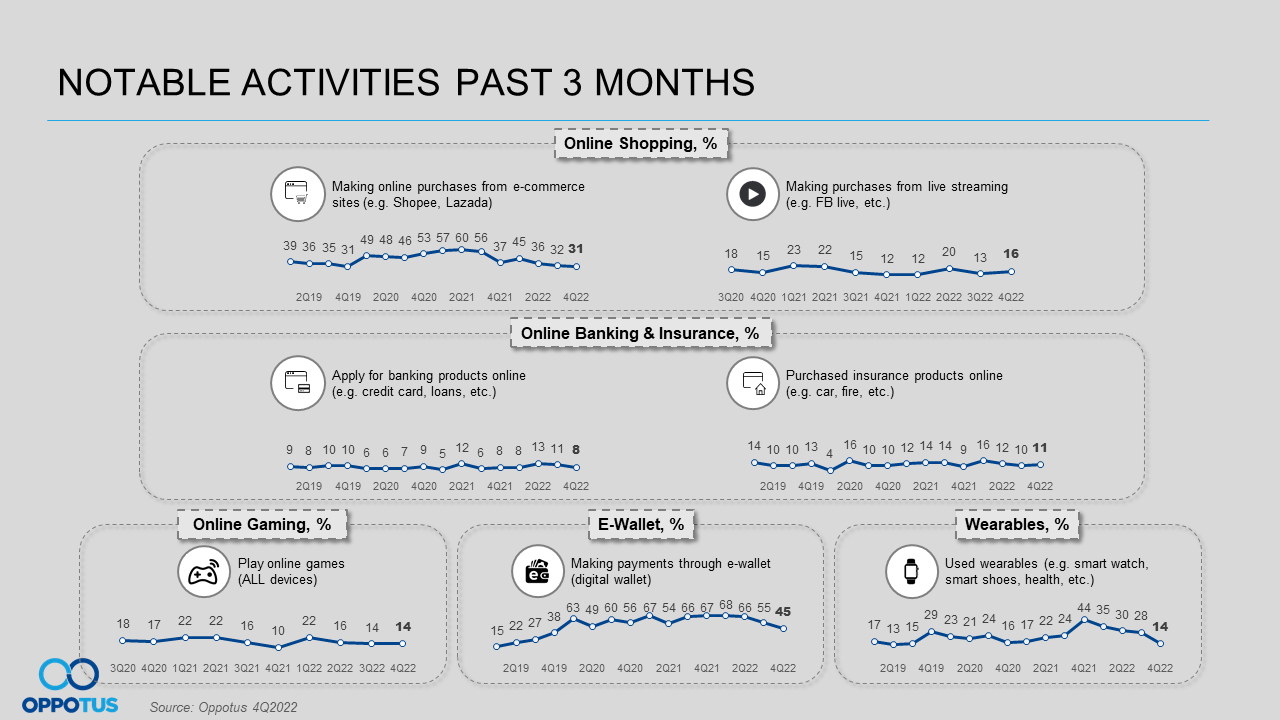

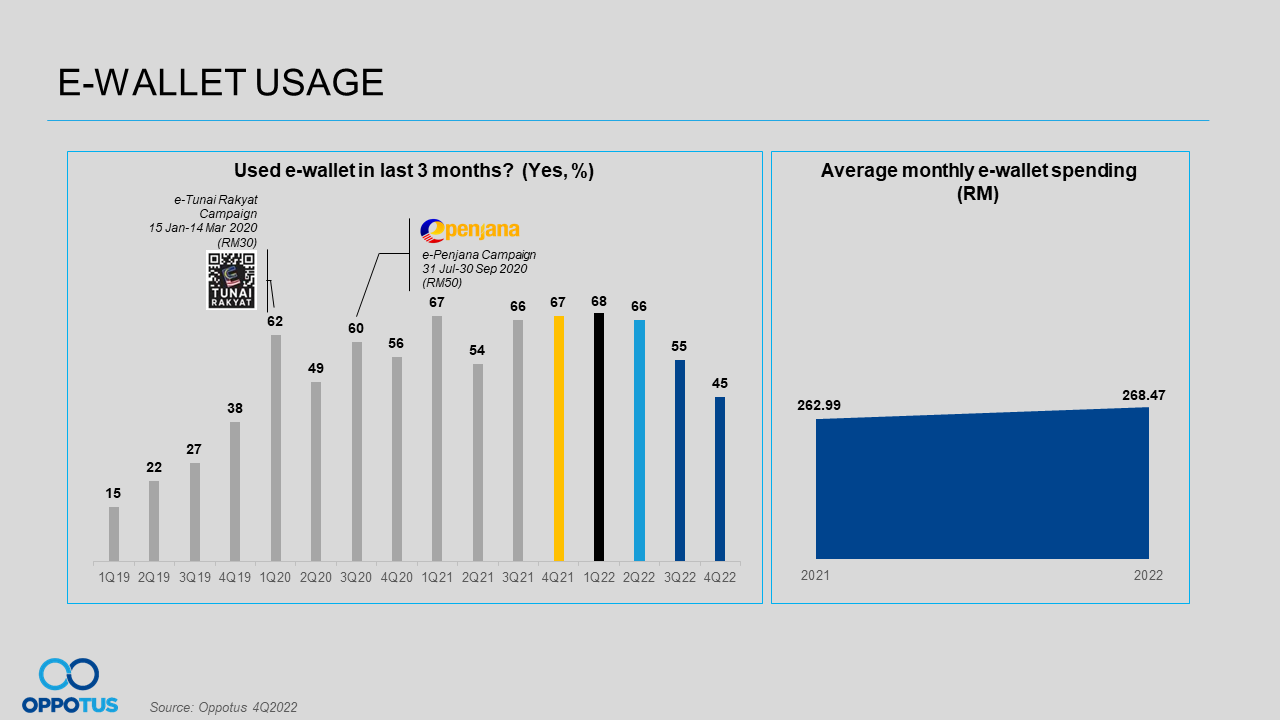

Usage of E-Wallet Continue to Dipped

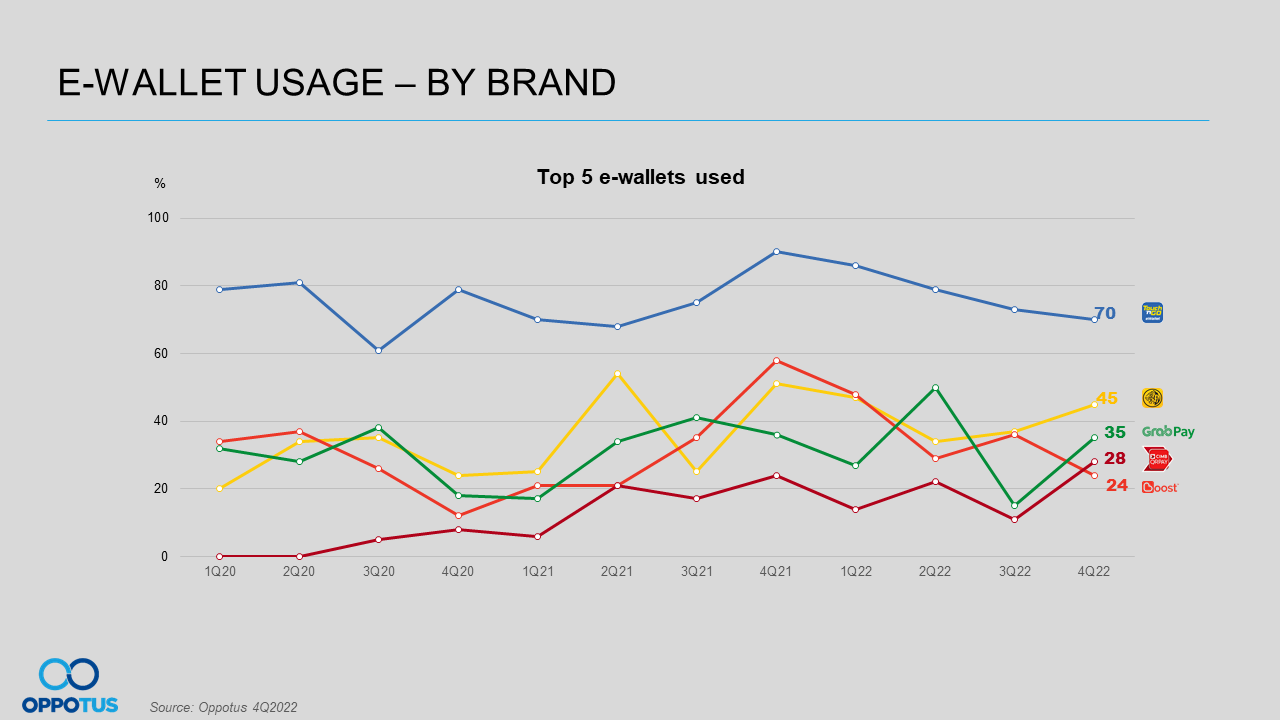

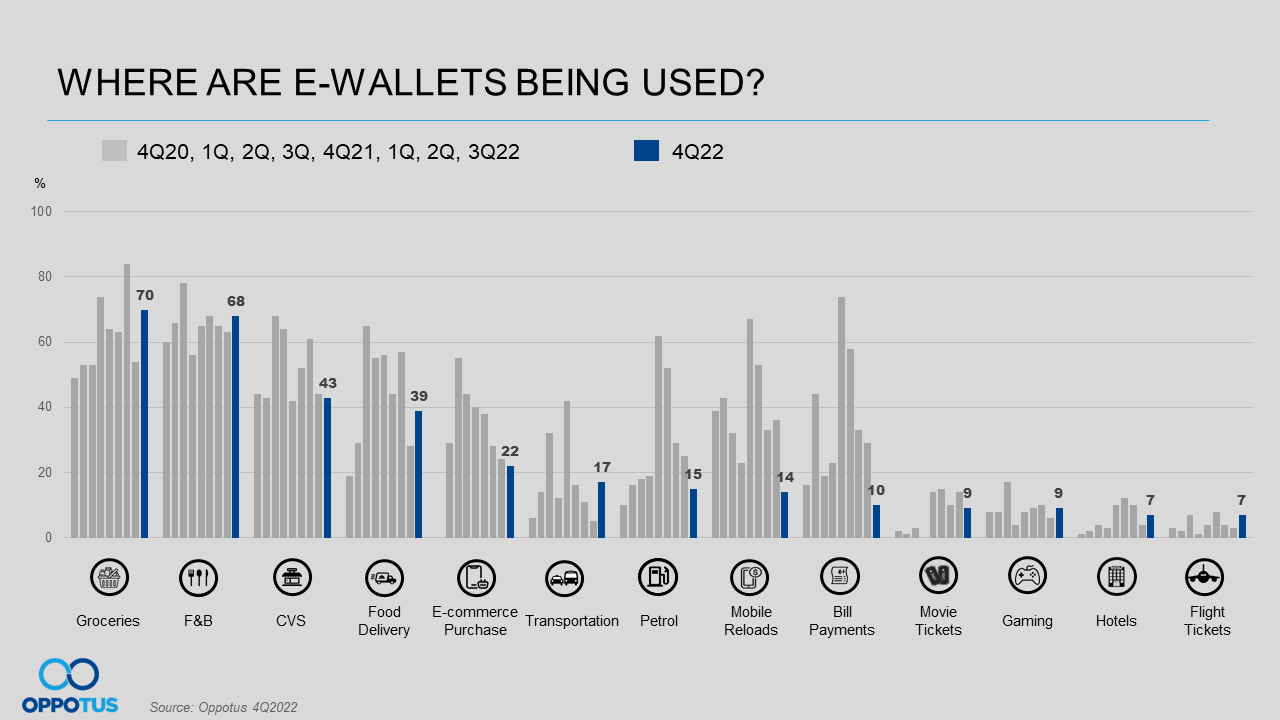

The usage of e-wallets declined in 2022. It is experiencing a drop of 23% from 1Q’2022 (68%) to 4Q’2022 (45%). With Malaysians being able to shop physically now, Cash and Debit Cards have become the preferred payment methods used when making transactions. However, the average e-wallet spending remained steady this year (RM268.47/month)compared to 2021 (RM262.99). Ever since 2020, Touch ‘n Go e-wallet has been the top choice among other e-wallet players. Even so, they are still expanding their services by collaborating with other companies. Besides, the top 3 channels where e-wallets are being used are Groceries, Food & Beverages (F&B), and Convenient Stores (CVS).

If you like to dig deeper into the numbers, please do reach out to us on theteam@oppotus.com

With the year of 2022 being deemed during the Post COVID-19 period, our MYCI also has been consistently on an uptrend since the beginning of 1Q’2022. And, it is recorded at an all-time high in 3Q’2022 (at 120-point mark) since the pandemic hit our ground. Despite the positive vibes, our MYCI recorded a slight decline in 4Q’2022. This could be due to the cost of living continuing to soar, coupled with the uncertainties towards the recently formed Malaysia government following GE-15. Not only that, news about the looming of new COVID-19 variants have somehow dampened Malaysians’ sentiments a little. But all-in-all, our MYCI is still at a good place to end the year at 115-point mark this quarter.

Malaysians’ perception towards their Current Financial Well-Being is having a downward trend this year. With the continuous rising in the cost of living in town, our financial well-being is almost at the level of hitting an all-time low (since 2019), especially the lower M40 group. The drop of MYCI in 4Q’2022 is mainly contributed by this too. However, our Prime Minister (PM) assured that the rising cost of living will be given priority by his unity government to alleviate the burden being shouldered by the people.

Consequently, the effect is spilled over the Outlook Of Financial Well-Being In The 12 Months. The index is now at the 122-point mark this quarter, also seen to hit an almost all-time low (with lowest mark at 120 it is still a very optimistic level – just not as high as before). Consumers are skeptical about their financial well-being in the near future. All income levels are experiencing a downtrend.

Inline with the decline in confidence towards the state of financial well-being, Malaysians’ Spend On Major Purchases index also recorded a drop (more so among the lower M40). Nevertheless, the index is still at its peak state. As the recent year end e-commerce sales could have contributed to the yet strong index as Malaysians, while holding back on purchase goods given the various monetary rewards, promotions, sales, etc, associated with e-commerce platforms.

A year ago, Malaysians’ sentiments towards the Current State of Economy hit the lowest point at 58-point mark (4Q’2021). Fortunately, it has been on a consistent upward trend throughout 2022 after the contractions seen during COVID-19. People regained their confidence consistently towards Malaysia’s economy quarterly. Malaysians’ confidence was boosted even further after the GE-15 ended with a new PM in November 2022. Our Ringgit value surged Malaysians’ sentiments and it is hitting an all-time high of 116-point mark.

Besides Malaysia’s current stage of economy, Malaysians are also confident with the Economy In The Next 12-Months. The index is gradually moving upwards (while hovering at 90+ points mark since 3Q’2022). With the index hitting 99-point mark this quarter, shows that Malaysians are feeling much more confident after receiving the positive vibes following GE-15. The upside strength seen for ringgit and the stock markets. It shows Malaysians’ increased confidence in the current government. People from different income levels and locations are mostly satisfied with Malaysia’s future economy.

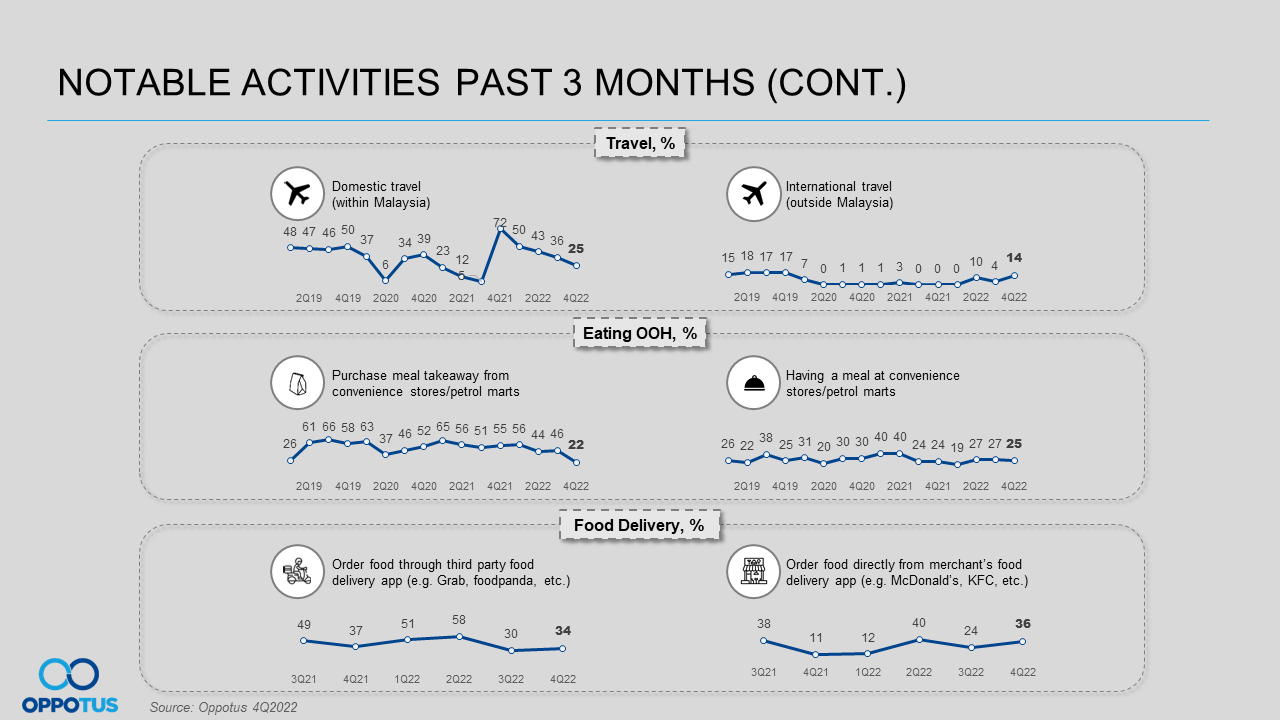

It is the last quarter of 2022, the holiday season for students and employees trying to clear their annual leaves before December ends. Traveling is one of the favourite activities people prefer most at year-end. Instead of only able to travel domestically, Malaysians are finally able to travel internationally after years of movement restrictions. They can now enjoy a little recharge before stepping in into 2023. Those who opt not to travel during this holiday season, Malaysians opt for house gathering or stay in amongst family therefore the rate of people ordering takeout increases too. Due to fewer road trips in town, people are purchasing / having lesser meals from / at convenience stores or petrol marts.

Besides that, shopping festivals are all over the Q4’2022. Big shopping events like 10.10, 11.11, and 12.12 are the good timings for Malaysians who wish to purchase with a very good deal. However, the rate of online shopping doesn’t grow because of that. The reason is that shopping sales are not limited to online platforms only. Physical shops are joining the game as well. As a consequence of that, usage of e-wallet recorded a dip.

Malaysians’ E-Wallet Usage continues to decline to 45% this quarter for the past three months (drop to PreCOVID-19 (2019) level). Despite the decline in usage, e-wallet spending on average remained steady year-on-year (at about RM265 per month). As mask-wearing is no longer mandatory, and movement control restrictions long gone, Malaysians are able to shop physically now. Therefore, Cash and Debit Cards have become the preferred methods used by Malaysians when making transactions. Consequently, the frequency of using e-wallet reduced. Meanwhile, e-wallet and QR Pay payment modes have similar share of usage – which could potentially impact the usage of e-wallet trend as well.

Unsurprisingly, Touch ‘n Go e-wallet remains as the leader among the other players. Touch ‘n Go e-wallet announced the expansion of its cross-border payment capabilities to China. Not only that, payments company Euronet has entered a strategic collaboration with TnG Digital to expand the use of its Touch ‘n Go e-wallet as well. While Maybank QRPay continue to strengthen their strategy and is now #2. GrabPay and CIMB QR Pay also recorded a spike in usage. Usage of major players such as Boost, Shopee Pay, BigPay recorded a decline. E-wallet users are mainly skew towards young adults between 25-34 years old, and upper M40-T20 group. For Maybank QR Pay & CIMB QR Pay users are skew towards the T20 group; whereas GrabPay and Boost users are skew towards Females.

The arrival of COVID-19 pushes the growth for e-wallet players. E-wallet are now one of the widely accepted payment methods in Malaysia. Usage of e-wallet on Groceries, F&B, Food Delivery and Transportation increased in 4Q’2022. Whereas usage of e-wallet for Mobile Reload and Bill Payment recorded a decline. Even though Malaysians’ intention to continue using e-wallet remained high, it is on a declining trend since 1Q’2022. There is a need for e-wallet players to provide a variety of incentives frequently to keep their consumers and encourage them to use the platform (given now consumers have other payment options to use too).

Malaysians’ intention to use e-wallet continues to grow and consumers are having equal preference for e-wallet & QR Pay. Therefore, it’s essential to have differentiation between these two payment modes. Hence, it is still viable to have these kinds of benefits every now and then to further boost the usage of e-wallet.

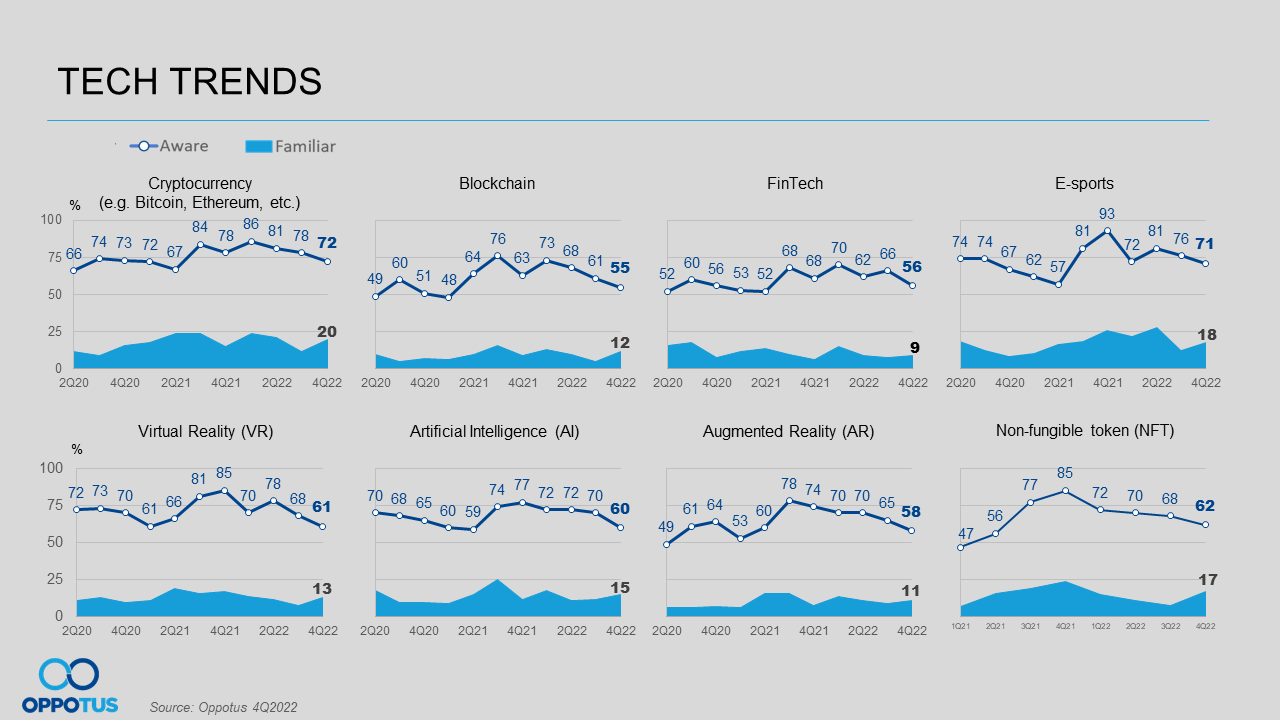

Technology is inevitable in our everyday lives. It has improved the standard of living of the people to a great extent. Furthermore, it has given a new dimension to the development of the country and the world. The Top 3 Tech Trends that Malaysians are interested in are Cryptocurrency (72%), E-sports (71%), and Non-fungible token (NFT) (62%). However, their awareness towards all of the tech trends declined continuously.

There’s one interesting piece of news related to E-sports in Q4. During the tabling of Malaysia’s Budget 2023, the Finance Minister announced that the government will be allocating RM13 million for E-sports Development. That could be due to the inaugural of the Commonwealth Esports Championships, the Malaysian e-sports athletes have major achievements by scoring three gold medals this year.

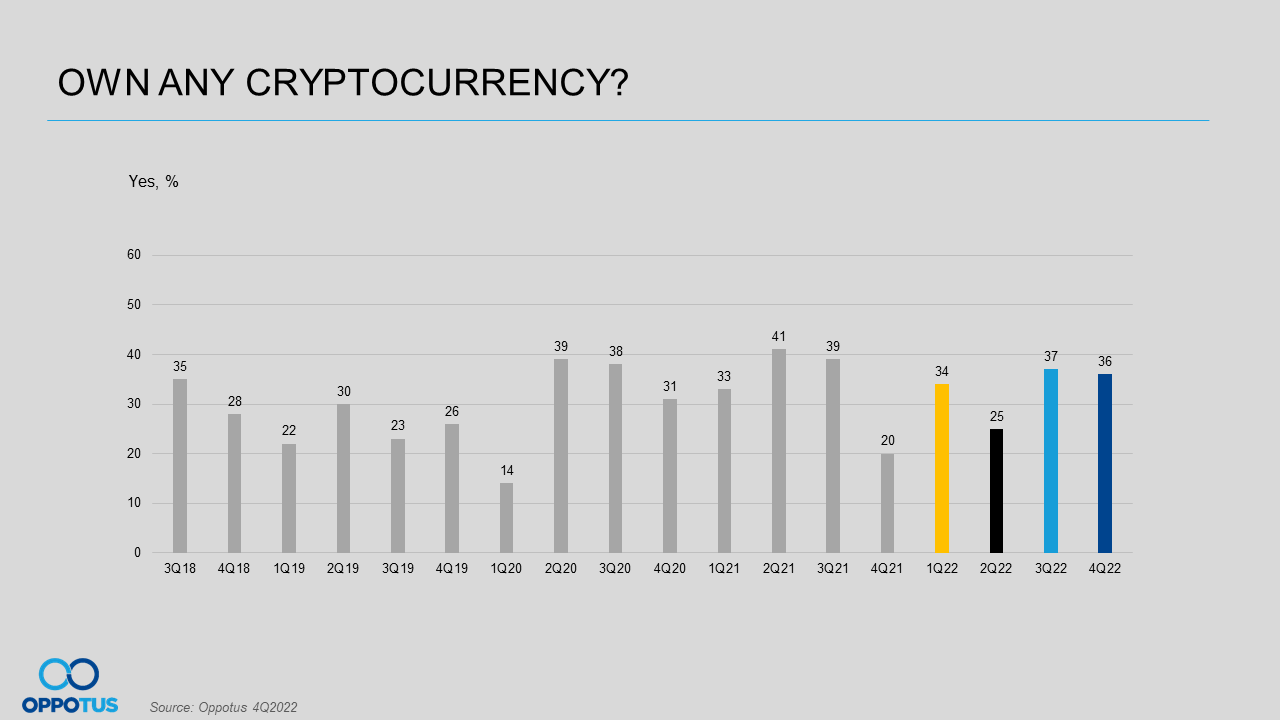

Futures Exchange (FTX), the world’s third largest crypto exchange, crashed and filed for bankruptcy protection on Nov 11 in the United States. However, Malaysia’s Cryptocurrency Ownership still remained stable at 36% in 4Q’2022. That’s because the Securities Commission Malaysia (SC) protected the cryptocurrency investors’ platforms adequately. They are actively keeping an eye on registered operators for any misconduct. Luno has also created a secure and regulated platform for crypto investors and traders. Hence, the collapse of cryptocurrency exchange FTX will not affect Malaysian cryptocurrency investors.

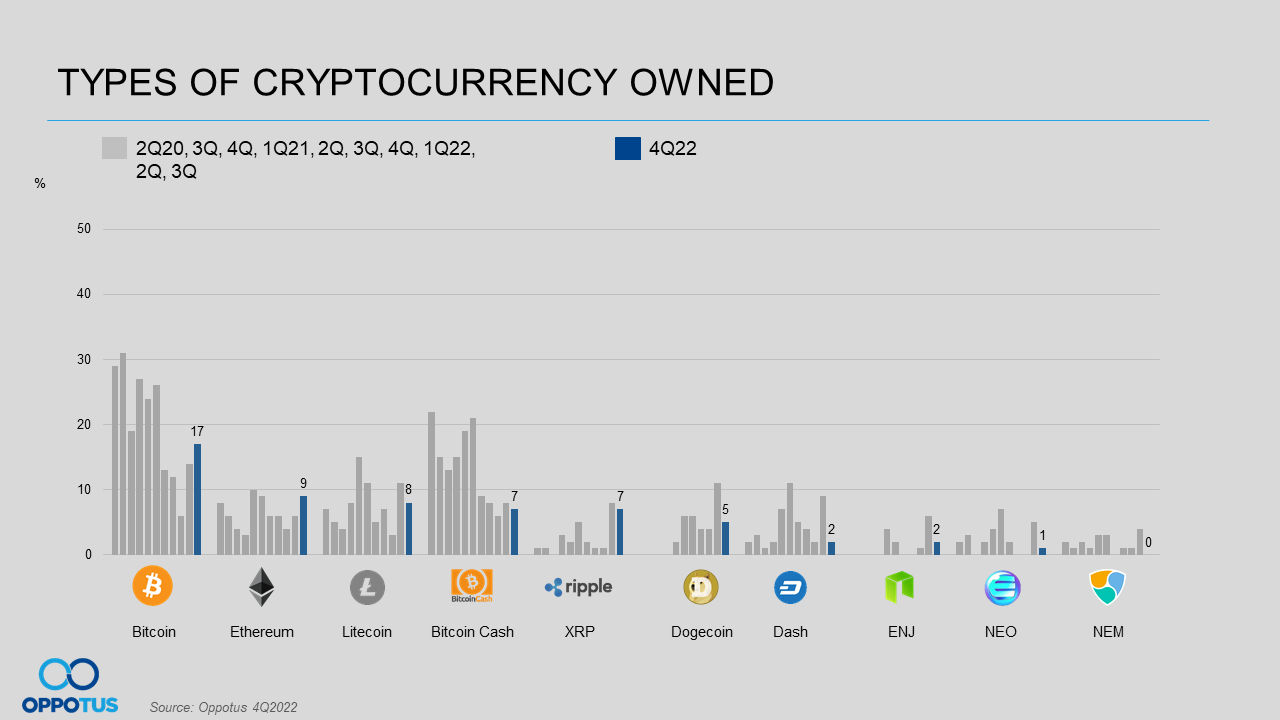

The Ownership of Each Type of Cryptocurrency recorded a decline, except Bitcoin and Ethereum. Malaysians who are Chinese, PMEB, and T20 resonate more with Cryptocurrency. As long as you trade through regulated platforms, investing in cryptocurrencies in Malaysia is safe. Hence, Malaysia is one of the top countries with the most crypto users. Considering Bitcoin is the most established cryptocurrency, it wins the first place for cryptocurrency owned by Malaysians. As for Ethereum, it is the top player in dApps and NFTs. Furthermore, it has the biggest sales volume in the world of NFTs. This is important as these are areas with huge potential for development.

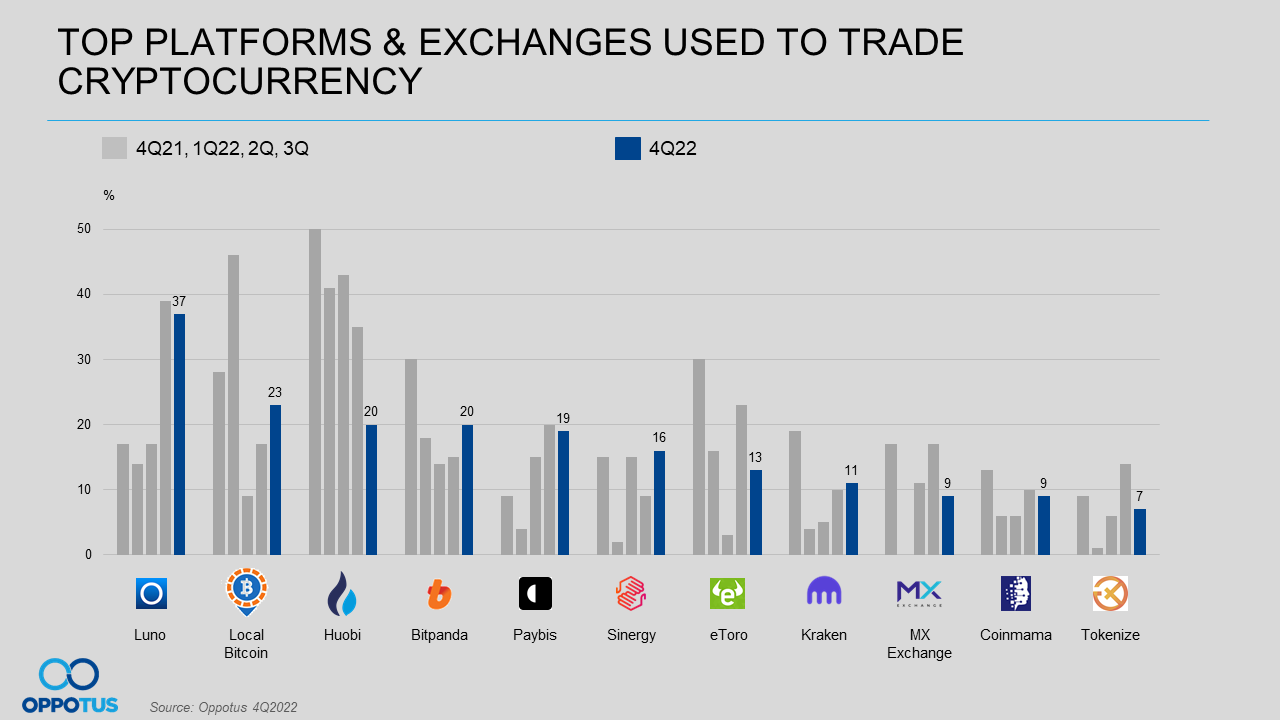

Luno remains the Top Platform & Exchanges Used to Trade Cryptocurrency. To educate Malaysians to strengthen their awareness of digital assets, Luno has launched the “Move with Luno” campaign. Aside from that, it also involves Luno Academy – an educational program that’s conducted online by Luno and guest speakers. This could be the reason why it remains as Malaysians’ most preferred platform. Other than Local Bitcoin, Bitpanda, Sinergy, and Kraken; usage of other platforms recorded a decline. Half of the owners do constantly keep themselves updated with Cryptocurrency information through a variety of channels. The Top 3 channels that they often go for are Word of Mouth (WoM) from friends, Telegram groups, and social media sites.

Note: Malaysians on Malaysia cover opinions of Malaysians aged 18 and above, M40 and T20 segments, in key cities of Peninsula Malaysia representatively.

For a closer look at the data, feel free to contact us at theteam@oppotus.com.