Welcome to Malaysians on Malaysia: our quarterly report on Malaysian consumer confidence. A new year brings us fresh opportunities and possibilities. It signifies a new start for us. With businesses allowed to operate in full capacity and reopening of international borders, our MYCI index and overall consumer confidence strengthen. Read on to see essential insights into consumer confidence, behaviour, e-wallet, tech, crypto and esports trends in Malaysia.

As we continue to go through the COVID-19 pandemic as a nation, our Malaysians on Malaysia study gives us a glimpse of the trends and sentiments during this period – this time focusing on how consumer confidence improved after the relaxation of movement restrictions and the reopening of international borders. Our previous coverage on Malaysian consumer confidence for 4Q’2021 can be found here.

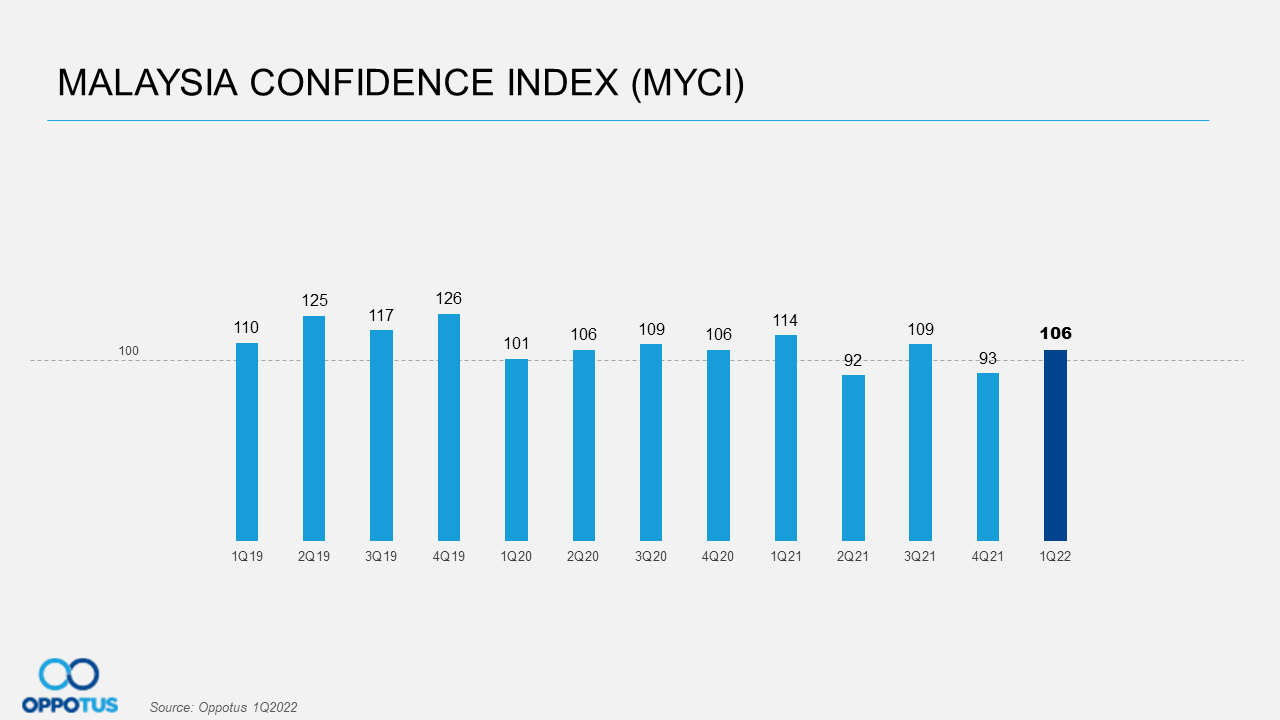

MYCI Improved As Borders Will Be Open Soon & Businesses Operating At Full Capacity

Malaysians are feeling optimistic as our consumer confidence is now at 106-points! Announcements of reopening international borders, businesses being able to operate at full capacity, and the increasing rate of booster shots helped. These positive sentiments have indeed uplifted Malaysians’ confidence and vibes. Hence, our Malaysia Confidence Index (MYCI) regains to the above 100-points mark (106-points vs 93-points in 4Q’21). Not only that, all our MYCI components recorded an uplift as well.

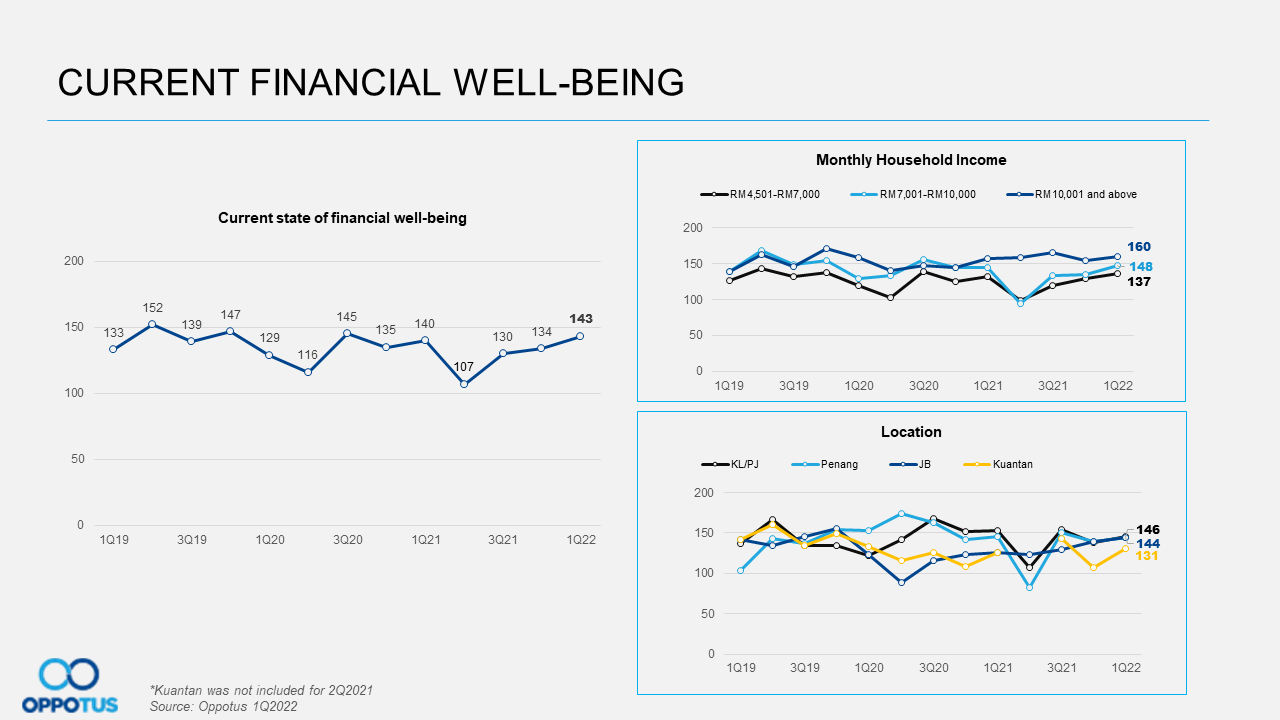

Malaysians Are More Optimistic With Their Own Financial Well-Being, But Remain Subdued Towards The Economy

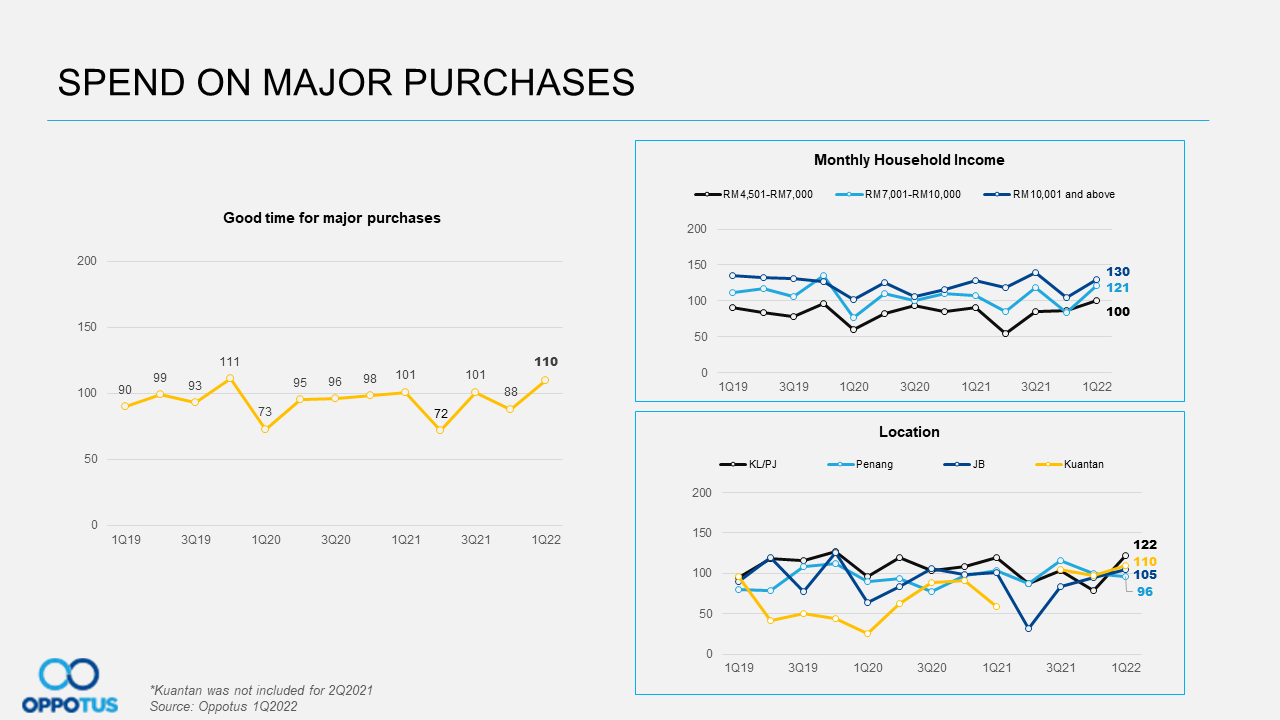

Finally, things are slowly getting back to normal in 1Q’2022. Seeing that businesses have continued full operations as before, Malaysians remain hopeful and optimistic with their own financial well-being. We see that Malaysians are starting to feel more comfortable with making major purchases too; which also coincides with e-commerce platforms’ major 4.4 sales.

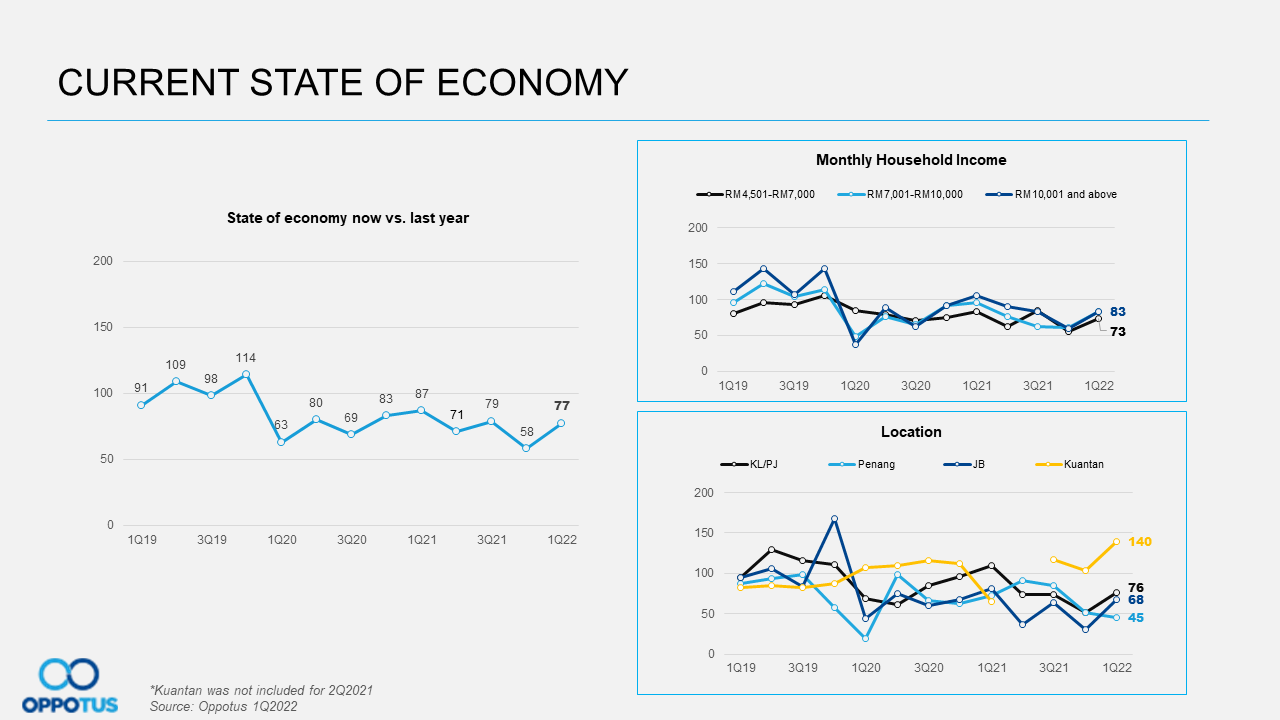

Even though there are no more movement restrictions in the nation, and our economic indices recorded an uptick; Malaysians are still skeptical about the country’s economy. Even though an uplift has seen across the economy indices, the sentiments towards the country’s economy remain weak, where both indices clocking in below the 100-points mark.

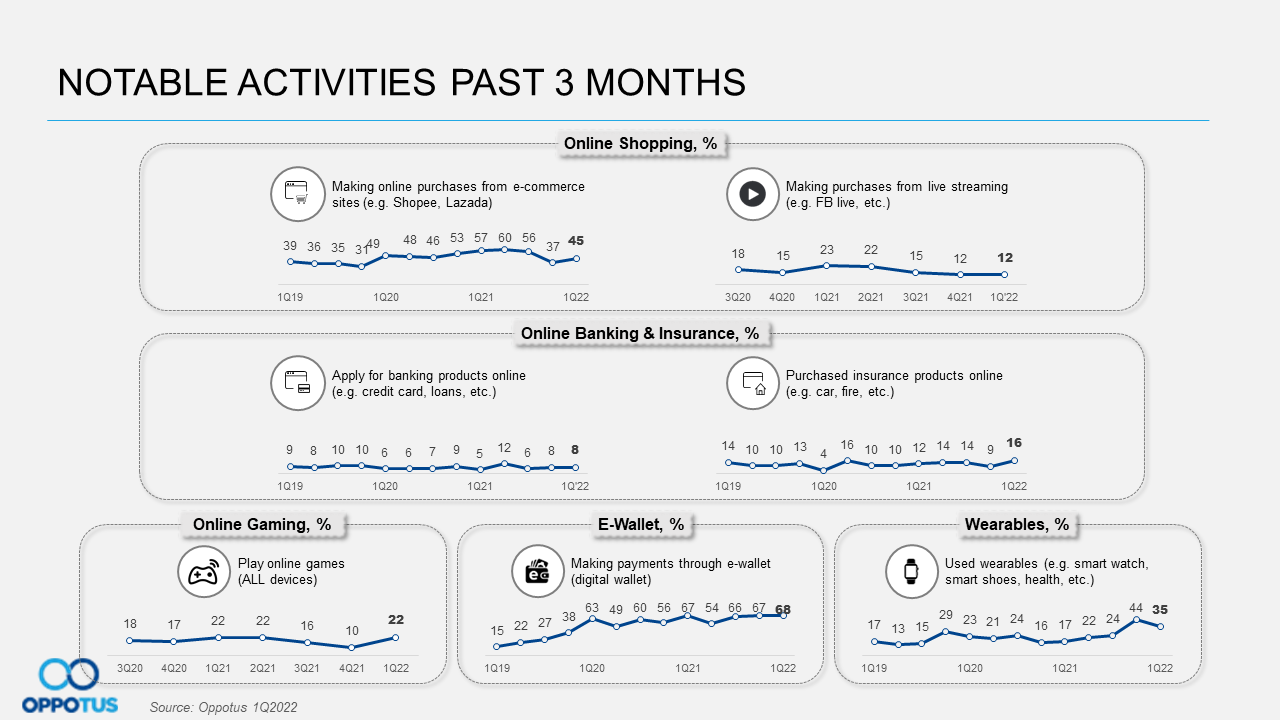

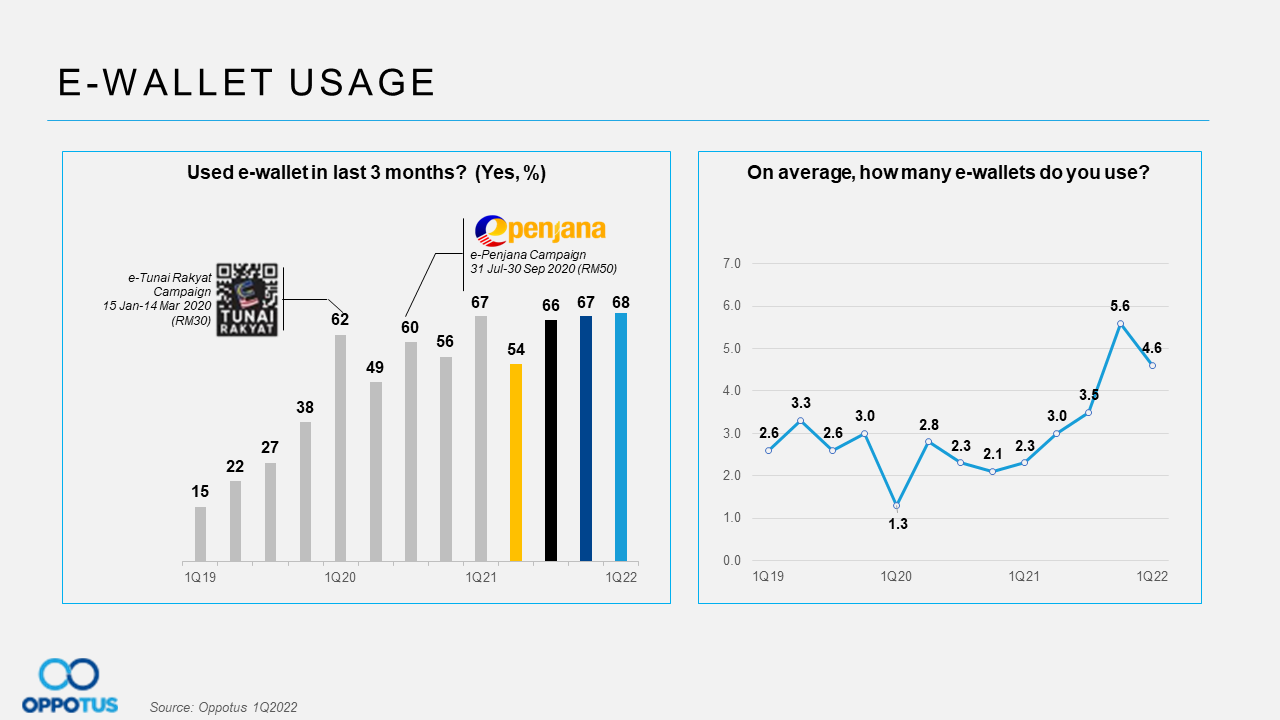

Average Number Of E-wallets Used Decline, But Is Still One Of The Highest Levels Since 2018

E-wallet usage remain stable since 3Q’2021, and is recorded at 68% this quarter. Averagely, Malaysians spend around RM172.76 each month through their e-wallets. However, the average number of e-wallets used has dropped from 5-6 to 4-5 e-wallets per user. This could be the result of many major promotional activities that have ended in 4Q’2021. However, this number is still one of the highest recorded since 2018.

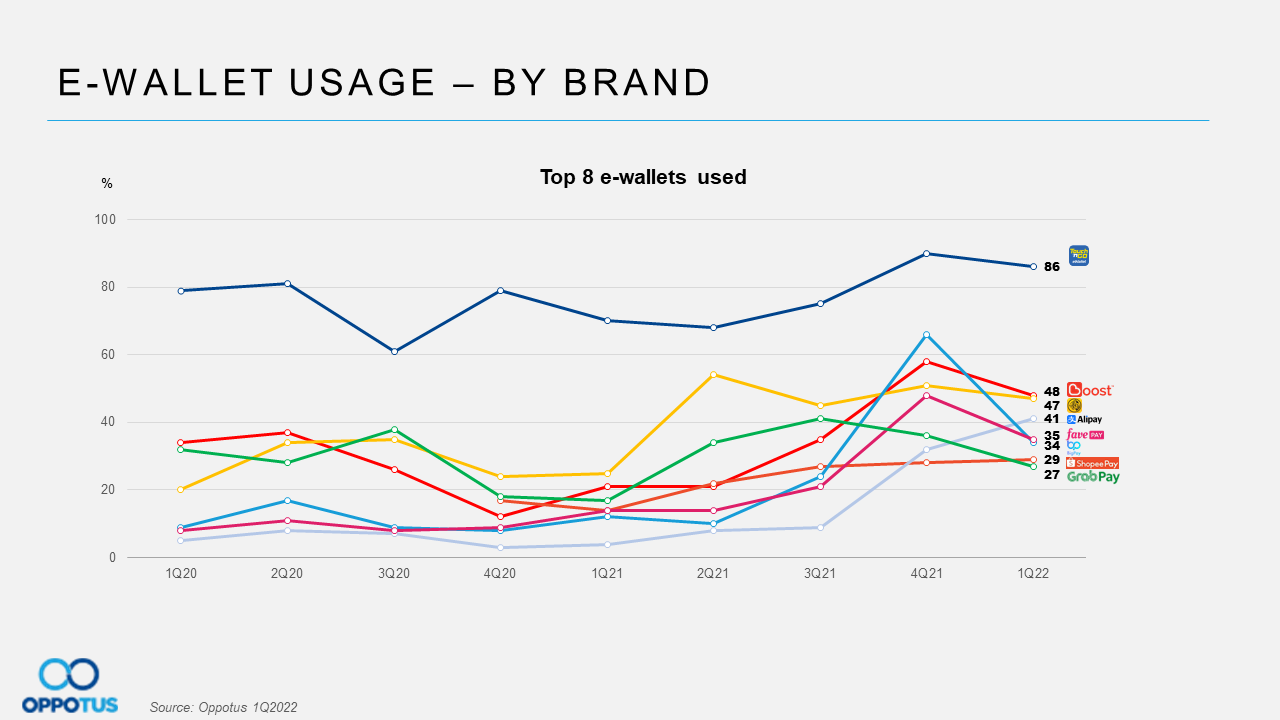

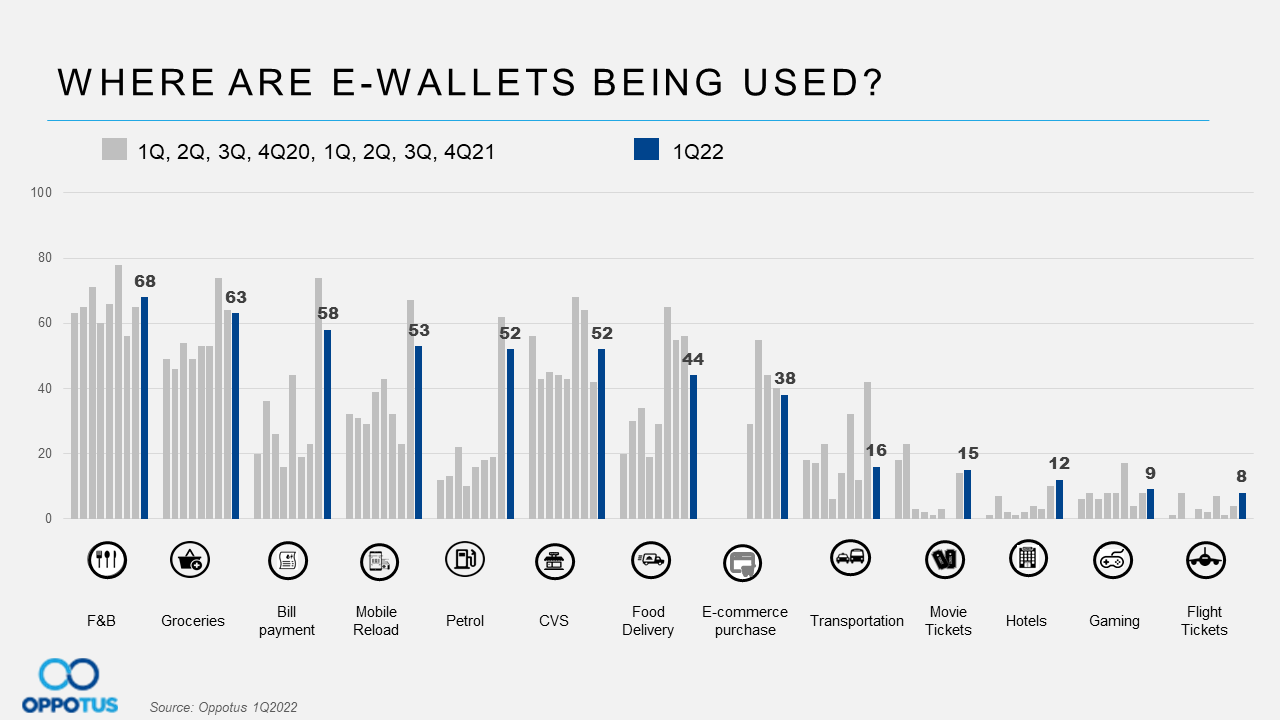

Predictability, Touch ‘n Go is still the leader among the players. Aside from ShopeePay and Alipay, other e-wallets have taken a dip in 1Q’2022. As Malaysians are gradually adapting to digital payments, e-wallets continue to be widely used, especially at F&B outlets, Groceries, Bill Payments, and so on.

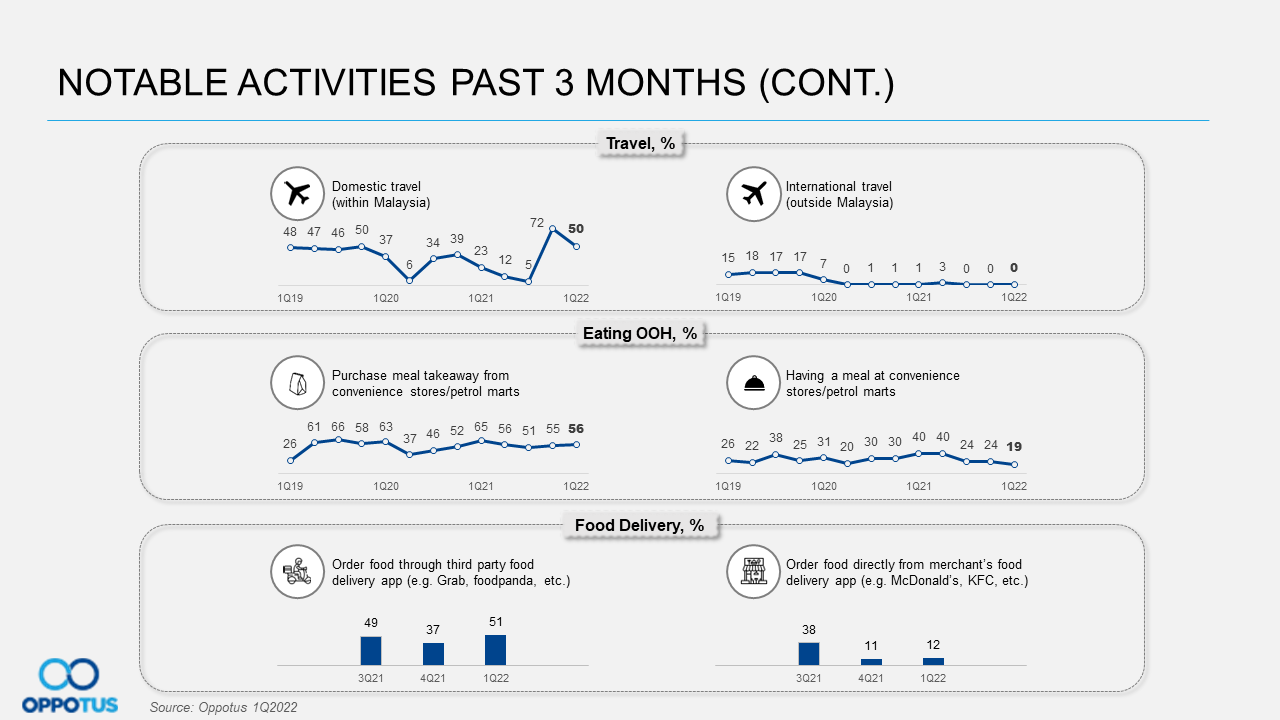

Outlook of Domestic Travel Remain Positive

As the 2021’s holiday season comes to an end, the majority of Malaysians have to return to work and school. Consequently, domestic travel incidence has come down somewhat. Having said that, we see that the domestic travel industry in Malaysia is moving towards a positive direction, with the ease of restrictions coupled and the nation’s growing vaccination rates.

If you like to dig deeper into the numbers, please do reach out to us on theteam@oppotus.com

We kick-start the first quarter of 2022 with our MYCI regains to be above the 100-point mark again! With the government announcing the reopening of the international borders and businesses allowed to operate in full capacity (come April 2022), our 1Q’2022 (106-points) MYCI sees a rebound from Q4’2021 (93-points). Even though Malaysia is in the midst of a wave of Omicron (the new variant), Malaysians are still feeling optimistic as the majority of them have received their Covid-19 booster dose. Hence, Covid-19 patients who are affected by the Omicron variant might be having milder or no symptoms.

Currently, businesses across all sectors allowed to operate fully, and people can get back to work again. Therefore, Malaysians continue to be optimistic about their current state of financial well-being. Seeing that the index has been continuously recorded an uptrend since after FMCO. An increasing uptrend has seen across various income groups and locations. It looks like Malaysians are living to the spirit of Malaysia Boleh. We stay put and stay confident throughout the COVID-19 pandemic period, notably the lower MHI group (considering them being hit the hardest during FMCO).

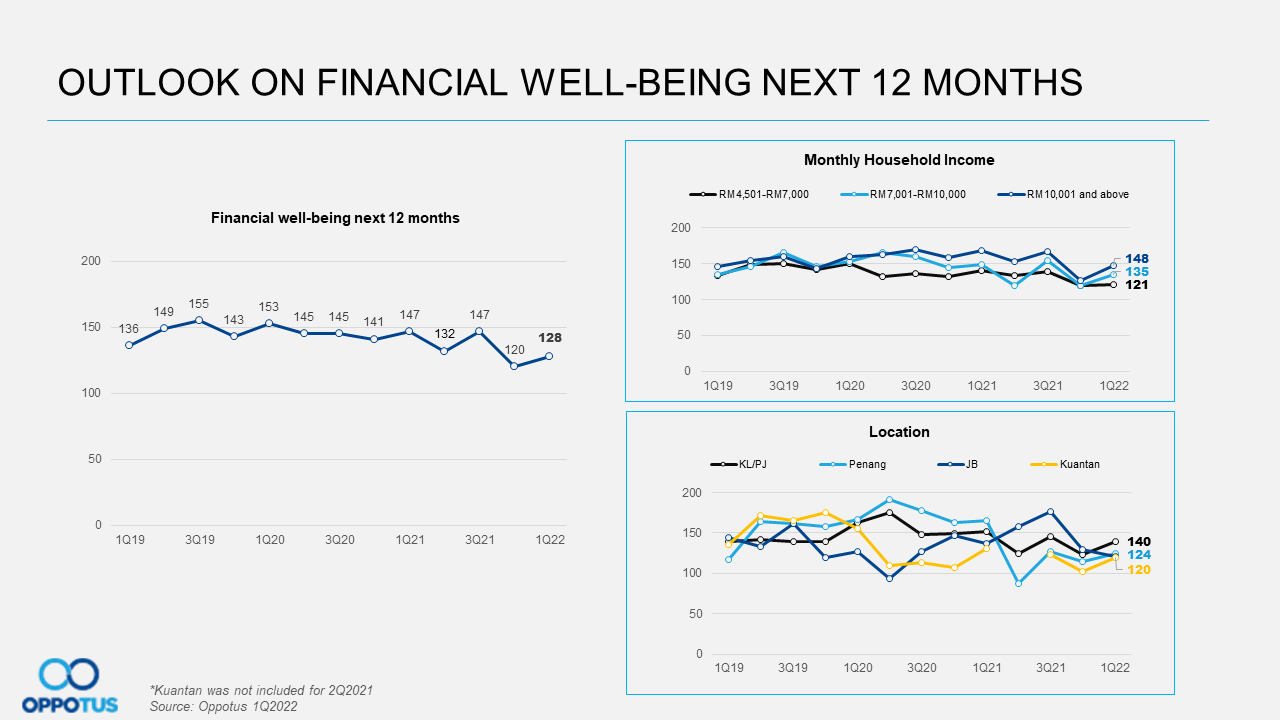

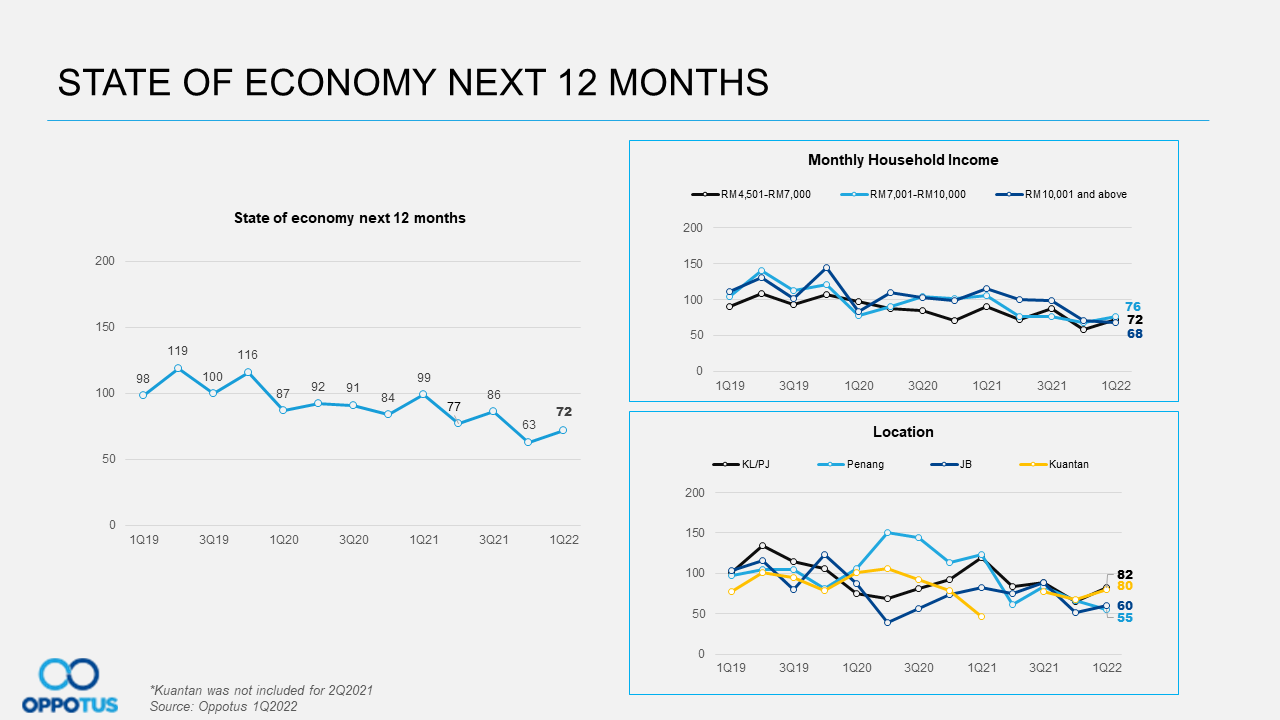

On the whole, the current conditions do affect Malaysians’ sentiments when looking forwards to their financial well-being in the near future too. This positive vibe will continue in the near future. The uptick in confidence signifies an increased positivity of their financial well-being in the next 12 months as well. Optimism has seen across all income groups and locations.

Malaysians are now finally willing to spend more on major purchases! With a positive outlook on financial well-being, Malaysians across all income levels are seeing now as the time and are ready to make major purchases. At 110-points, the index is at its 2nd highest point since its highest point at 111 back in 4Q’2019 (just right before the COVID-19 pandemic hit our country). Furthermore, with the major 4.4 e-commerce sales around the corner, it helped on boosting the performance of this index as well.

Malaysians’ confidence towards the economy recorded a lift of +19 points in 1Q’2022. Whereas, they are becoming more confident about their financial well-being this quarter. However, the sentiments remain weak as it is still below the 100-points mark. The recent announcement on the international borders opening and businesses able to operate in full capacity (April) has indeed lifted the spirits of Malaysians where we are no longer being imposed to any travel or movement restrictions.

Despite this, Malaysians remain skeptical about the country’s economy. Our current unrest political environment and talks about the upcoming GE-15 could be the reasons why Malaysians are feeling doubtful about the economy.

As for sentiments towards the Malaysian economy in the near future, this trend seem to continue in the next 12 months. As things will be fully back to normal and with our international borders opening soon, we anticipate that the upward trend of our MYCI will continue to soar while COVID-19 is here to stay for a little while more. We can hope that the continued easing of Government movement restrictions, it would continue to help lift the overall confidence in the nation’s economy now and in the future.

Covid-19 has caused numerous changes in the world that impacted the lives of many individuals. The e-commerce industry in Malaysia is expanding consistently with the growing rate of digitization of domestic business. Consequently, Malaysians are getting familiar with online banking and e-wallet. It is easy, safe, and helps consumers on speeding up the transaction process.

Employees return to work and students go back to school as the country is slowly getting back to ‘normal’. Hence, Malaysia’s domestic travel rate recorded a drop this quarter. Besides, people have less time to prepare food at home as employers required all employees to return to work full time. Therefore, more people are having food delivery, taking-away meals, and dining in restaurants.

Flexibility and convenience are some of the reasons people use digital wallets! With technology constantly advancing, the usage of e-wallet remains stable at 68%. And, the Covid-19 pandemic and the enforcement of MCO indeed boosted the adoption of e-wallets. The average number of e-wallets used recorded a dip in 1Q’2022, from 5-6 to 4-5 e-wallets per user. However, it is still one of the higher numbers recorded since 2018. The fluctuations could be due to one of the major players – BigPay. They ended their promotional activities at the end of 4Q’2021. Averagely, Malaysians spend around RM172.76 per month on purchases through their e-wallets.

Although still the clear market leader, Touch ‘n Go e-wallet’s usage seems to be on a slight decline in 1Q’2022. Boost and Maybank QR are neck-to-neck in 2nd position, replacing BigPay (who was No.2 in 4Q’2021 – the reason is probably they have ended their promotional activities in Dec 2021). Not only Touch ‘n Go, other e-wallets sees a usage decline in 1Q’2022; except Alipay and ShopeePay. Usage of ShopeePay is increasing steadily since Q1’2021. It is now ahead of GrabPay (which is showing signs of decline since Q4’21).

With the Bank Negara’s aim to transform Malaysia into a cashless society, this industry doesn’t seem to be slowing down anytime soon. E-wallets are widely used within the market, especially in F&B, Groceries, and Bill Payment. Currently, the government allows businesses from all sectors to operate in full force. Therefore, Malaysians have a better financial situation to spend more on leisure and entertainment activities, such as movie tickets, gaming, hotels, and flight tickets.

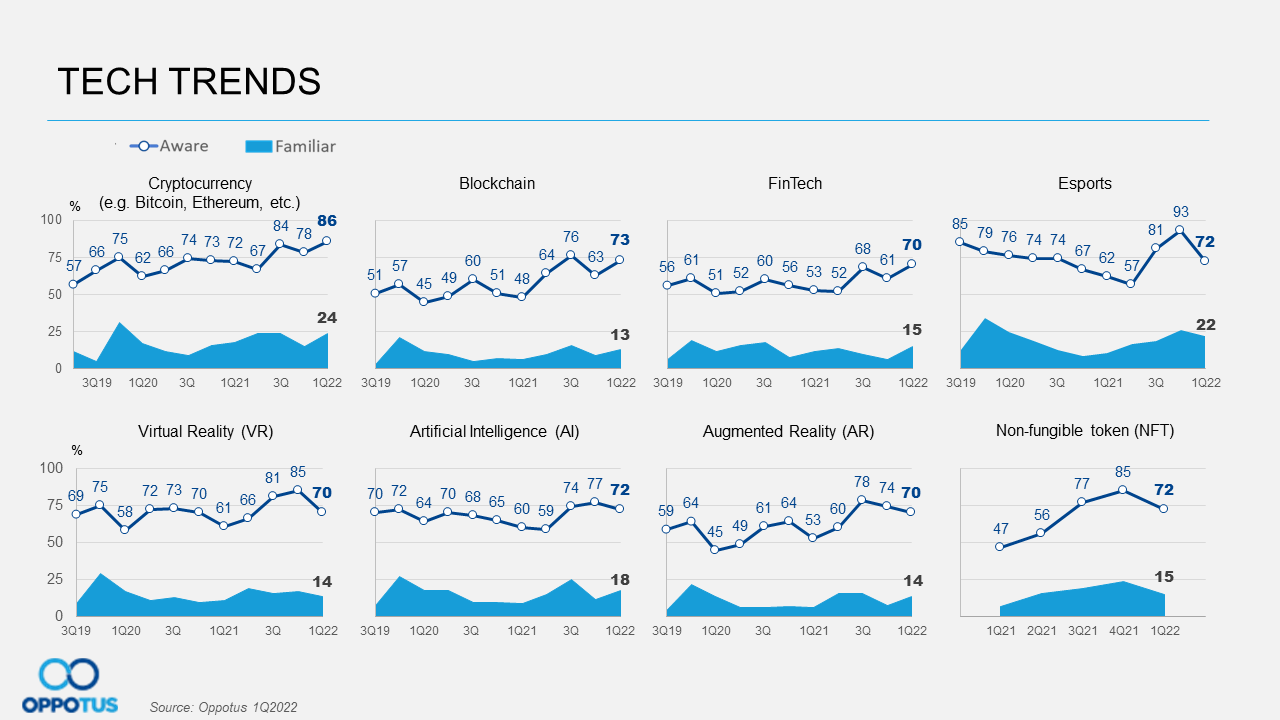

Technology has revolutionized our world and it affects almost every aspect of our life. The top 2 technologies that Malaysians are currently aware of are Cryptocurrency and Blockchain. Malaysians’ awareness towards Cryptocurrency and FinTech have broken their record at 86% and 70% this quarter. Unfortunately, majority of the tech trends are experiencing a drop from their previous peak in the last quarter, which are Esports (-21%), Virtual Reality (VR) (-15%), Artificial Intelligence (AI) (-5%), and Non-fungible token (NFT) (-13%).

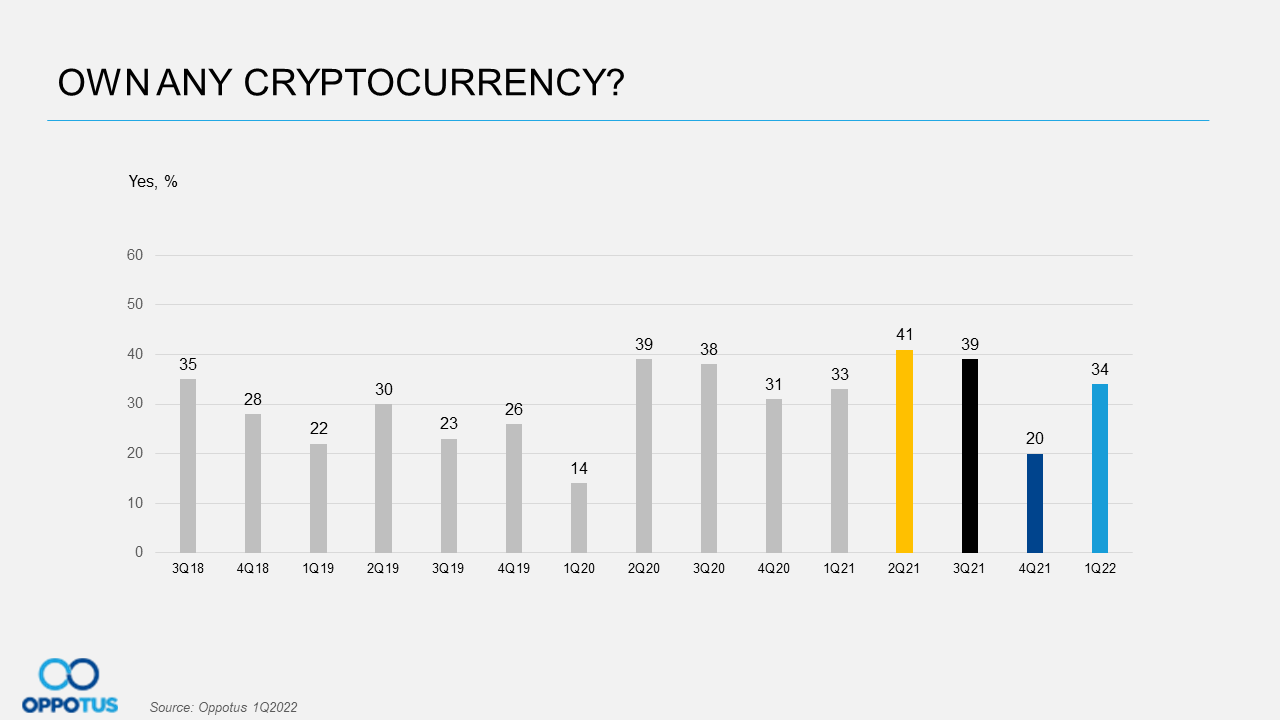

Malaysians’ ownership of the Cryptocurrency market recently went through a roller coaster ride from 39% (3Q’2021) to 20% (4Q’2021). Fortunately, it is making a comeback with 34% this quarter. Thenceforth the People’s Bank of China (PBOC) banned cryptocurrency transactions, which caused Malaysians to lose confidence in holding digital assets. However, situation twisted after the positive predictions from professional experts at the beginning of 2022. Malaysians are feeling optimistic about owning cryptocurrencies now.

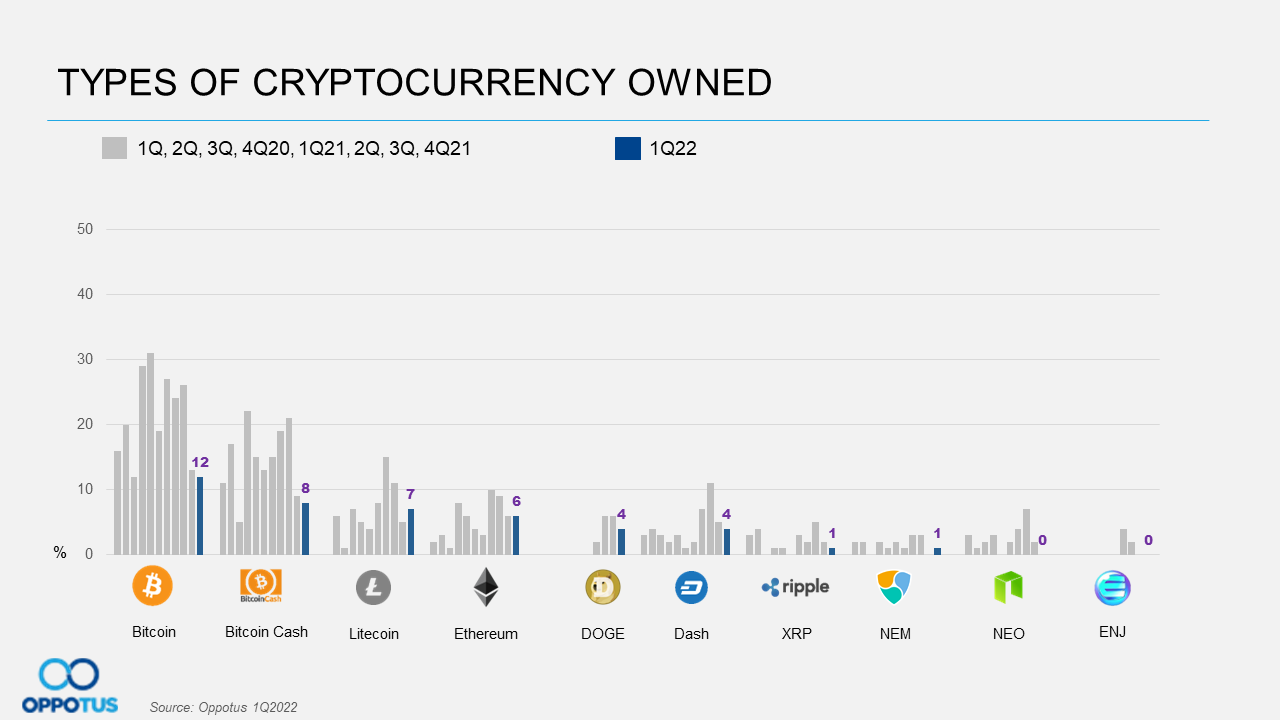

Even though positive predictions were all over the internet, Malaysians’ ownership of Cryptocurrency continues to drop, except for Litecoin and Ethereum. However, the ownership towards Bitcoin (BTC) and Bitcoin Cash remain as the Top 2 cryptocurrencies owned by Malaysians.

Malaysians on Malaysia cover opinions of Malaysians aged 18 and above, M40 and T20 segments, in key cities of Peninsula Malaysia representatively.

For a closer look at the data, feel free to contact us at theteam@oppotus.com.