Welcome to Malaysians on Malaysia: our quarterly report on Malaysian consumer confidence. As Malaysia continue to brave through the various challenges of 2021; unfortunately, Omicron affected Malaysians’ sentiments this quarter which saw our MYCI Index taking a dip. Scroll down to see more insights about Malaysia’s consumer confidence, behaviour, e-wallet, tech, crypto and esports trends.

As we continue to go through the COVID-19 pandemic as a nation, our Malaysians on Malaysia study gives us a glimpse of the trends and sentiments during this period – this time focusing on how the arrival of Omicron affected Malaysians’ sentiments to contract somewhat. Our previous coverage on Malaysian consumer confidence for 3Q’2021 can be found here.

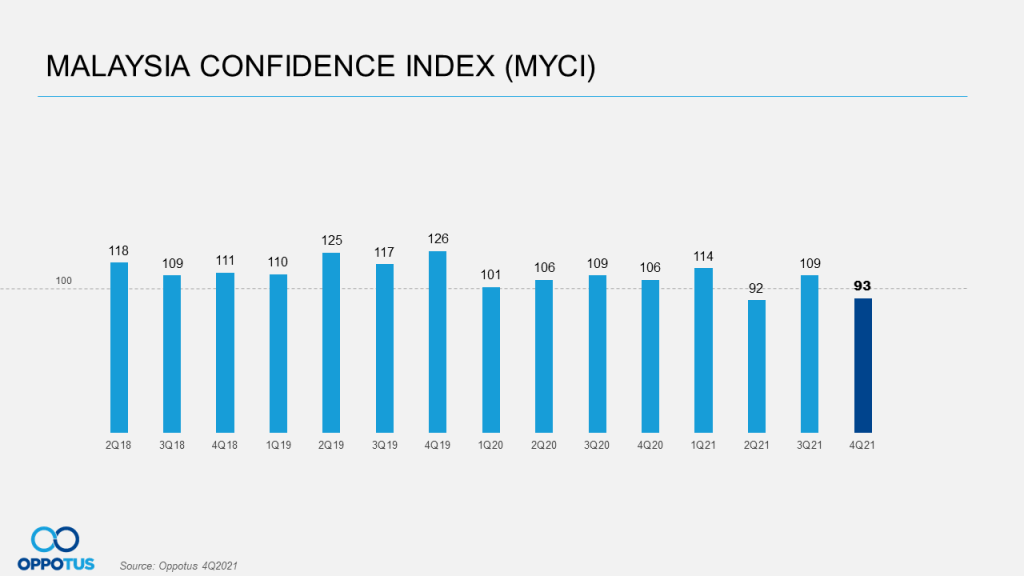

MYCI Decline Due To The Looming Omicron Variant

Just as people start to feel at ease somewhat, dips are recorded across many of our Malaysia Confidence Index (MYCI) components. With the looming of Omicron, our MYCI saw an overall decline from 109 to 93 points. Even though most of the businesses are now back to fully operational, Malaysians’ confidence is dampened after the wide-spread announcement and coverage of Omicron by the local media. Businesses’ productivity have also seen much impact due to large number of cases in the country, brought about by the necessary quarantines imposed on Covid positive patients and ‘close contacts’.

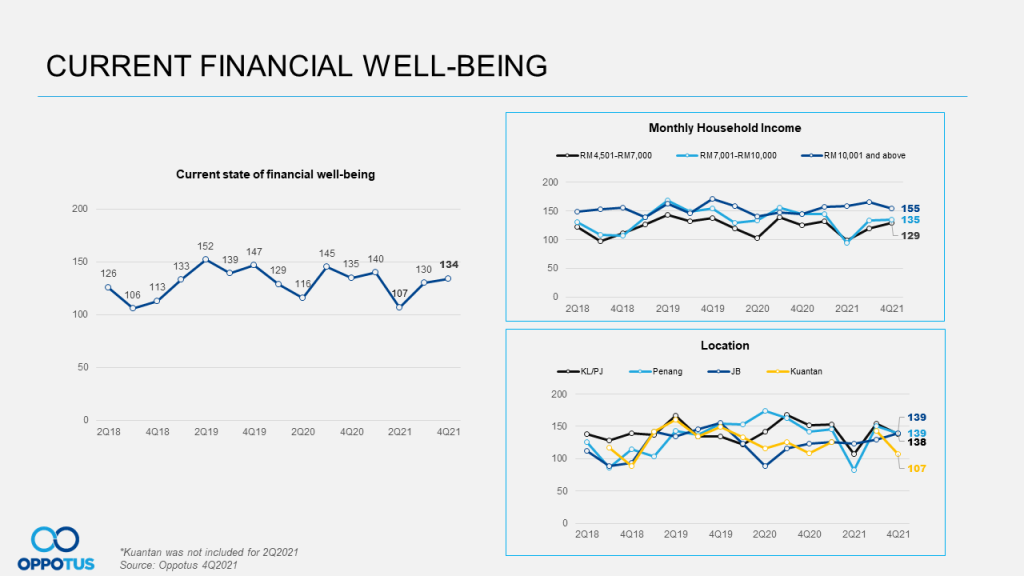

Malaysians Bleak On Financial Well-Being And Remain Subdued Towards The State of The Economy

In 4Q’21, businesses have regain operating as normal and the Country have begun implementing COVID-19 booster shots too. However, the news around the looming of Omicron variant is seen to take a toll on Malaysian’s confidence this quarter, especially in the case of perception of their own financial well-being. At the same time, there are news coverage about the effect of rising cost of living, major floods and damages occurring in certain areas in Malaysia too.

All in all, Malaysians are still less positive about the Malaysian economy in general, and are also holding back on major purchases for the time being. With that, our MYCI economy indices also see contractions and is at its all-time low in 4Q’21.

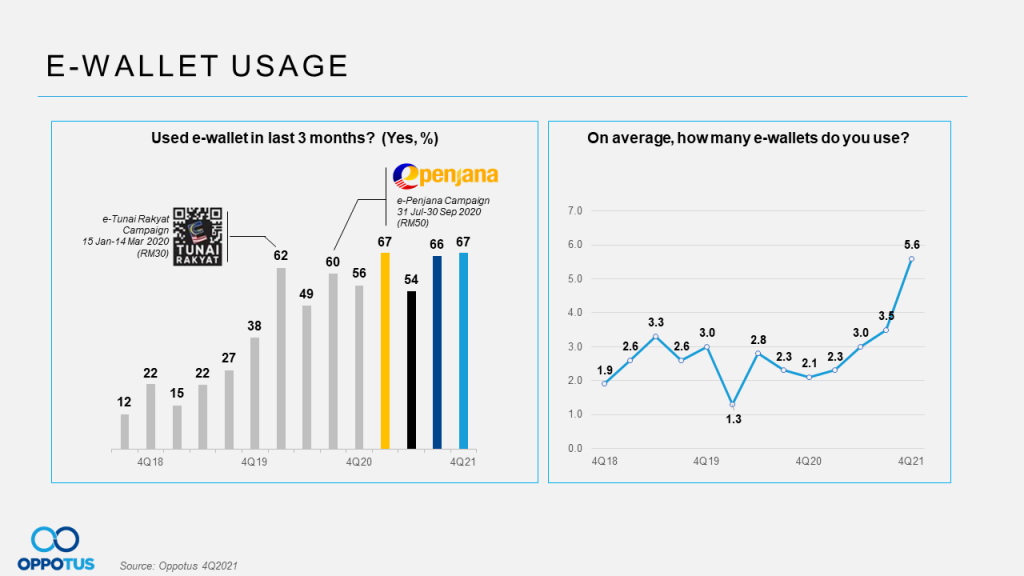

E-wallets Multiple Brand Usage Increases

In Q4,21, Malaysians are now seen to be using more different e-wallets than before averagely this quarter. With so many activities within the e-wallet space, it is no surprise that consumers are opting to try out the different e-wallet services out there so as to enjoy the various perks and benefits offered by the different players.

Spikes Seen In Domestic Travel

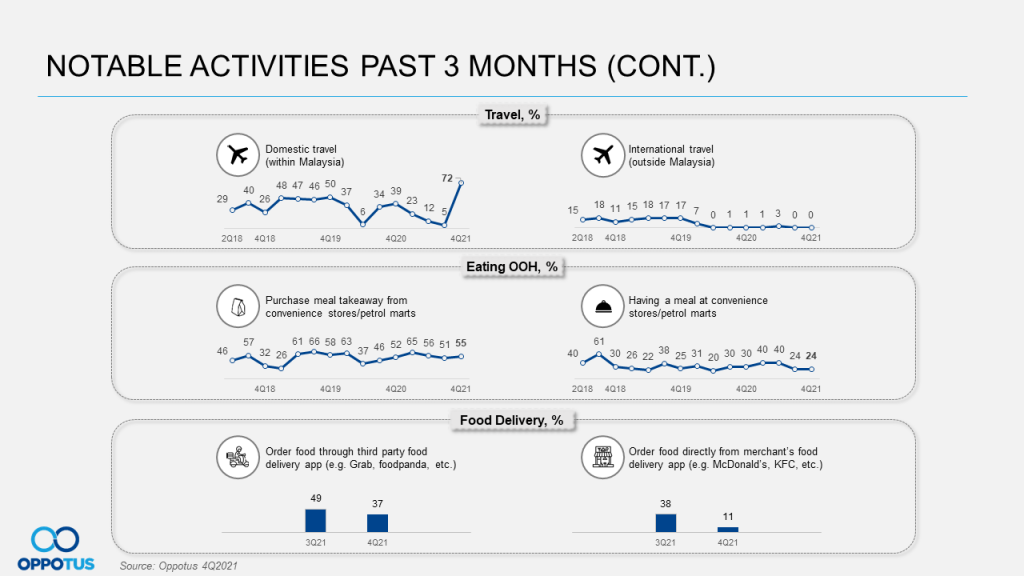

Tourism industry in Malaysia is recovering and getting better this quarter! Despite the fact that Omicron is spreading, we still see a boom in domestic tourism activities towards end 2021. After 2 years of travel restrictions, we see a lot more Malaysians travelling around locally this quarter (72%), vis-à-vis previous quarters: 1Q-3Q’21 (3%). The Langkawi travel bubble pilot program that kicked off on Sept 16 certainly helped to restart the tourism “engine” in Malaysia.

If you like to dig deeper into the numbers, please do reach out to us on theteam@oppotus.com

It’s the last quarter of 2021, good news is that many businesses are now back on track. The bad news is, Malaysians are now faced with a new Covid variant – Omicron. Consequently, the arrival of Omicron is affecting Malaysia’s businesses and productivity with quarantines that infected employees need to be on. After a rebound in 3Q’21, our MYCI show signs of decline again in Q4’21. It has now dipped to 93-pts (below the 100-point mark, again). Besides, the media coverage on the possible effect of Omicron virus coupled with the coverage on the rising cost of living seen to take a toll on consumers’ confidence more on the economy aspects of things.

Our current financial well-being is the only component that looks to be stable in 4Q’21. With many businesses now being allowed to operate as normal and people are allowed to resume work as usual, Malaysians continue to be confident about their current personal financial well-being. Other income groups remain optimistic about their current financial well-being, except the T20 segment.

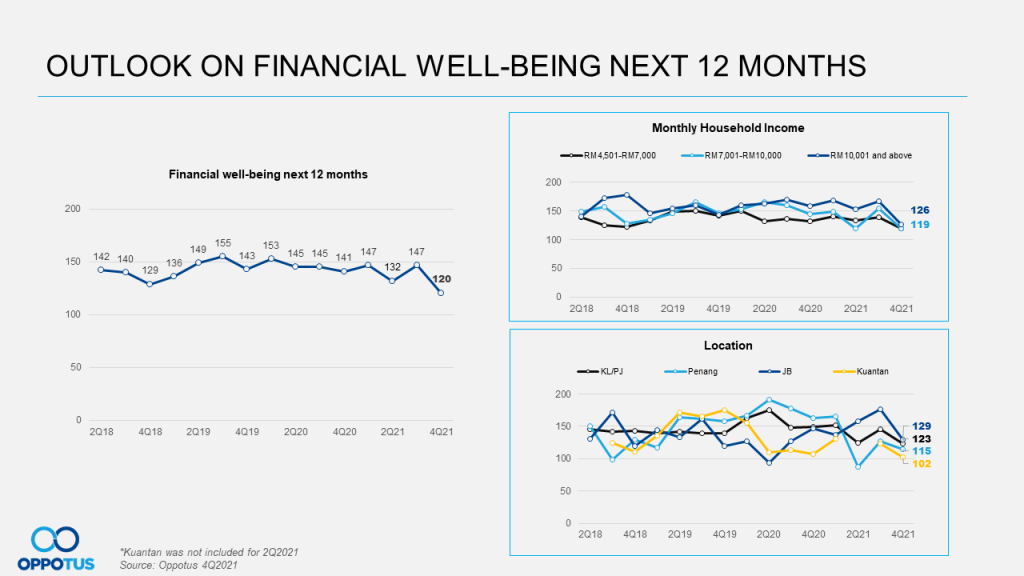

Although Malaysians are feeling positive towards their current financial well-being, but they are not feeling the same towards their financial well-being of next 12 months. With companies cutting back on expenses to sustain the impact of the pandemic and the rising cost of living, consumers are skeptical with their financial well-being in the coming near future. The downtrend is seen across all the income level.

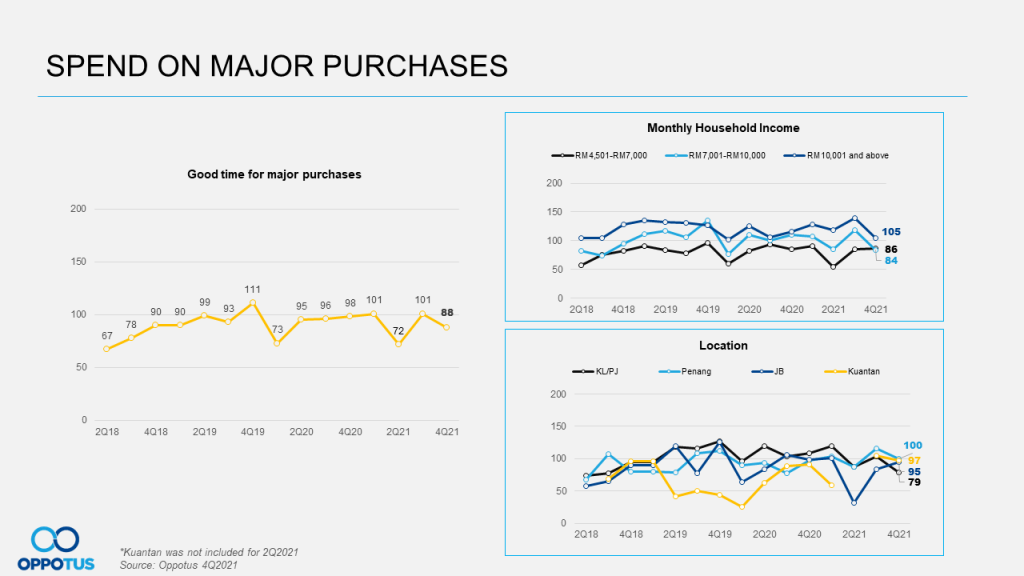

Just as we thought Malaysians will be willing to spend more on major purchases as businesses are allowed to operate in full force; sentiments here instead reverse and we see a decline from 101-pts to 88-pts in the last quarter of 2021! It suggests that Malaysians are still pretty cautious with using their money.

The downtrend on spends on major purchases index is also a reflection of consumers’ skeptism towards their financial well-being the coming year. Similar contraction is also seen across various income groups and locations, except for B40 segment remaining stable.

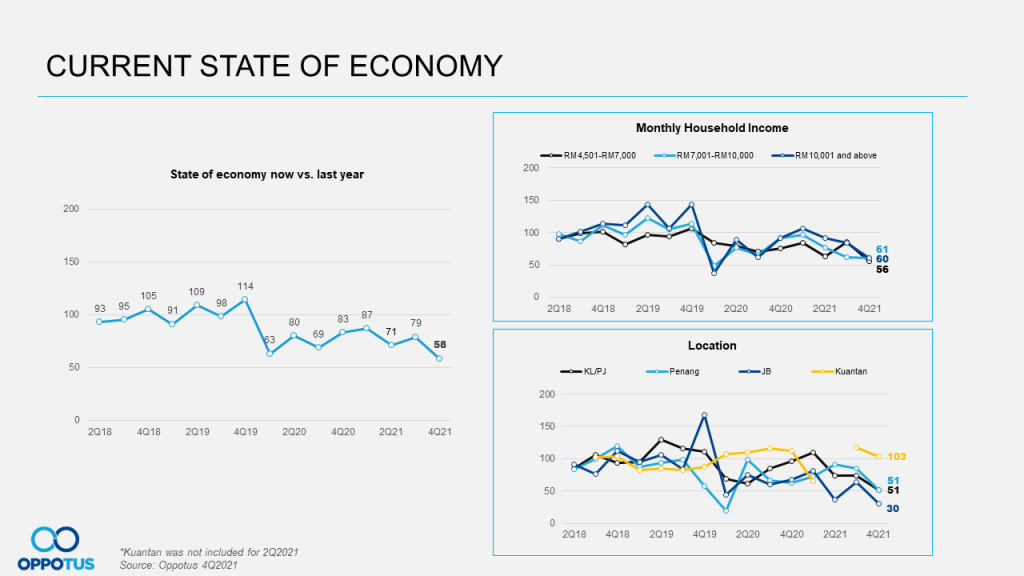

Malaysians’ confidence towards the economy in 3Q’21 did not carry over to this quarter. With the rising cost of living coupled with the looming Omicron, our economy indices are hitting an all-time low at 58-pts. A further drop of 21-pts is recorded for current state of the economy. In terms of income group, T20 and the lower M40 have a more negative outlook towards the economy.

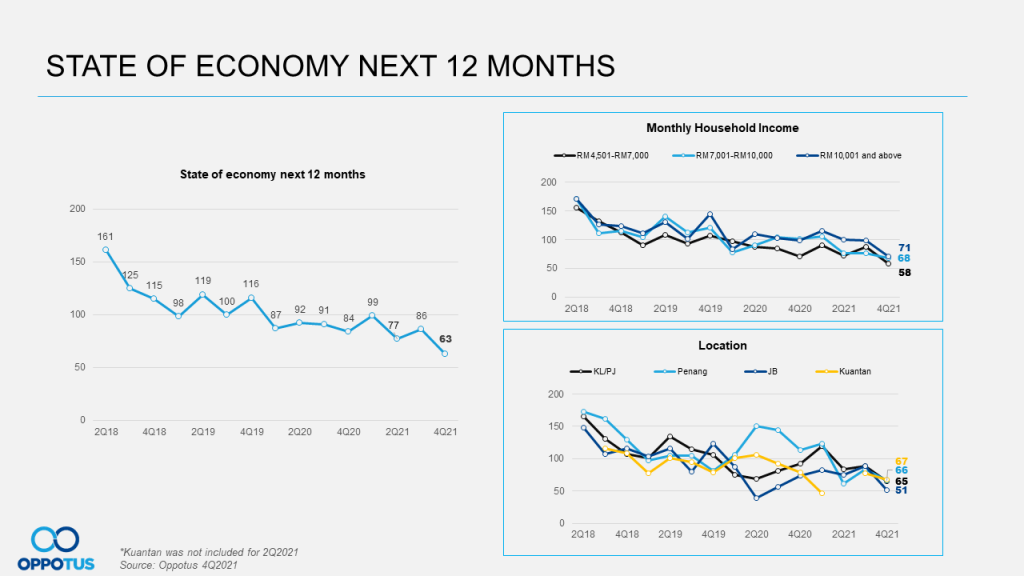

Correspondingly, indicators for the Malaysia economy in the next 12 months continue to see contraction as well. It’s hitting an all-time low at 63-pts too. The index has stayed below the 100-pt mark since 1Q’20, showing that Malaysians believe that our economy might take a longer time to make its full recovery.

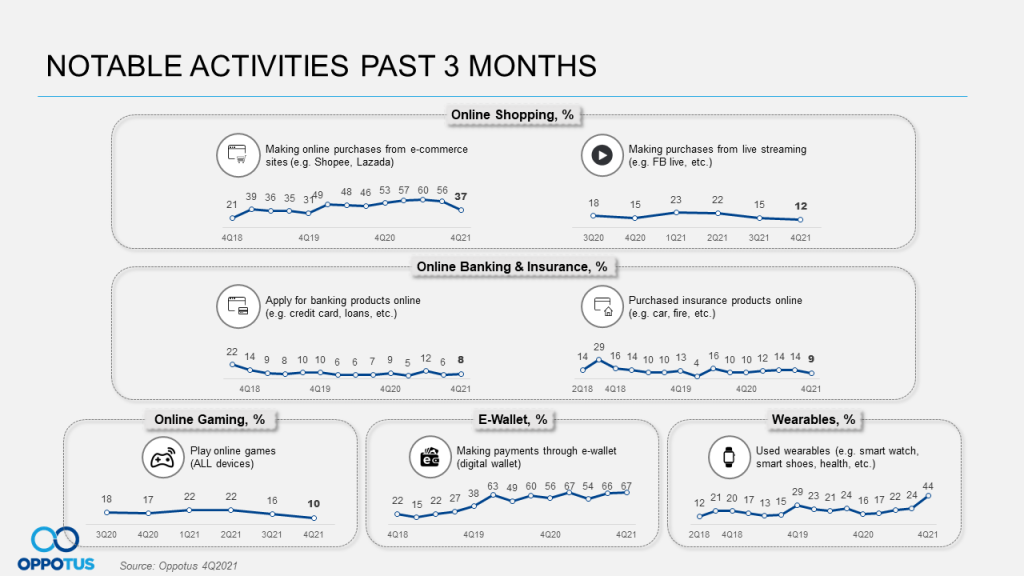

Since movement and dining restrictions lifted in 3Q’21, it appears that people are ordering food delivery less often than before. It remains to be seen whether this trend will continue to fall.

With things more opened up now, and coupled with the end of year holiday season, many Malaysians have been busy travelling across Malaysia domestically for various reasons – reaching an all-time-high at 72%.

E-wallets have been one of the fastest growing payment trends in Malaysia, as well as one of the most watched. The usage remain stable in 4Q’21, with over two-thirds of the adult population now using this payment mode. What’s interesting is we now see a spike in the number of e-wallets each user uses has grown from the usual 2-3 previously, to 5-6 e-wallets this quarter. This is by far the highest average recorded, suggesting that merchants are not only diversifying to accept many different e-wallets, and also many brands have been offering a new wave of promotions and incentives coinciding with the lifting of previous restrictions. Averagely, Malaysians spend around RM260 per month on purchases through their e-wallets.

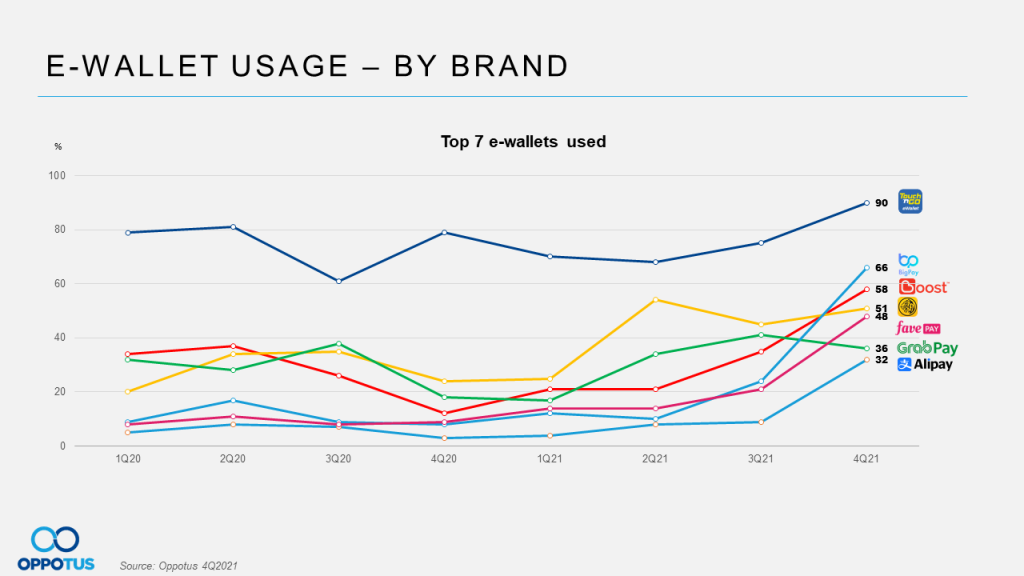

In line with the increase of average e-wallets used per consumer, we see a huge boost in usage across the different e-wallets. As you might expect, Touch ‘n Go is still the market leader among the others. Interestingly, BigPay moved from Top 5 (3Q’21) to Top 2 this quarter! This could be due to its recent spotlight of offering free air tickets and lifestyle vouchers just by making payment. The usage of Maybank QR, Boost, Fave Pay, and Alipay recorded an uplift as well; while GrabPay recorded a slight decline.

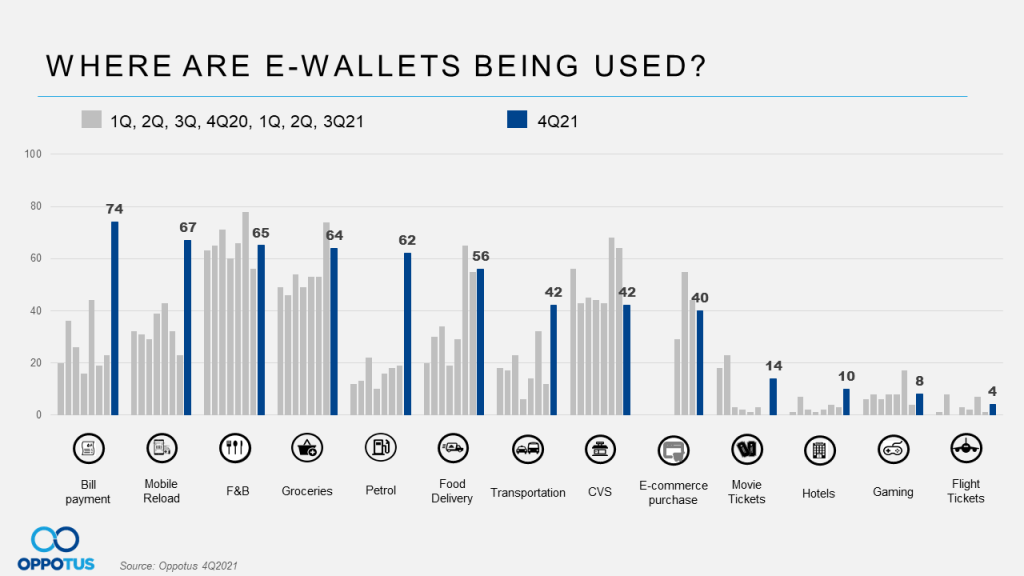

Unquestionably, e-wallets offer convenience for many consumers. With the goal of achieving efficiency, convenience and safety, we see a variety of businesses adopting e-wallet as one of their payment options. A sharp increase in e-wallet usage is seen in 4Q’21 for Bill Payment and has now top the list when it comes to e-wallet usage channels, replacing Groceries. Other than Bill Payment, channels like Mobile Reload, Petrol, Transportation, Movie Tickets and Hotels are recording an all-time-high this round too!

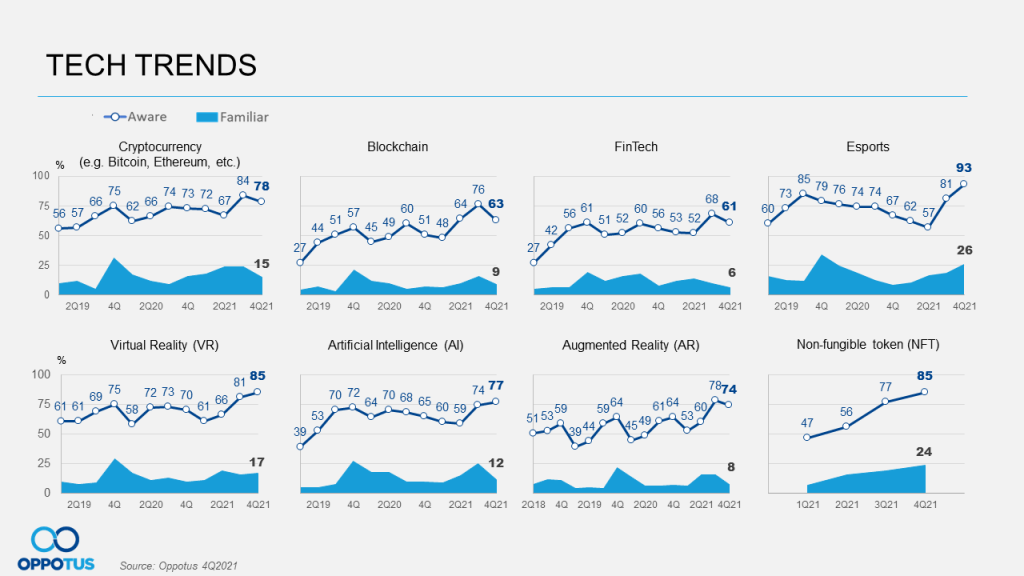

Technology is the driver of convenience and it changes human life in many ways. Whether it is in education, travel, communication, transportation, business, etc., its existence has made things better. There are four tech trends hitting a new record of their own this round, which are Esports (+12%), Virtual Reality (VR) (+4%), Artificial Intelligence (AI) (+3%), and Non-fungible token (NFT) (+8%). It took NFT far less time to reach the levels it is at now as compared to the time crypto took, suggesting a gaining wave of interest by Malaysians to this web3 space.

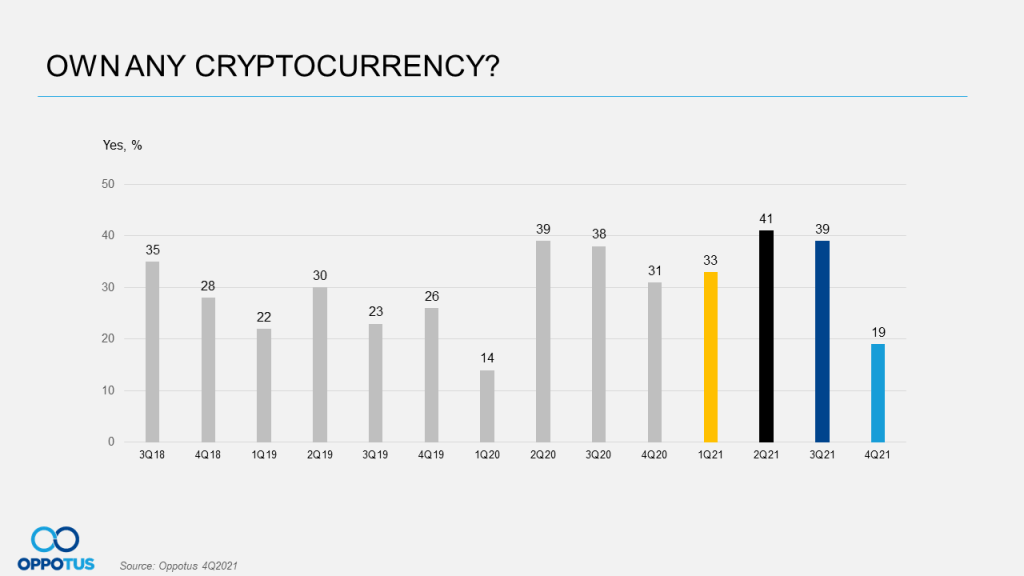

In late September 2021, the People’s Bank of China (PBOC) banned all cryptocurrency transactions, creating a bear market for crypto across the World. Here in Malaysia, we see this trend become apparent as Malaysians’ ownership of Cryptocurrency recorded a huge 50% drop to 19% in 4Q’21.

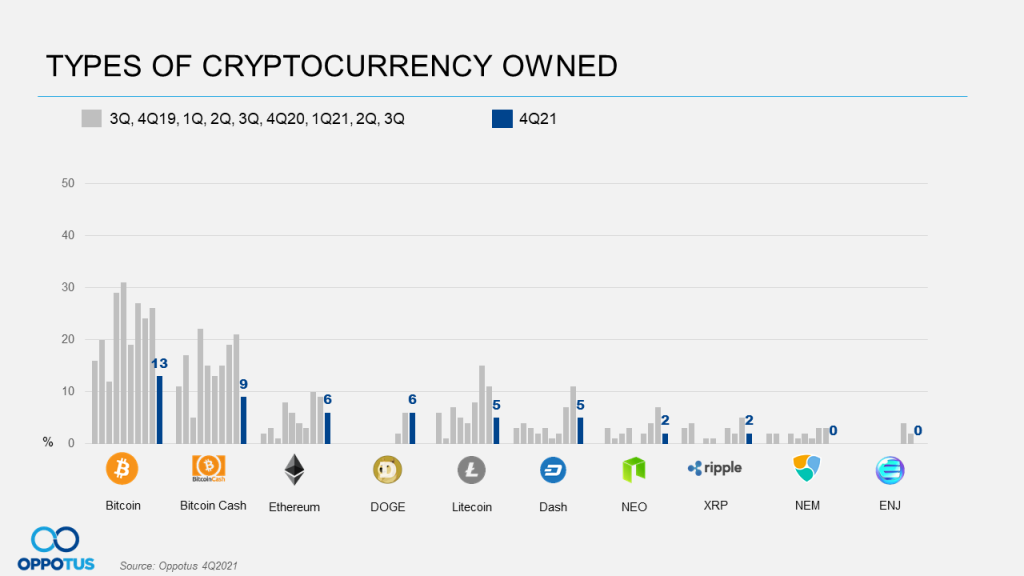

As a consequence of that, there is a noticeable drop in each types of cryptocurrency this quarter, except for DOGE (remain the same as Q3’21 at 6%). Despite the fact that the ownership of cryptocurrency recorded a drop, Bitcoin (BTC) and Bitcoin Cash (BCH) still remain the top 2 favorite cryptocurrencies owned by Malaysians.

Malaysians on Malaysia cover opinions of Malaysians aged 18 and above, M40 and T20 segments, in key cities of Peninsula Malaysia representatively.

For a closer look at the data, feel free to contact us at theteam@oppotus.com.